Market Monitor | February Update

Headlines and Highlights

- New tariffs implemented: The United States on Tuesday put into effect previously delayed tariffs on goods coming in from its three largest trading partners: China, Canada and Mexico. The tariffs add a 25% fee on all Mexican and Canadian exports coming across those borders and an additional 10% for Chinese goods on top of the 10% imposed earlier. The levies, which follow through on President Trump’s pledges when he took office in January, brought quick retaliation. U.S. businesses expressed trepidation at the impact they could have on their costs.

- Key inflation data eases slightly: Inflation as measured by the Federal Reserve’s preferred gauge inched closer to the 2% target to start the year, leaving Fed officials to watch for further progress and no tariff-related setbacks before resuming interest-rate cuts. The personal consumption expenditures price index was up 2.5% year-over-year in January, improved by a tenth of a percent from December, while “core” PCE (excluding food and energy) cooled to 2.6%. The Fed is expected to hold the benchmark rate at the current level of 4.25%-4.5% at its March 18-19 meeting.

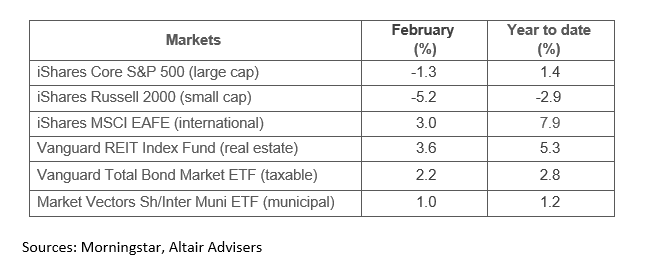

- Rocky month for U.S. stocks: The U.S. stock market declined in February amid uneasiness about the unknown impact of tariffs, government cutbacks and other proposals from Donald Trump’s first month back in the White House. The S&P 500 edged3% lower, reducing its year-to-date gain to 1.4%, while small caps tumbled in the month’s final week, shedding 5.2% in February to go negative for 2025. International stocks outperformed the U.S. for a second month, led by Europe, to boost the benchmark’s year-to-date gain to 7.9%. Bonds gained as the benchmark 10-year U.S. Treasury yield, which reached 4.8% in mid-January, dipped to 4.2%; bond prices rise as yields fall.

Select Market Returns

Our Views

- Stiff new tariffs have added further uncertainty to an evolving global economic outlook. A trade war will be more consequential for the economy and markets the longer it endures. We believe it is unlikely to be long-lasting because all sides have major incentives to negotiate given the potentially negative impacts. President Trump already has shown a willingness to delay or back off on tariff threats.

- Inflation’s downward progress will be challenged in a protracted trade war due to costlier imports and retaliatory tariffs. The underlying trends that have caused prices to gradually cool – such as a steady decline in rent inflation – should partially offset new short-term pressure from tariffs, however.

- International stocks’ strong performance to start the year demonstrates the value of portfolio diversification. Leading the gains have been international bank stocks and defense stocks in Europe, boosted by expectations of higher defense spending to fill a gap being left by the Trump administration. International stocks also remain attractive for their comparatively low valuations; less reliance on a handful of tech stocks, as in the U.S.; and increased prospects for an end to the Russia-Ukraine war, among other reasons.

- February has historically been one of the worst-performing months for U.S. stocks – including being last in postelection years since 1950, according to Carson Investment Research. Even with tariff concerns weighing down the market, the S&P 500 would have been slightly positive in February without a rare down month for the Magnificent Seven stocks and is less than two weeks removed from its all-time high.

- The U.S. economy has slowed in the first quarter but remains in solid shape for the additional pressures that tariffs will bring. Employment remains strong, corporate profits are up significantly, and “soft” data like the confidence surveys that have weakened recently tend to be poor predictors of real economic activity.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.