Market Monitor | Mid-Month Update

Headlines and Highlights

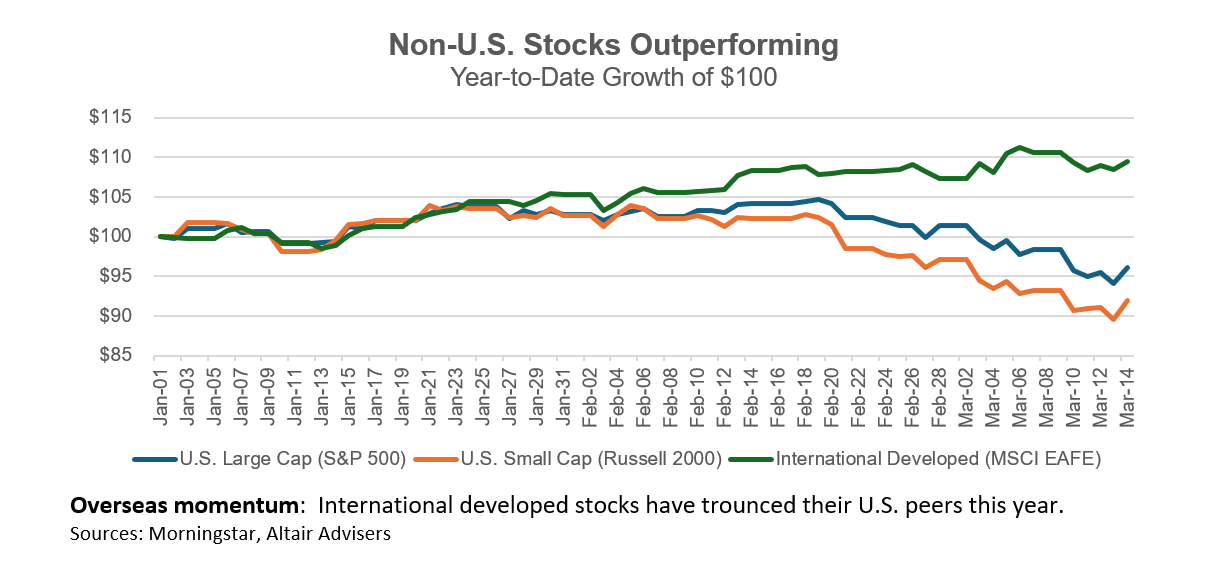

- Stock market sees first correction since 2023: The S&P 500 fell into correction territory last week – down 10% from its February 19th high – amid investor unease about the flurry of tariff announcements from the White House. The index stabilized when a government shutdown was averted. But its worst week since September left it down 5.2% in March and 3.9% year-to-date. The small-cap benchmark fared worse with returns of -5.4% and -8.1%, respectively. Overseas stocks have thrived while the U.S. slumps; the benchmark for international developed markets rose to +10.5% through mid-March as European stocks boomed.

- Trump tariffs intensify: President Trump doubled down on his tariffs that have launched a global trade war and said he will not “bend” in the fast-accelerating fight. Trump vowed to counter-retaliate to tariffs planned by the European Union and Canada in response to U.S. duties on steel and aluminum imports, threatening a 200% tariff on imports of EU wines and spirits. The president’s aggressive trade policy has unsettled business leaders and consumers, recent surveys show, in addition to weighing on markets.

- Inflation easing for now: Consumer prices rose at the slowest pace since October last month, offering some relief ahead of tariffs that are expected to push costs higher. The Consumer Price Index increased just 0.2% from the prior month, reducing the annual rate by two-tenths of a percent to 2.8% (or 3.1% when excluding volatile food and energy prices). While the progress was encouraging, the Federal Reserve is likely to remain in wait-and-see mode at its meeting this week while putting off further interest-rate cuts until there is more clarity on the administration’s actions and the trajectory of inflation.

Chart of Interest

Our Views

- Markets remain vulnerable to an intensifying trade war, particularly if retaliatory tariffs scheduled to take effect April 1st are sustained for a lengthy period. Tariff turmoil caused the S&P 500’s recent 10% pullback but has yet to cause abnormal volatility. On average, a correction averaging 10%-14% occurs about once a year.

- Corrections have turned into bear markets (20% drops) only about 25% of the time since World War II, typically when economic growth and earnings fall sharply. We do not believe those conditions are imminent despite rising investors’ fears during the recent market sell-off. If a market decline approaches that level, we are prepared to add to higher risk assets because corrections absent severe recessions are historically good buying opportunities.

- Softening economic data and sentiment tied to tariffs have slowed the U.S. economy in 2025. However, we do not believe a severe recession, if any, is on the horizon. Low unemployment claims, robust corporate profits and narrow credit spreads all indicate a still-healthy economy. (Tight credit spreads between corporate and Treasury bond yields suggest the perceived risk of default is low.) We expect modest economic growth to continue in 2025.

- Consumers are still spending at a healthy clip, an important sign for economic stability, despite recent surveys showing declines in confidence and sentiment. Retail sales grew at a solid pace last month despite concerns about an economic slowdown and tariffs. Sales could struggle in the months ahead if consumer anxiety remains elevated.

- The Federal Reserve is likely to resume rate cuts at its upcoming May or June meeting if the current trend of slowing demand and cooling consumer prices continues. We expect the Fed to make at least two quarter-point reductions this year, lowering the benchmark interest rate from the current 4.25% to 3.75% or lower.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.