Market Monitor | Mid-Month Update

Headlines and Highlights

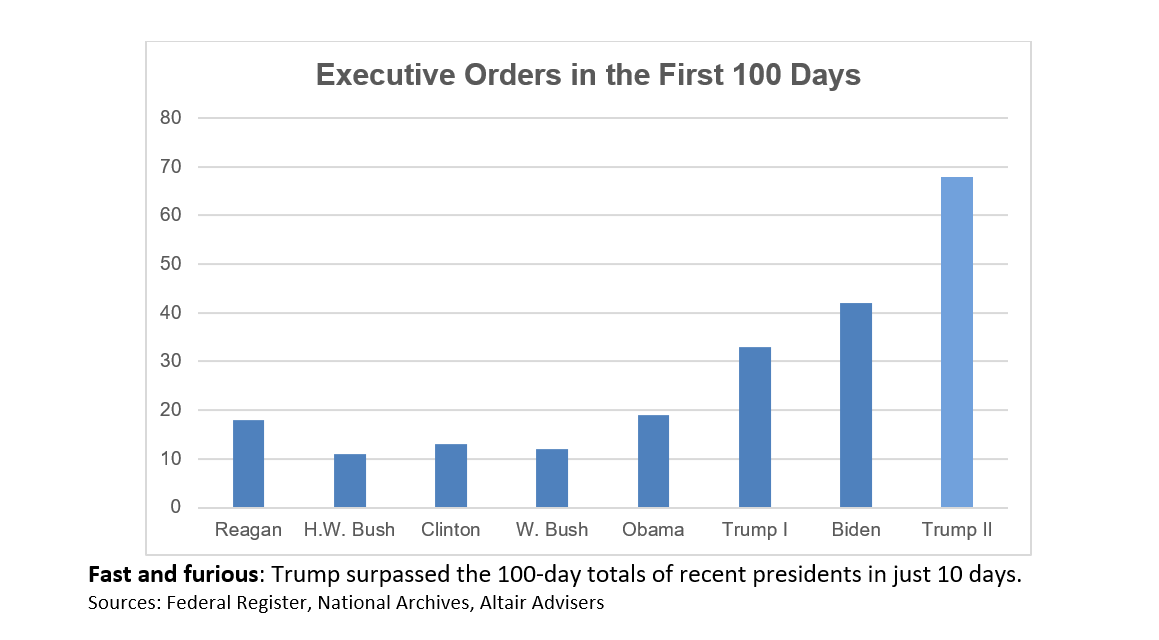

- Trump’s frantic first month includes tariffs, much more: President Donald Trump has continued moving aggressively to enact his second-term agenda, including announcing new tariffs against U.S. trade partners and threatening more to come. Trump also has taken steps to shrink the federal government, crack down on immigration and remake social policy. The early flurry of actions included 68 executive orders in his first 27 days.

- Inflation ticks up unexpectedly: Consumer prices rose at a 3.0% yearly rate in January, up from 2.9% and more than expected amid the fastest monthly increase (0.5%) since August 2023. Core inflation, which excludes volatile food and energy prices, edged up to 3.3%. Inflation’s recent stall around 3% is likely to keep the Federal Reserve’s plans for further interest-rate cuts on hold. Fed Chair Jerome Powell told a Senate committee that “We do not need to be in a hurry to adjust our policy stance” with the economy strong and inflation lingering above the 2% target.

- International stocks pace the markets in 2025’s early going: Brightening prospects for Europe and a weaker dollar have helped overseas stocks outperform the U.S. market so far this year. The international developed stocks index rose 3.3% in the first half of February for an 8.3% gain year-to-date. Fueling the rise are Europe’s improving economic and profit outlook, the dollar’s 2% drop against other major currencies and prospects of a cease-fire in Ukraine, all boosting the continent’s Stoxx 600 to record highs. The S&P 500’s more modest performance in February left it up 4.1% year-to-date at mid-month. Bonds and REITs also gained modestly.

Chart of Interest

Key Takeaways

- Tariffs’ coming impact on the U.S. and global economies is particularly hard to forecast given that some are suspended, others have not yet been fully detailed, and all are subject to negotiations. We continue to believe that the president may be willing to endure some temporary pain to achieve his objectives but will try to avoid a long-term trade war with harsh tariffs given their economic and market risks.

- The CPI report showing that inflation’s downward path remains rocky does not alter our expectation that the Federal Reserve will resume lowering interest rates this year, with at least two quarter-point cuts still likely. However, it lessens the chance of reductions resuming at either of the next two Fed meetings in March or May as Fed officials await more significant progress.

- The U.S. economy remains strong, underpinned by a healthy labor market and robust corporate earnings. Concerns about whether tariffs will lead to a prolonged trade war and meaningfully higher inflation add increased risk to the future outlook. But the strength of current fundamentals suggests the economy is well-positioned to endure a slowdown, should one occur, without a recession.

- Manufacturing expanded last month for the first time since 2022, a recovery that now faces a new challenge with tariffs that will make American exports more expensive. The Institute for Supply Management’s manufacturing purchasing managers index nudged into positive territory with a 50.9 reading (above 50 signifies growth) after contracting for 26 consecutive months.

- European stocks’ surge to begin the year could signal the start of improved performance for international developed stocks vs. their U.S. peers, but it is unclear without further evidence of sustainable outperformance. International stocks remain a core, though smaller, part of our recommended portfolios for their historically cheap valuations, less concentration than Mag 7-dominated U.S. stocks, and value as diversifiers to growth stocks.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.