Market Monitor | April 17, 2025 Update

Headlines and Highlights

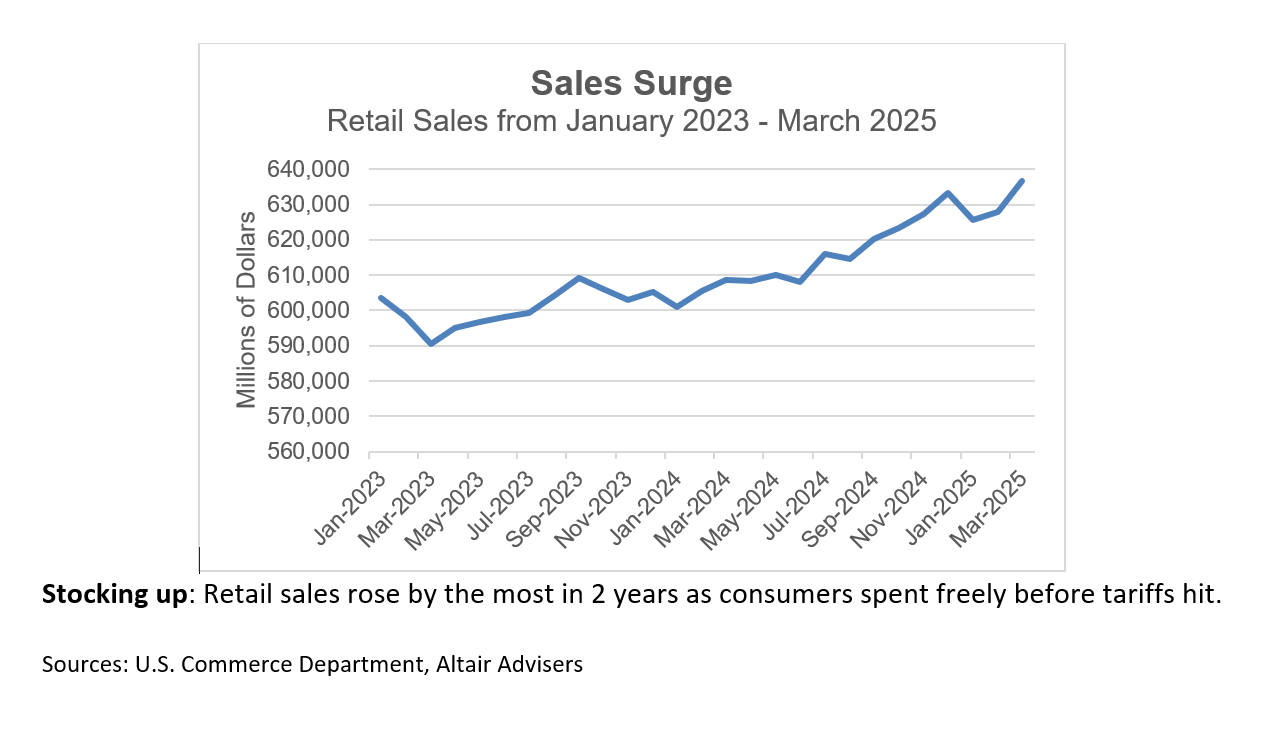

- Trade war tensions rise; economic impact yet to hit: Companies, economists and other forecasters warned of a coming jolt to profits, growth and prices as global trade tensions rose this week and uncertainty remained high. The head of the International Monetary Fund, Katalina Georgieva, said President Trump’s new tariffs will cause economic pain but likely not a global recession. The latest U.S. data continued to show the economy in solid shape. Retail sales had their largest monthly increase since January 2023 in March, due partly to consumers front-running tariffs with big purchases.

- Powell says tariffs will put Fed in tough spot: Federal Reserve Chair Jerome Powell said the trade policies the administration is pursuing will likely cause both unemployment and inflation to rise, putting the Fed in a difficult position. The central bank has a dual mandate to ensure full employment and stable prices. Powell said in a speech at the Economic Club of Chicago that monetary policy cannot be adjusted to address weakness in both those areas at the same time. The Fed remains in wait-and-see mode. Markets expect four interest-rate cuts by year-end.

- Markets enjoy quieter week: Most financial markets logged their first positive week since last month as investors shrugged off warnings of coming tariff pressures and watched for progress from country-by-country negotiations. International stocks, small caps, and REITs all saw modest gains. The S&P 500 advanced Thursday but was down 1.5% in the short trading week, moving 14% off the February 19th all-time high. The bond market was calm after last week’s tariff-related turmoil.

Chart of Interest

Our Views

- The global trade war will slow world economic growth this year and probably 2026 as well, but it is too soon to gauge the overall impact. We believe the harshest tariffs on most countries will prove to be short-lived as the Trump administration negotiates them downward. The timeline for China tariffs is less certain, but this week’s reports suggest a willingness to negotiate and we believe they too will be revised much lower once cooler heads prevail.

- U.S. recession odds have risen as a result of the government’s most significant trade policy shift in decades. The imposition of a universal minimum 10% tariff alone will hurt businesses by effectively charging a higher tax on their goods that increases their expenses. Consumers will suffer when price increases are passed on to them. The economy entered this period in strong shape, however, and we believe any recession likely will be short and shallow in keeping with most prior recessions.

- Financial markets face further bouts of volatility ahead amid persistent uncertainty about President Trump’s intentions with trade policy and a weakened outlook for consumers and corporate earnings. We believe another big decline in the S&P 500 would present an excellent long-term buying opportunity. If the index should drop to about 25% below its February 19th high, we plan to purchase more higher-risk assets.

- Inflation is almost certain to move temporarily higher once companies have raised their prices and the impact of tariffs is fully felt. We expect it to rise back above 3% this year. But we believe a repeat of the surge that sent inflation to 9.1% during the pandemic is unlikely.

- The bond market experienced temporary turbulence late last week during the tariff chaos with a sudden surge in yields and corresponding drop in prices. That raised questions about why bonds momentarily did not play their usual safe-haven role in a crisis. The reasons remain less than fully clear. But it appears to us that the panic was overdone, as yields have since moderated. As Powell noted in his Chicago remarks, bond markets remain orderly and functioning “as you would expect them to in this time of high uncertainty.”

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.