Market Monitor | Mid-Month Update

Headlines and Highlights

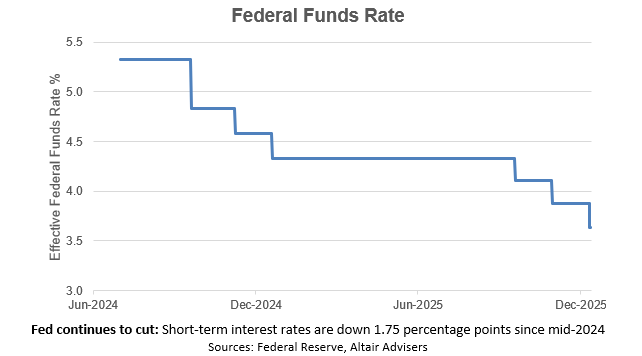

- Fed makes 3rd rate cut of 2025: The Federal Reserve’s Open Market Committee matched market expectations at its December meeting by reducing short-term interest rates by 0.25%, citing growing worries about the U.S. labor market. Fed chair Powell expressed concern that the U.S. may have experienced negative jobs growth in recent months. As a result, he said current risks to employment are greater than risks regarding inflation, so a stimulative interest-rate cut to a range of 3.5-3.75% was warranted this month.

- Unemployment up in November: The government’s monthly report on employment for November pegs the nation’s jobless rate at 4.6%, up from 4.4% in September and higher than expected (the October report was canceled due to the government shutdown). The Bureau of Labor Statistics estimates that 64,000 net new jobs were created in November, but the agency also revised down the numbers for October to a net loss of 105,000 positions, driven mostly by a large cut in federal government jobs. August and September were also revised down.

- Stocks dip slightly as AI fears rise: The S&P 500 large-cap index was down 0.4% in the first half of December on rising unease about valuations for AI-focused stocks. Year to date, the index is up 17.3%. The small-cap Russell 2000 has climbed 1.3% so far in December (14.8% year to date) on lower interest-rate expectations. International developed markets gained 2% month to date (30.5% in 2025), while bonds and U.S. REITs are both down in December but up for the year.

Chart of Interest

Key Takeaways

- Powell blames current inflation on the tariffs imposed by the Trump administration. But even despite tariffs, inflation appears to be anchored. A major reason is that housing prices – the largest single contributor to the Consumer Price Index – are declining in many parts of the country.

- Global trade continues to grow despite higher U.S. tariffs. The World Trade Organization says the total value of traded goods globally will increase this year by roughly 7% to $35 trillion. The WTO credits the value increase to a combination of higher prices and higher trade volumes, as the global middle class continues to expand and their consumption increases.

- Holiday spending in the U.S. is predicted to top $1 trillion for the first time, but shoppers are less than merry about prices. A new survey from The Associated Press-University of Chicago found that half of Americans say they are struggling to afford their gift list, given inflation’s cumulative impact on affordability since the pandemic.

- The U.S. dollar was down about 1% in the first half of December – for the year, the U.S. Dollar Index has fallen 9.2%. Factors driving the decline include interest-rate expectations, U.S. economic uncertainties and trade-related turmoil. A weaker dollar has provided a significant tailwind for international stocks in 2025.

- U.S. corporations are already saving big – in some cases, billions of dollars – from the tax-related provisions of the One Big Beautiful Bill Act passed in July. The key driver of the lower tax bills is the ability to fully deduct some capital and research expenses immediately. Interest expense deductions were also enhanced.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.