Mid-Month Update

Headlines and Highlights

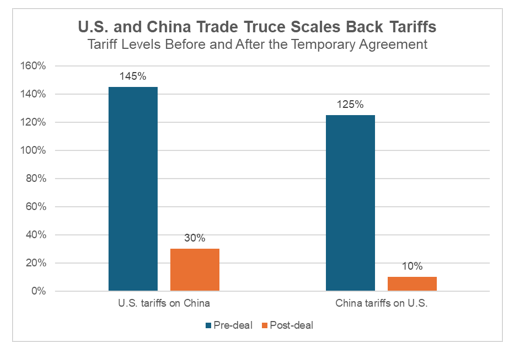

- US-China détente buys time for trade deal: The United States and China lowered their harsh retaliatory tariffs on each other for 90 days while they negotiate toward a more meaningful agreement. The truce between the world’s two biggest economies marked a major de-escalation in President Trump’s global trade war for the near term while doing little to resolve future uncertainty.

- Inflation falls to new four-year low: Consumer prices rose at their slowest annual pace in four years last month as the effect of import tariffs had yet to fully filter into the economy. The Consumer Price Index was up 2.3% year-over-year while core prices – which exclude the volatile food and energy categories – climbed 2.8%, both the lowest since the spring of 2021 when inflation began to accelerate in earnest. The April data suggested that companies did not yet rush to pass higher import costs on to consumers by raising prices.

- S&P 500 erases its loss for 2025: The Standard & Poor’s 500 index turned positive for the year for the first time since February on the strength of positive trade-war developments that has produced solid gains this month. The large-cap benchmark rose 6.3% in the first half of May for a year-to-date advance of 1.1% and moved with 3.2% of its February 19th all-time high. Small caps equaled the S&P 500’s strong start to the month of May but remain down 5.6% year-to-date. International equities momentum slowed in May but have gained an impressive 15.1% so far this year. Bonds are up around 2% since the start of the year.

Chart of Interest

Our Views

- The U.S.-China trade truce is a temporary but welcome salve for markets and the economic outlook, demonstrating the Trump administration’s willingness to back off its hard line on import tariffs. Despite Beijing’s initial cooperation, however, we do not expect it to give up much, leaving Washington to make further major concessions to get a deal done after the 90-day truce ends.

- Even a mild recession appears less likely now that the U.S. administration has shown it will delay and substantially reduce tariffs in order to secure trade deals. The tariffs remaining in place will still drag down growth. But the suspension of extreme tariffs on China provides more time for the administration to stimulate the economy with tax cuts and deregulation.

- The 90-day pause on most “retaliatory” tariffs has bought the Federal Reserve more time to hold off on further interest-rate cuts due to lower recessionary odds, as they monitor the potential impact of tariffs on the inflation data. We now do not expect the Fed to resume rate cuts before its September meeting.

- Stocks’ substantial gains in recent weeks have largely been the result of a tariff relief rally that could be reversed without further rollbacks or final agreements. But the broad participation in the rally by stocks across all sectors over the past five weeks is a positive sign of growing investor confidence in companies of all sizes.

- Bonds continue to play a valuable role in portfolios despite the recent rise in yields that has crimped returns. (Bond prices fall when their yields rise.) Investors are receiving significant income with yields at multi-year highs. We believe yields will be range bound at their current levels now that the odds of a recession are diminishing.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.