Market Monitor | September Update

Headlines and Highlights

- Budget impasse results in government shutdown: Federal government services shut down when the new fiscal year began with Senate Republicans and Democrats deadlocked over funding. About 40% of the federal work force, or 750,000 people, was at least temporarily idled. The Trump administration threatened to eliminate thousands of those jobs while also reducing health services funding. The U.S. government has now shut down 21 times in the past half-century. Four have lasted two weeks or more, most recently a record five-week shutdown seven years ago during President Trump’s first term.

- Fed rate cut ends long pause: The Federal Reserve lowered interest rates by a quarter percentage point in its first reduction since December 2024 and forecast more cuts in the months ahead. The Fed had previously held firm on rates with inflation under 3% and declining but not yet down to its 2% target. Fed Chair Jerome Powell indicated inflation is likely to accelerate with prices on goods rising as a result of the government’s new import tariffs. But he said the reason the Fed decided a rate cut was needed now was to help offset any threat to the economy from a cooling labor market.

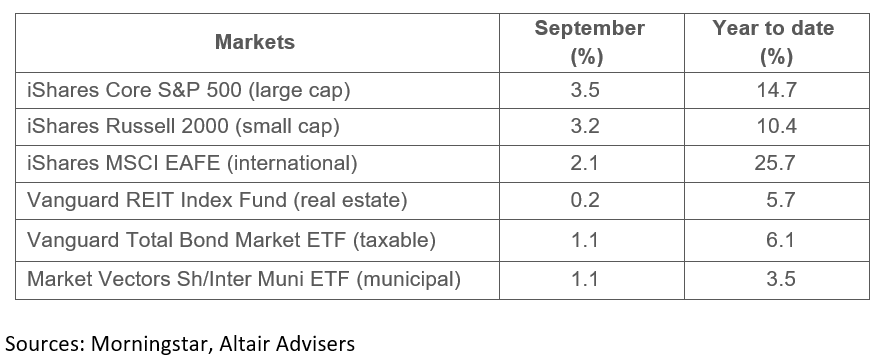

- Markets thrive in September: Stocks defied September’s reputation as a weak month with solid gains stemming from investor optimism about lower interest rates and the surge of corporate spending on artificial intelligence. The Standard & Poor’s 500 added 3.5% in what historically has been its worst month, averaging about a 1% decline over the past century. Small-cap stocks matched the S&P with a fifth straight month of gains (3.2%) to forge into double digits for the year (10.4%). International developed stocks trailed domestic large caps for the fourth time in the past five months but still climbed 2.1% to maintain an 11-percentage-point gap over their U.S. peers for the year. Bonds rose 1.1% as yields declined during the month.

Select Market Returns

Our Views

- The government shutdown poses the risk of a short-term disruption to the economy and makes it harder for markets to discern the extent of activity because of the lack of data during the closure. But history suggests any resulting market pullback is likely to be brief. After falling 13% ahead of the most recent closure beginning in December 2018, the S&P 500 rose 10% during the 35-day shutdown and reached new highs soon afterward.

- The Federal Reserve is likely to lower interest rates further at its October 28-29 meeting. We are more skeptical about the market’s assumption that another Fed cut this year is all but assured, however. We believe the Fed may forgo a rate cut at its December meeting if the job market holds firm and the inflation rate rises by then – conditions suggesting that additional easing would be neither needed nor advisable.

- The labor market is clearly softening but has yet to pose a major concern for investors. While hiring has slowed in recent months, the most recent initial jobless claims data showed no evidence of a pickup in layoffs above historically normal levels. But the delay in releasing this week’s jobless claims update and monthly jobs report because of the shutdown obscures the current outlook.

- The Supreme Court’s decision allowing Federal Reserve governor Lisa Cook to remain in her job until it hears oral arguments on her case in January was an important affirmation of the Fed’s independence. President Trump, who wants to replace her with someone who would push harder for lower interest rates, contended he had the right to oust her, but the court needs to determine whether there is legal cause. The central bank must remain free of political considerations.

- We expect tariffs to remain at an elevated level regardless of the outcome of the Supreme Court hearing next month on challenges to President Trump’s authority to impose them under the International Emergency Economic Powers Act. The high court is likely to decide how tariffs can be imposed but not reject them outright. As president, Trump will have other legal means to impose levies on countries if he is not allowed to do so by invoking the emergency act.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.