Market Monitor | April Update

Headlines and Highlights

- Trade war unresolved but tension de-escalates: The global trade war remains shrouded in uncertainty a month after President Trump’s “Liberation Day” announcement of steep import tariffs. However, countries’ tough rhetoric has softened and hopes of trade agreements have risen as some reported bilateral talks proceed. The White House says negotiations are under way with more than a dozen nations ahead of Trump’s self-imposed July 8th The huge U.S.-China trade dispute remains stalemated. But Beijing’s carefully worded statement Friday that it is “evaluating” the U.S. willingness to open talks was seen as a sign of a potential thaw in the frosty standoff between the world’s two largest economies.

- Economy not reflecting tariff pain yet: The latest data shows the U.S. economy slowing but still healthy as companies and consumers await the full impact of tariffs. Gross domestic product in the first quarter was negative (-0.3%) for the first time since 2022, but the decline was fueled by a massive surge in imports as businesses rushed to stock up. Today’s jobs report demonstrated the labor market’s resilience, with employers adding a more-than-expected 177,000 jobs in April. Business investment remained firm and inflation slowed sharply in March, moving closer to the Federal Reserve’s 2% target. Most companies kept their outlooks vague while discussing first-quarter earnings but cautioned of a likely jolt from tariffs.

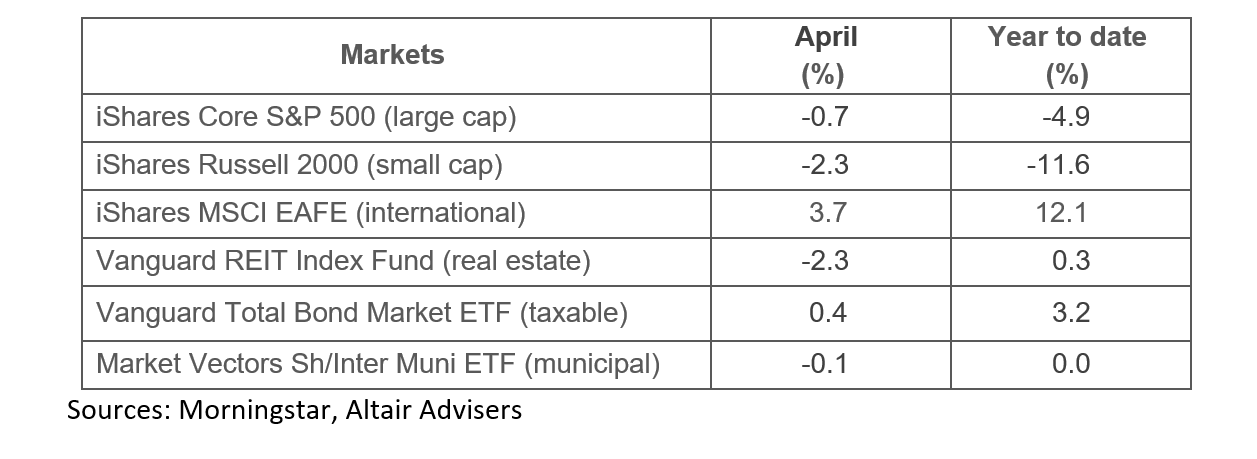

- Markets end rocky month on upswing: Global financial markets that were sent reeling across the board by the U.S. tariffs announcement in early April have since recovered strongly. Stocks in overseas developed markets led the way again in April with a 3.7% gain and outperformed their American peers by a whopping 17 percentage points (+12.1% to -4.9%) through four months. The S&P 500, down as much as 13.8% for the month on April 7th, erased nearly all of that drop by month’s end (and the rest of it today) on optimism for agreements lowering tariffs. Small-cap stocks also bounced back after having plummeted, but continue to struggle in 2025.

Select Market Returns

Our Views

- Tariffs pose what we believe to be about an even-odds threat of causing a mild recession once their impact is fully felt. We do not view this week’s negative GDP number as a recession harbinger, however. While the economy is slowing, this was largely the result of a surge in imports as companies tried to front-run tariffs. Economic data will soon give a better read of tariffs’ consequences.

- U.S. stocks’ steady rise since their tariffs-driven plunge bottomed in early April – and now a nine-day winning streak for the S&P 500 – has been driven by hope for trade deals that have yet to be reached. We expect this period of relative calm to end soon unless there are substantial agreements lowering tariffs. The 90-day pause in tariffs that boosted markets has not lessened the substantial pressure on businesses and consumers from the highly uncertain outlook.

- Diversification helped portfolios during a chaotic April and bumpy first four months of 2025, reaffirming our belief in its value over the long term. While both U.S. large- and small-cap stocks declined, international stocks again outperformed and taxable bond investments posted modest gains (while municipal bonds were little-changed).

- The Federal Reserve will likely cut interest rates in June or July. We anticipate two to three quarter-percentage-point reductions by year-end. The Fed is not likely to preemptively speed up its rate cuts because of tariffs.

- The inflation rate is likely to top 3% by year-end due to higher prices from tariffs, but the increase should be short-lived as a slowing economy reduces demand. The cooling of inflation that was evident in March should help soften tariffs’ impact. Core inflation as measured by the Consumer Price Index as well as the Personal Consumption Expenditures price index, the Fed’s favored inflation gauge, both eased to3%.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.