Market Monitor: March Mid-Month Update

Headlines and Highlights

- Government quells U.S. bank turmoil: The federal government took preemptive measures to ensure the stability of the banking system following the second- and third-largest bank failures in U.S. history. Regulators guaranteed all deposits at the Silicon Valley Bank and Signature Bank and established a program shielding other banks from prospects of a crippling run on deposits. The crisis erupted when Silicon Valley Bank, a major lender for venture capital and private equity and a crucial resource for tech startups, was unable to meet a flood of withdrawal requests and was shut down by regulators.

- Bank jitters spread, extend global markets’ down month: Global stocks accelerated their March decline after problems emerged with Credit Suisse that existed well before the failure of the two U.S. regional banks. European bank shares sank after Credit Suisse’s biggest shareholder said it would no longer inject money into it, then recovered some of their losses when the Zurich-based bank received a funding lifeline from the Swiss National Bank. The S&P 500 reached mid-month down 2% in March, erasing much of its year-to-date gain. International developed and emerging-markets stocks also are negative this month but are outperforming U.S. stocks in 2023. Bonds have registered solid gains in the dash to safe havens.

- Mixed inflation report adds to pressure on Fed: Consumer prices saw their smallest annual increase since September 2021 in February but remained stubbornly high, complicating the Federal Reserve’s decision on interest rates at its meeting next week. The Consumer Price Index rose 6% from a year earlier, down from 6.4% in January, but excluding food and energy core inflation climbed the most in five months at 0.5%. Fed Chair Jerome Powell suggested last week that the central bank could raise rates higher than expected. The bank panic, however, caused markets to drastically reduce expectations for rates’ path this year.

Chart of Interest

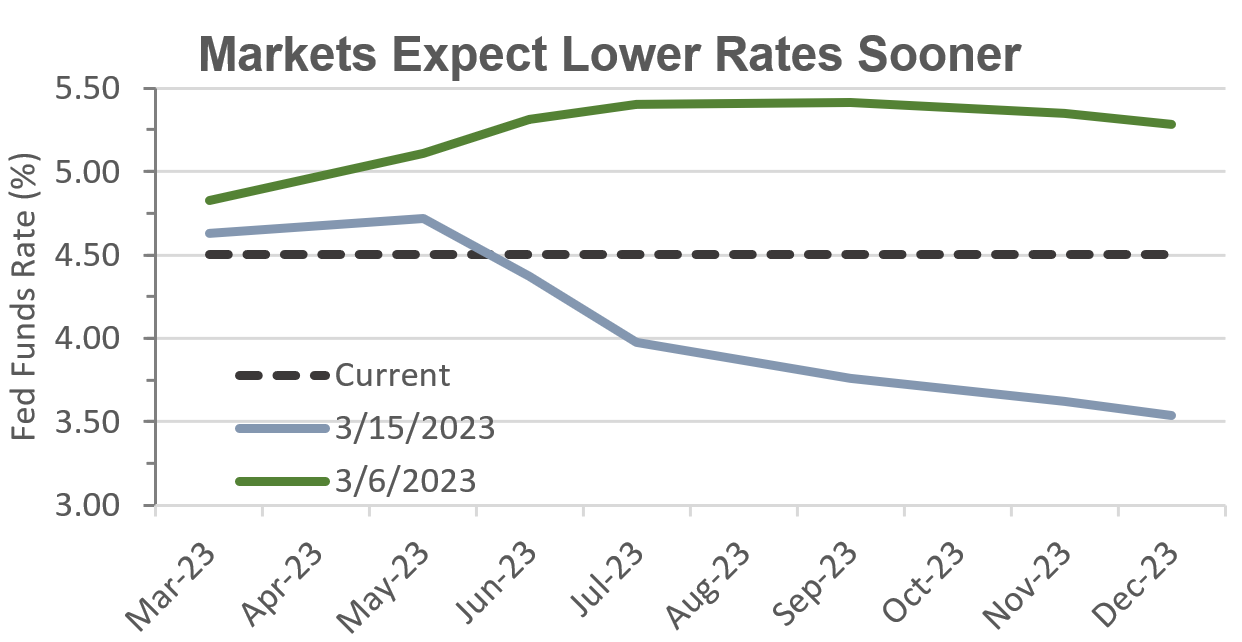

Fed Turnaround Coming? Traders expect a more than 1% drop in interest rates by year-end.

Sources: CME Group, Altair Advisers

Our Views

- The Federal Reserve will almost certainly forgo the half-percentage-point rate increase it appeared to be leaning toward next week in favor of a quarter-point hike given the bank scares. In addition to its year-long focus on inflation, it now must balance the risks of increasing consequences from higher rates. While the Fed is likely to pause its increases soon, we do not believe it will cut rates by a full percentage point by year-end as the market now predicts.

- We believe contagion risk from this month’s bank turmoil remains limited. The banking sector is far healthier now than during the global financial crisis, with much stronger balance sheets. The temporary scare in European bank stocks this week stemmed from a restructuring at Credit Suisse which was not directly related to the U.S. bank failures. We do not believe that the current situation is analogous to the 2008 banking crisis.

- The federal government’s swift rescue of bank depositors last weekend should significantly reduce the risk of future U.S. bank failures. Its newly created Bank Term Funding Program adds an important bulwark to the banking system in providing liquidity so banks do not have to sell securities at a loss to meet deposit withdrawal requests. While the action should help stem short-term volatility, regional banks are likely to face continued pressure and more consolidation as they lose capital to larger national banks.

- Venture capital funds and their portfolio companies will face higher capital costs and more stringent terms as a result of the Silicon Valley Bank collapse, although the best-capitalized and more established managers should be well-positioned to handle the new challenges. The crisis will likely create more private equity activity and opportunities with nonbank lenders in private credit.

- The economy continues to defy any expectations of an imminent recession with surprising resilience after a year of higher rates, even while showing some inevitable signs of slowing. The Atlanta Fed has upgraded its estimate of first-quarter growth to 3.2% from below 1% at the beginning of last month amid strong momentum in consumer spending. Inflation remains elevated but underlying signs such as this week’s reported decline in the producer-price index confirm its continued cooling.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice