Market Monitor: April Mid-Month Update

Headlines and Highlights

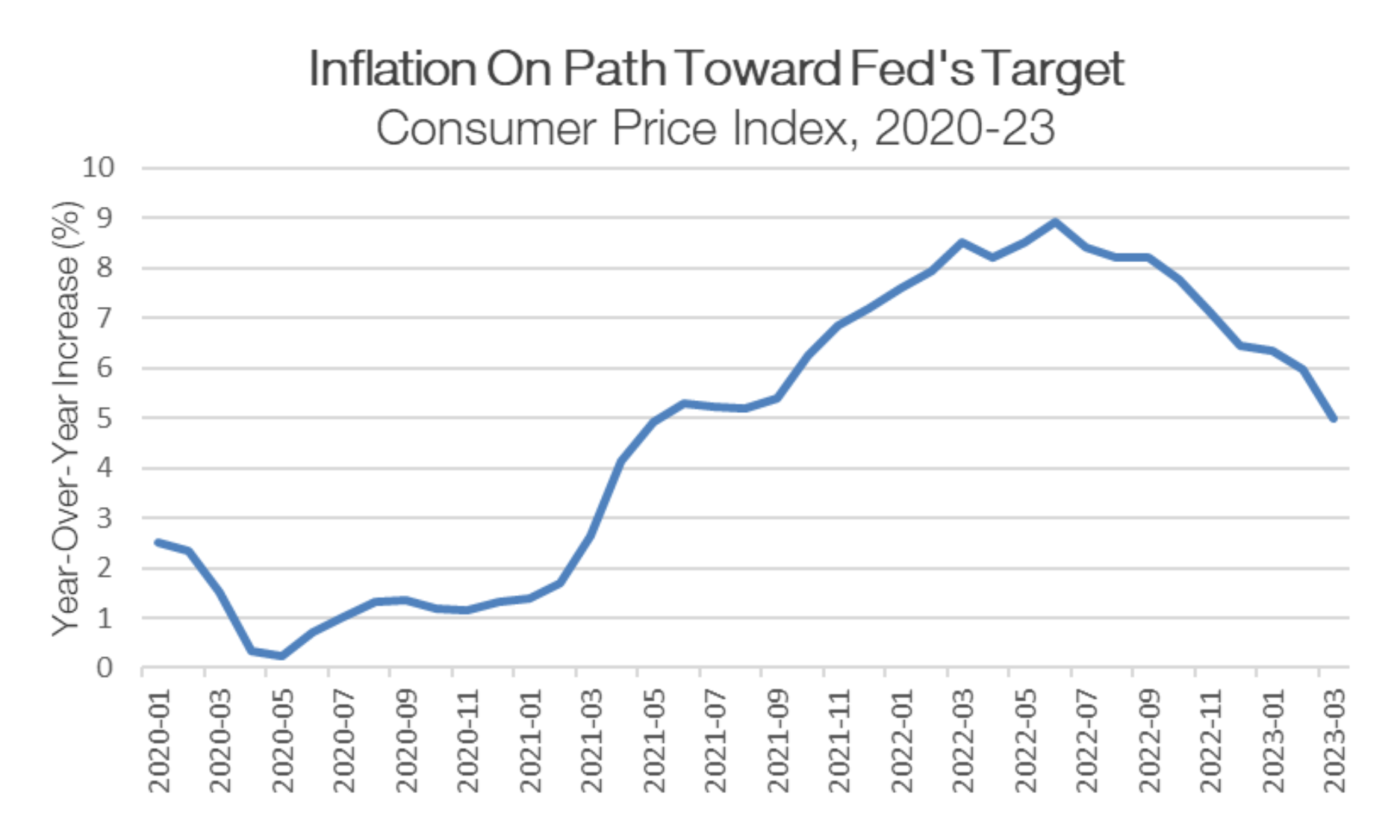

- Inflation slows to two-year low: The once-sizzling pace of consumer price increases cooled to 5% year-over-year in March, the lowest level since June 2021, in further evidence that the Federal Reserve’s inflation crackdown appears to be working. Excluding the more volatile energy and food categories, the core Consumer Price Index accelerated to a still high 5.6%, which could persuade the Fed to raise interest rates again in May. But a decline in wholesale prices – down 0.5% in March to a modest annual rate of 2.7% – provided additional confirmation that inflationary pressures are easing.

- Big banks kick off critical earnings season with strong results: Giant U.S. banks exceeded first-quarter expectations in an auspicious start to an important corporate earnings season and a sign that fallout from the banking crisis has been relatively contained so far. The surge in profits and revenue reported by JPMorgan, Citigroup, Wells Fargo and PNC demonstrated resilience amid the turbulence that convulsed regional banks in March. Analysts surveyed by FactSet still anticipate a 6.5% drop in U.S. corporate profits from a year ago, which would be the biggest decline since the early days of the pandemic and a sign of rising recession risks.

- IMF sees lower global growth: The International Monetary Fund forecast continued growth in most of the world but reduced its earlier projections amid pressures from tighter monetary policy, Russia’s invasion of Ukraine and stress in the financial sector. The IMF estimated global growth of 2.8% in 2023 and 3.0% in 2024, down from 2.9% and 3.1% three months ago. Its prediction for U.S. growth ticked up from January but remains sluggish at 1.6% this year and 1.1% in 2024. The IMF said the “fog around the world economic outlook has thickened.”

Chart of Interest

5% and falling: Headline inflation has been declining since peaking at 9% last June.

Sources: U.S. Bureau of Labor Statistics, Altair Advisers

Key Takeaways

- Banking issues appear contained for now and both federal and IMF officials say the decline in lending after the failure of two mid-sized banks last month does not signal a worrisome contraction in credit. However, the bank turmoil has added uncertainty to the economy.

- The job market remains strong but is moderating as the Federal Reserve continues with interest-rate increases that began over a year ago. Employers hired at a more moderate pace in March, average hourly earnings grew at the slowest annualized pace (3.8%) since June 2021, and job openings fell to 9.9 million from 10.6 million a month earlier.

- Financial markets have been mixed so far in the second quarter, reflecting investors’ wait-and-see mode on corporate earnings and any evidence of bank crisis aftereffects. Through mid-month, benchmark indexes showed U.S. large caps up 0.8%, small caps down 1.1%, REITs down 2.3% and international developed stocks rising 2.4% as they continued to outperform their U.S. peers. Bonds logged modest gains.

- U.S. consumers and small businesses are increasingly pessimistic about the impact of high inflation despite its recent decline, according to separate surveys by the University of Michigan and the National Federation of Independent Business. Consumers were slightly more optimistic overall than a month earlier but more anxious about inflation. Small business owners identified inflation as their top concern, ahead of tighter credit conditions and difficulty finding workers.

- China’s reopening is expected to bolster the global economy as a travel boom and other activity pick up momentum. The IMF said the Chinese economy is expected to expand by 5.2% this year, up by 0.8 percentage point from what it predicted six months ago and unchanged since January despite lowered forecasts for many other countries. One downside: The reopening could add to global inflationary pressures.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice