Market Monitor: April Update

Headlines and Highlights

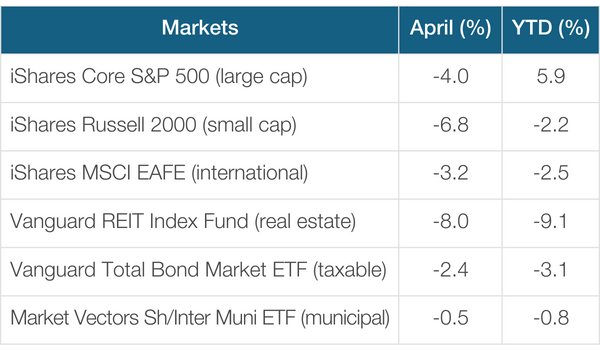

- Markets endure tough month: Stocks and bonds both had their worst month of 2024 in April as higher-than-expected inflation data fueled concerns that interest rates will not be lowered any time soon. The S&P 500 fell 4% to end a five-month winning streak but remained up 5.9% for the year to date. Small caps (-6.8%) joined REITs (-8.0%) in negative territory for the year, while international stocks (-3.2%) also gave ground. Bond prices were pushed lower by reduced expectations for rate cuts, which sent the 10-year Treasury yield climbing to 4.7%.

- Fed holds firm in rate-cut pause: The Federal Reserve left interest rates unchanged at 5.25% for a sixth straight meeting and indicated a willingness to hold them there indefinitely until inflation moderates further. Chair Jerome Powell cited the recent lack of progress toward the 2% inflation objective and said it will probably take longer than expected for the Fed to begin cutting rates. But he said inflation – 2.7% as measured by the PCE price index – remains likely to resume its decline, and he dismissed concerns about the possibility of a rate hike. Market expectations are for one to two rate cuts by year-end, starting no sooner than September.

- Growth slowed in first quarter: The U.S. economy expanded by a modest 1.6% annual pace from January through March, the slowest quarterly growth in nearly two years, due to less inventory expansion and a wider trade gap. Despite the reduced momentum, the main engines of the economy remained healthy, according to the Bureau of Economic Analysis report. Consumer spending rose by 2.5%, business investment was stronger than expected, and the labor market held steady. Corporate profits are on track for 3.5% growth in the quarter, according to FactSet.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The Federal Reserve is taking a calculated risk that the economy will not weaken materially while it keeps interest rates at a 23-year high, waiting for inflation to drop closer to its 2% target. We agree with extending this pause for now but we will be watching for cracks, since keeping rates at current levels for too long could eventually tip the economy into a recession.

- Markets could move sideways in the near term until there is more visibility about inflation and rate reductions. They should benefit from a resumption of inflation’s downward progress, which we expect in the coming months, as that will clear the way for rate cuts beginning this year. Yields should drop correspondingly, helping bonds.

- The U.S. economy is getting an important tailwind from infrastructure and investment programs approved earlier this decade, and we expect it to continue throughout 2024. This federal stimulus money takes time to work into the economy and has begun to flow more freely. The strength of the economy, particularly the job market, continues to buy time for inflation to come down and the Fed to remain patient before reducing rates.

- The world economy faces more challenges than the U.S., given wars in the Middle East and Ukraine and recession concerns in some countries, but has shown more resilience than expected in 2024. Signs of accelerating recoveries in Germany, the United Kingdom and Japan are providing momentum. Another lift could come from foreign central banks cutting rates before the Fed does.

- Geopolitical risks and high energy costs, both linked to the wars in Gaza and Ukraine, are the largest threats to global growth and inflation. Absent any shocks, however, the outlook for the rest of 2024 is positive.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.