Market Monitor: February Mid-Month Update

Headlines and Highlights

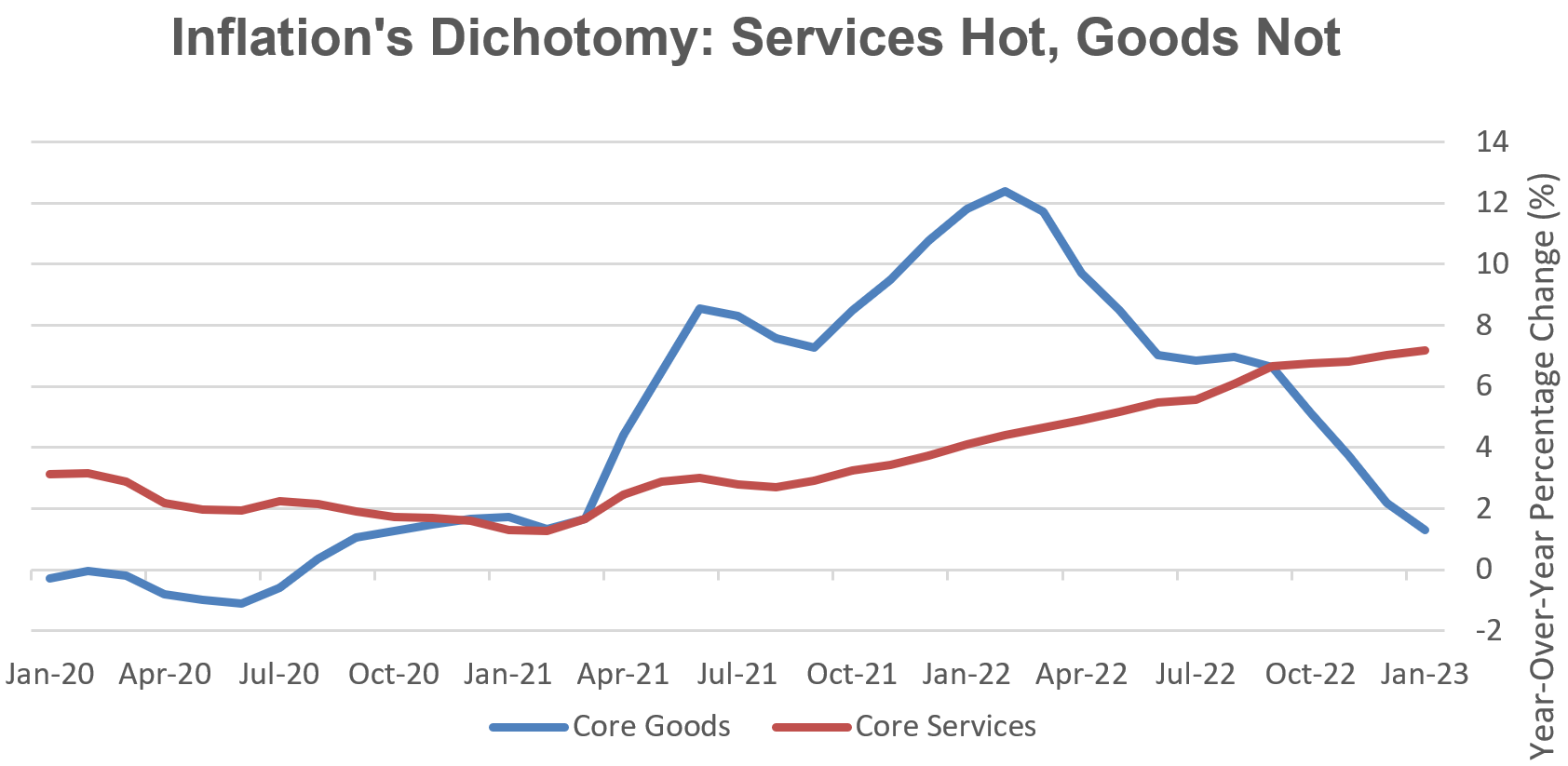

- Inflation’s progress moderates: Inflation decelerated for a seventh straight month in January but at a slower pace than previously, keeping pressure on the Federal Reserve to maintain its restrictive monetary policy. The Consumer Price Index climbed at an annualized rate of 6.4%, down from 6.5% in December, while so-called core inflation (price growth excluding food and energy) ticked down to 5.6% – still far above the Fed’s 2% objective. Rental and other housing costs were the biggest contributors to inflation. Core services inflation was 7.2% year-over-year while core goods inflation was 1.4%.

- Consumer strength powering economy to solid start in 2023: Retail sales increased by the most in two years in January and the University of Michigan’s index of consumer confidence climbed to a more than one-year high this month despite continuing concerns about inflation. The 3% jump in retail sales following a decline in December underscores the economy’s durability amid rising interest rates while also bolstering the case for the Fed to maintain its anti-inflation campaign until it sees more evidence of cooling. The economy is tracking at a relatively robust annual growth rate of 2.5% in the first quarter, according to the Atlanta Federal Reserve Bank.

- Brainard’s departure leaves key Fed post open: Lael Brainard, the Federal Reserve’s vice chair and one of its more moderate voices in setting interest-rate policy, left the post for a job as President Biden’s top economic adviser. Brainard’s move to director of the National Economic Council creates a vacancy for the No. 2 Fed decision-maker after Jerome Powell at a time the central bank is trying to quash inflation through a series of rate hikes without triggering a recession. While publicly supporting the aggressive policy moves led by Chair Powell, she is considered one of the Fed’s more dovish members – cautioning of the economic risks of raising rates too high.

Chart of Interest

Sizzling Services: Elevated inflation now mostly reflects fast-rising services prices.

Sources: Federal Reserve of St. Louis, Altair Advisers

Key Takeaways

- Markets are mixed so far this month as investors assess mostly upbeat recent economic data along with the prospect of additional interest-rate increases and inflation. U.S. stocks were mostly higher at mid-month while international stocks, REITs and bonds were lower amid higher rates and a stronger U.S. dollar. The S&P 500 Index added 1.5% in the first half of February for a 7.9% year-to-date gain.

- Expectations for further rate hikes have risen as a result of the January inflation reading and last month’s robust jobs report. Market traders betting on the Fed’s policy rate already were widely expecting a quarter-percentage-point increase at the central bank’s March meeting, according to the CME FedWatch Tool. Now the consensus is for a similar-sized hike in both May and June, taking the fed funds rate – currently 4.5% – to a peak of 5.25% before an anticipated Fed pause.

- One important area of the economy that the Fed has been successful in cooling is the housing industry, which is very interest-rate sensitive. U.S. housing starts fell by 4.5% in January to the lowest monthly level since June 2020. The annual rate is down 27% from a year ago.

- U.S. corporate earnings appear to have experienced their first year-over-year decline since the third quarter of 2020 in the fourth quarter. With nearly three-quarters of S&P 500 companies having reported results, profits are down 4.9% compared with a year earlier. Revenue growth of 4.6% also are on pace to be the lowest since 2020, according to FactSet. Analysts predict earnings growth of 2.5% for all of 2023.

- China’s economic activity is returning to normal at a relatively slow pace since the country ended its Covid controls in early December, mixed recent data show. The modest return of growth could reduce expectations for China’s contribution to the world economy this year, but it also eases concerns that a burst of spending could stymie efforts to tame global inflation.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice