Market Monitor | January Update

Headlines and Highlights

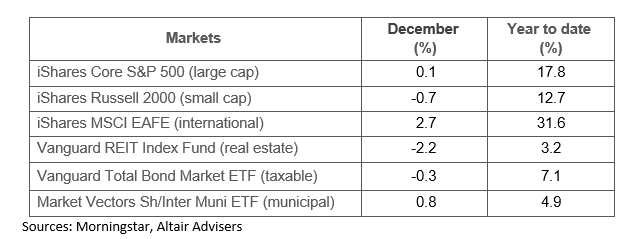

- Santa Claus rally lifts U.S. stocks: The S&P 500 index of large-cap U.S. stocks rebounded in the second half of December, closing at an all-time high of 6,932 on Christmas Eve. The index’s +0.1% total return in December marked an eighth-straight monthly gain. For the year, the index gained 17.8%, which brought its cumulative return over the past three calendar years to just over 86%. The late-December rally came as investors grew increasingly confident that the Federal Reserve will cut interest rates more than once in 2026. Small caps, which tend to be sensitive to rates, benefited from the same catalyst, though they ended at -0.7% for the month. The U.S. strike against Venezuela in early January boosted oil stocks but had little immediate impact on the broader market.

- 3rd quarter real GDP surprises to the upside: The U.S. economy grew by an inflation-adjusted 4.3% in the third quarter of 2025, according to an initial report from the federal Bureau of Economic Analysis. The growth rate was the highest for a single quarter since 2023 – it improves on the strong 3.8% real GDP growth rate for the second quarter of the year. The report, which was delayed nearly two months by the government shutdown, credited most of the third-quarter economic gains to higher consumer spending. Also contributing to growth were increased government spending and net exports, while investment declined slightly.

- Trump issues “rule” for new Fed head: President Trump said he expects the next Federal Reserve chair to lower interest rates when the economy is performing well and to worry less about possible inflation due to overheating. On his social-media platform, he spelled out what he called the “Trump Rule”: “The United States should be rewarded for SUCCESS, not brought down by it. Anybody that disagrees with me will never be the Fed Chairman!” The president has said that he will announce his choice at some point in late January, and that he has still not totally ruled out firing current Fed chair Powell before his term ends in May.

Select Market Returns

Our Views

- AI-related growth that drove the stock market in 2025 will continue this year as the Mag 7 and smaller competitors vie for position at the leading edge of innovation. That said, bouts of volatility are to be expected as the AI story evolves over time. Our diversified portfolios position us well to ride out any market turbulence.

- Even after a stellar 2025, international stocks are positioned to keep performing well in the coming year. Along with solid GDP growth expectations, they will benefit from attractive valuations and cheaper money – all of the world’s major central banks except the Bank of Japan are currently in rate-cutting cycles.

- Efforts to shore up the labor market should continue to be the Fed’s primary focus in 2026. We think up to two more rate cuts are warranted this year to support the economy without stoking inflation. While the Fed is now projecting just one cut in 2026, our view is generally in line with market expectations that a second cut could make sense.

- The strong spending trend for consumers is continuing despite measures showing that consumer confidence is growing weaker as prices and unemployment rise. We think spending will hold up into the new year given lower interest rates and fiscal stimulus via the One Big Beautiful Bill Act that puts more money into consumers’ pockets.

- Higher U.S. home sales for a third straight month in November is a sign that the nation’s housing market could be starting to normalize. This would be a boon for would-be buyers and sellers alike. The National Association of Realtors reported that the sale of existing homes increased at an annualized rate of 4.13 million, the highest pace since February.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.