Market Monitor | Mid-Month Update

Headlines and Highlights

- Powell probe stirs Fed furor: The Justice Department opened a criminal investigation into Federal Reserve Chair Jerome Powell, provoking a backlash from critics who called it an attack on the Fed’s independence. The probe focuses on Powell’s Senate testimony last summer about Fed building renovations, which have incurred substantial cost overruns. Powell, former Fed chiefs, global central bankers and some Republican senators assailed it as a blatant attempt by the Trump administration to pressure the Fed to lower interest rates.

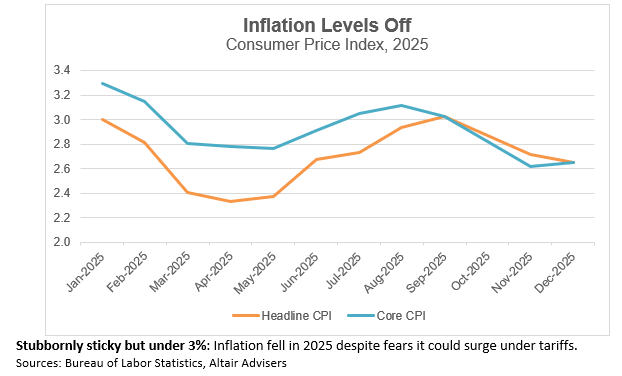

- Inflation holds steady despite tariffs: Consumer inflation remained little changed at the end of 2025, capping a year in which it cooled slightly despite a midyear rise due to new tariffs. The Consumer Price Index rose 2.7% year-over-year in December, and core CPI – which excludes volatile food and energy – was up 2.6%. Both figures were unchanged from the prior month but represented a slower pace of price increases than the 3.0% and 3.3%, respectively, from last January. Grocery prices rose last month at their fastest pace since July 2022.

- Small caps surge to start the year: Smaller-company stocks as measured by the iShares Russell 2000 ETF soared 7.8% in the first half of January, buoyed by lower interest rates and investors’ growing risk appetite amid a positive economic outlook. Large caps as benchmarked by the iShares S&P 500 ETF added5%. International stocks carried over their 2025 momentum into the new year; the benchmarks for developed- and emerging-markets stocks were up 3.5% and 5.9%, respectively. Bonds and real estate posted modest gains.

Chart of Interest

Key Takeaways

- Unemployment declined from 4.6% to 4.4% in December even as the 50,000 new jobs created during the month fell short of expectations. The new-jobs number for the month was roughly the same as the monthly average last year, which gave rise to the description “no hire, no fire” labor market. The 584,000 jobs added in 2025 were the fewest in a non-recession year since 2003.

- Broad support for Powell in Washington and on Wall Street appears likely to prevent the Trump administration from trying to forcibly remove the Fed chair. We expect the Justice Department to pull back in its investigation. Disagreeing with the Fed is fine – we have done it numerous times over the years – but maintaining its independence is essential.

- The latest measure of America’s trade deficit showed a surprising 39% plunge to its lowest monthly level since 2009. The Commerce Department reported that imports exceeded exports by $29.4 billion in October, down from more than $48 billion in September, reflecting a sharp drop in imports due to tariffs while exports remained strong.

- Annualized GDP growth for the fourth quarter of 2025, as estimated by the Atlanta Fed, jumped from 2.9% to 5.4% in early January following the Commerce Department’s trade-deficit report. This estimate has held fairly firm in the face of other data releases. The first official GDP numbers for the quarter are scheduled for release in late February.

- Existing home sales rose more than 5% in December, the National Association of Realtors reported. It was the largest monthly increase since early 2024 and the fourth straight month of higher sales. Lower mortgage rates and flat growth in home prices are credited with boosting transactions in recent months, but 2025 overall saw the fewest homes change hands since 1995.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.