Market Monitor: January Update

Headlines and Highlights

- Fed says rate cuts coming but not imminent: The Federal Reserve gave the strongest evidence yet that plans for interest-rate reductions are in the works but dimmed market hopes for a cut as early as March. The central bank held rates steady for a fourth straight meeting while dropping its prior caution about the possibility of more tightening from its statement, signaling it is done with hikes and now focused on easing its policy. But Chair Jerome Powell said the Fed needs to see more data confirming inflation’s downward trend before initiating a rate-cutting cycle. He said that is unlikely by the March meeting, meaning the earliest would be May 1st.

- IMF boosts global growth outlook: The International Monetary Fund cited stronger-than-expected U.S. economic expansion and China’s fiscal stimulus in boosting its forecast for global growth this year to 3.1% from 2.9% in October. Chief Economist Pierre-Olivier Gourinchas said the world economy is displaying “remarkable resilience” in the face of high interest rates and elevated inflation and is now in the final descent toward a soft landing. Threatening the outlook are, among other risks, the potential for global supply disruptions and a resurgence of inflation from the Houthi attacks in the Red Sea and a widening of the Middle East war.

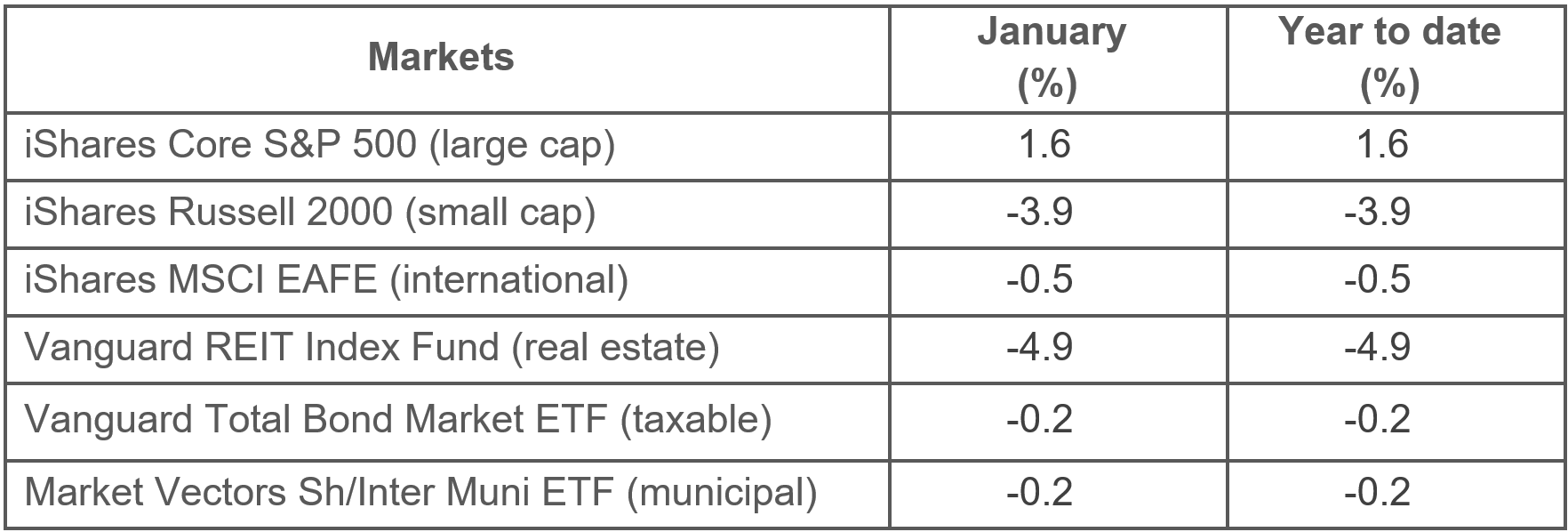

- Markets choppy to begin the year: The main benchmark for U.S. stocks was positive for a third consecutive month in January but other markets were mixed as investors showed caution while continuing to await rate cuts. The S&P 500 rose 1.6% for the month after a larger gain was sliced in half in the last two hours of trading, reflecting disappointment in the Fed pushing off rate cuts. The index posted six new closing highs in January. Small caps and REITS both retrenched after rocketing up more than 20% the previous two months. Bonds and international developed stocks both edged lower.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The Federal Reserve’s apparent intention to maintain the federal funds rate at the current 5.25% level for months longer should help further tame inflation, but standing pat too long is risky. Keeping the rate high for longer than necessary would undermine the strong economy. A Fed policy error could eventually lead to an economic slowdown or a recession.

- Inflation remains on a sustainable downward path if there is no major expansion of the Middle East war, which already has pushed energy prices higher and caused major disruption to global shipping routes because of Houthi attacks. The Fed’s 2% goal has been achieved over the past six months but not yet on a longer-term basis.

- The U.S. economy appears on course for a soft landing, as evidenced by the 3.3% annual growth rate in the fourth quarter. Unemployment remains low at 3.7%, consumer spending has exceeded expectations and the labor market is healthy, lowering the chances of a recession that many economists predicted was inevitable by now.

- Stocks will be hard-pressed to match last year’s strong double-digit gains but should benefit from less restrictive monetary policies both in the United States and abroad. While results from fourth-quarter earnings have been mostly flat compared with a year ago, analysts still expect double-digit growth for the full year of 2024.

- Bonds also should benefit from more dovish global central banks; bond prices rise as interest rates fall. The U.S. 10-year Treasury yield may be pushed lower, although we expect it to be more rangebound in 2024 than the wide range in which it moved throughout 2023.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.