Market Monitor | Mid-Month Update

Headlines and Highlights

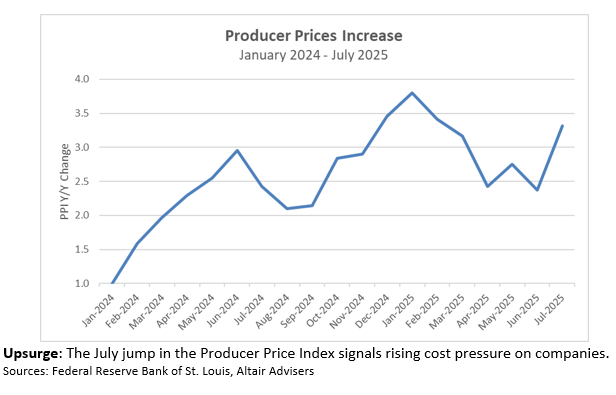

- Wholesale inflation rises more than expected: Producer prices rose by the most in three years last month, raising concerns about a potential resurgence of inflation for consumers. The producer price index, considered a good pre-indicator of overall inflation, increased by 0.9% from June in a sign companies are seeing an impact from recently imposed U.S. tariffs. It raised wholesale inflation to 3.3% from 2.3% a month earlier. Core consumer prices, watched closely by Federal Reserve policymakers, climbed to 3.1% from 2.9% — the highest since February.

- Ukraine cease-fire push intensifies: Global investors are watching closely as the U.S. steps up efforts to broker a cease-fire between Russia and Ukraine in the largest war in Europe since World War II. Markets have been little-changed in cautious trading during separate summit meetings between Presidents Donald Trump and Vladimir Putin in Alaska and among Trump, Volodymir Zelensky and European leaders in Washington. A breakthrough agreement, if sustained, could reduce a major overhang on global markets.

- Overseas stocks re-energized as tariff uncertainty eases: International developed stocks added 5.6% in the first half of August as trade deals and settled tariff rates resolved some near-term concerns. The benchmark for international developed stocks, which had underperformed U.S. stocks for three months after a roaring start to 2025, resumed its hot streak and was up 23.9% year-to-date. The S&P 500 gained 1.8% for a gain of 10.5% so far this year. Small caps moved into positive territory for 2025 (+3.3%) with a 3.5% rise. Bonds edged higher as yields declined.

Chart of Interest

Key Takeaways

- Even with the uptick in inflation, we believe the Federal Reserve will lower interest rates next month for the first time since December and again once more by year-end. We expect tariff-induced inflation to be short-lived. Chair Jerome Powell’s speech this Friday at the Fed’s annual conference in Jackson Hole, Wyoming, will be an important indicator of what Fed policymakers do next.

- Consumers have grown more negative about prices but have spent freely throughout the summer, providing a solid foundation for continuing U.S. economic growth. Despite the first drop in consumer sentiment since April, retail sales rose by 0.5% last month on top of an upwardly revised 0.9% increase in June.

- Corporate earnings season for the second quarter, nearly complete, has highlighted the resilience of U.S. corporations amid worries about the coming impact of tariffs. Companies have reported 11.7% higher profits than in the same quarter a year ago, more than doubling initial expectations, according to FactSet.

- The S&P 500 has reached double-digit returns in 2025 despite fears tariffs might derail economic growth. Investors have remained bullish based on companies’ heavy AI-linked capital expenditures and prospects for productivity gains plus the increasing likelihood of interest-rate cuts soon.

- Real estate has continued to lag other investments in 2025, with the Vanguard REIT Index Fund up just 2.6% year-to-date after underperforming the S&P 500 by 20 percentage points (24.9% to 4.9%) last year. Coming interest-rate cuts are likely to benefit this rate-sensitive sector.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.