Market Monitor | Mid-Month Update

Headlines and Highlights

- Federal government workforce remains idled: The government shutdown is approaching the halfway mark of the record 35-day stoppage in 2018-19 with no end to the funding stalemate in sight. Both Republicans and Democrats believe they have the upper hand in the 16-day-old standoff. Even the start of what was expected to be large-scale layoffs of federal employees has not heightened the sense of urgency to strike a deal. The shutdown is threatening the availability of key government statistics – most notably, the Consumer Price Index – that require extensive manual labor to compile and publish.

- U.S. and China again face off over protectionism: The drama over U.S.-China trade relations has returned to center stage after Chinese President Xi Jinping slapped more export limits on rare-earth minerals vital to U.S. tech companies. President Trump retaliated with threats of new tariffs on all Chinese imports and export controls on certain U.S. technology. U.S. farmers and other businesses are feeling an impact from the trade dispute. Soybean farmers are struggling to find buyers after China pulled out of long-standing deals following Trump tariff moves earlier this year.

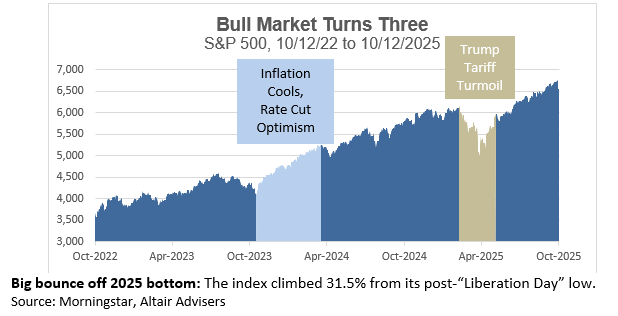

- Stock bull market extends into a 4th year: For the ninth time since the end of World War II, a bull market for U.S. stocks has celebrated a 3rd In mid-October 2022, the S&P 500 bottomed out near the end of the Federal Reserve’s interest-rate escalation – over the next 36 months, the index’s total return was 91%. The previous eight bull markets reaching the three-year mark have lasted an average of 6½ years while gaining 213%, making the current rally relatively modest by comparison. Those bulls averaged 12.7% in their fourth year, according to CFRA Research.

Chart of Interest

Key Takeaways

- The Federal Reserve is widely expected to lower interest rates by 0.25% to a range of 3.75%-4.0% at its next meeting on October 29th, down 1.5 percentage points from last year’s peak. The Fed has been slower than several other major central banks to lower rates, citing inflation concerns amid tariff uncertainty.

- The world economy has proven more resilient than expected in the face of President Trump’s tariffs. The International Monetary Fund edged up its 2025 global growth forecast to 3.2% from 3% three months ago while forecasting that 2026 will be slightly slower at 3.1%, citing the escalating U.S.-China trade war as a significant risk.

- U.S. economic growth has gotten an extra boost from a spate of multibillion-dollar investments in generative AI and other artificial intelligence undertakings involving OpenAI, Oracle, Nvidia, AMD and other tech giants. The Atlanta Fed estimates that the economy expanded at a robust annual pace of 3.8% in the third quarter, although some key recent data was not available to incorporate into forecasts due to the government shutdown.

- A softening labor market is the economy’s most vulnerable area. Fed Chair Jerome Powell said this week that the sharp slowdown in hiring poses a growing risk, and job openings also are down. The absence of a surge in layoffs, however, suggests the market is stagnant versus in crisis.

- Small-cap stocks have surged after a slow start to 2025, benefiting from the Fed’s first rate cut in nine months. The small-cap benchmark is up 16% since June, and 14% year-to-date, after a negative first half of the year.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.