Market Monitor: September Mid-Month Update

Headlines and Highlights

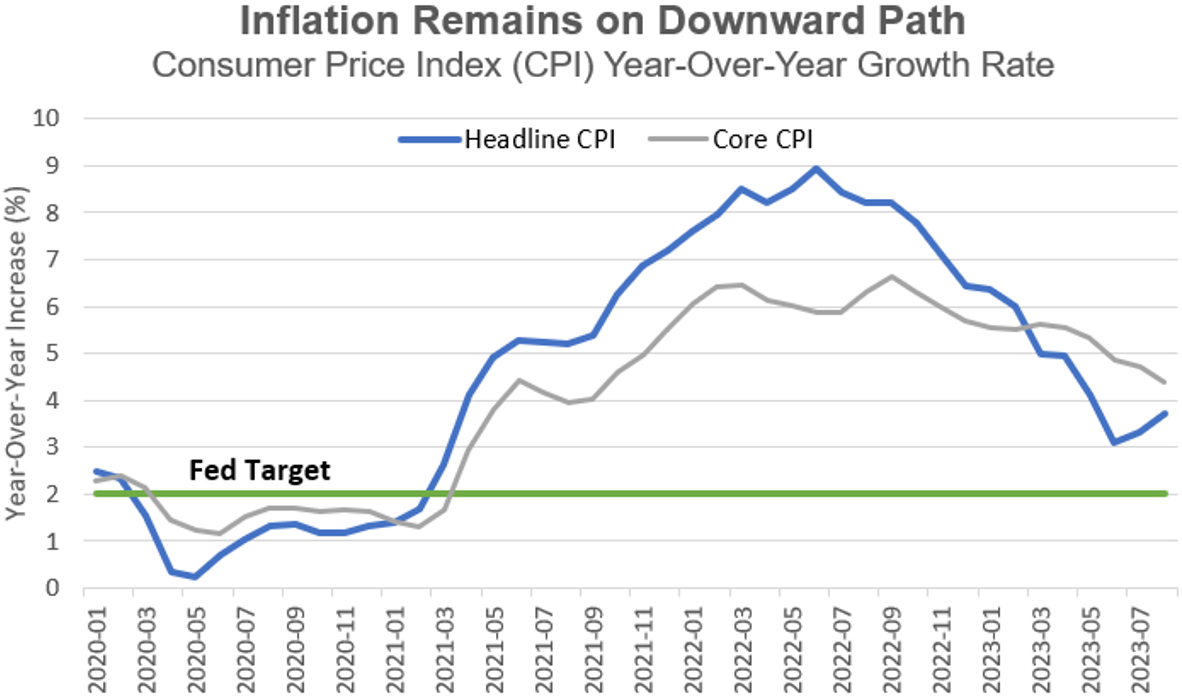

- Inflation picks up but overall outlook encouraging: The Consumer Price Index saw its biggest monthly jump in over a year due to a spike in energy prices, rising 3.7% in August from year-ago levels. Core inflation continued to normalize, however, meaning the Federal Reserve appears likely to forgo another interest-rate hike at its September meeting this week. Excluding the food and energy categories, core prices rose at an annual rate of 4.3%, the smallest advance in nearly two years. Consumers’ year-ahead inflation expectations, a key determinant of future spending behavior and actual inflation, fell sharply to 3.1%, a University of Michigan survey showed.

- U.S. economy shows continued strength: Consumers and the labor market, twin pillars that have undergirded the economy during more than a year of higher rates and inflation, displayed solid growth in the latest data. Retail sales increased more than expected last month thanks to both a jump in gasoline prices and the summer splurge on services such as travel, concerts and sporting events. The number of Americans applying for first-time unemployment benefits fell to the lowest level since February, reflecting relatively few layoffs in a robust job market.

- 2024 world outlook slower: Global growth has been stronger than expected in 2023 but is poised to slow next year as countries feel the full impact of interest-rate hikes, according to the Organization for Economic Cooperation and Development. The Paris-based OECD raised its world GDP forecast for this year to 3% from 2.7%, citing a strong start due to lower energy prices and China’s reopening, while lowering its estimate for 2024 growth to 2.7%. U.S. economic growth is predicted to drop to 1.3% next year from 2.2% this year.

Chart of Interest

Nearing target: Core inflation continued trending lower in August even as headline CPI rose.

Sources: Federal Reserve Bank of St. Louis, Altair Advisers

Key Takeaways

- Global stocks were mostly lower in the first half of September after a down August. The S&P 500 shed 1.2% while remaining up 17.3% year-to-date. International developed stocks edged 0.1% lower but retained a double-digit gain for 2023 at 10.4%. Emerging-markets stocks eked out a 0.1% gain while U.S. and global REITs declined 0.8% and 0.9%, respectively. Bonds remained slightly negative for the year; U.S. municipal bonds ticked down 0.2% and taxable bonds fell 1.1%.

- The dollar has risen 5% against a basket of other leading currencies in the past two months, propelled by data showing greater economic resilience in the U.S. compared to Europe and elsewhere. It remains nearly 8% below last year’s multi-decade high, resulting in less pressure on the profits of U.S. companies with substantial overseas sales.

- Corporate earnings are projected to end their streak of three quarters of negative growth this fall, a positive sign for markets. FactSet Research estimates S&P 500 profits rising 0.8% year-over-year in the third quarter and 8.6% in the fourth quarter.

- China’s economy appears to have stabilized in August after a first-half slump. Consumer spending, factory output, industrial production and urban employment all improved as the government ramped up pro-growth measures.

- A U.S. government shutdown will begin October 1st if Congress fails to enact legislation to fund the federal government for the upcoming fiscal year, as appears increasingly likely. It would be the first since a five-week closure in 2018-19 that permanently cost the U.S. economy an estimated $3 billion, according to the Congressional Budget Office. Markets have generally not reacted much to past shutdowns. The chance of market turbulence is higher with a prolonged shutdown, but we believe the eventual resolution will bring a quick rebound from any volatility.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.