Market Monitor: November Update

Headlines and Highlights

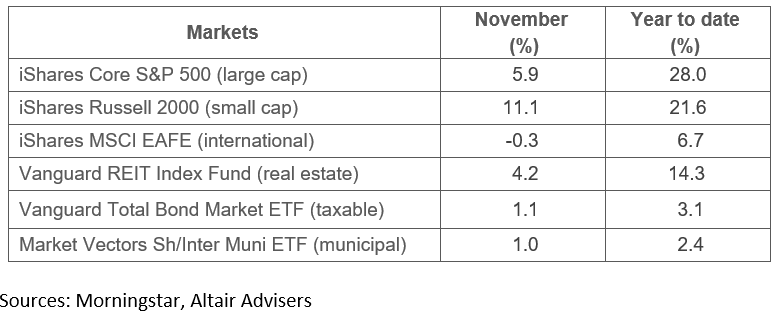

- U.S. stocks see best monthly gains in a year: Large- and small-cap stocks rose by the most in any month since November 2023, reflecting investors’ enthusiasm for President-elect Donald Trump’s proposals for cutting taxes and easing the regulatory burden on businesses. The benchmark for small caps soared 11.1% last month to more than double its 2024 gain, while the S&P 500 rose 5.9% to push its year-to-date return to 28%. The dollar’s climb and the threat of tariffs on foreign goods by the Trump administration pressured international developed (-0.3%) and emerging-markets (-2.7%) stocks.

- Inflation’s decline stalls, putting Fed’s rate-cut pace in question: An acceleration of consumer price increases has raised doubts about whether the Federal Reserve will lower interest rates as quickly as it expected. The PCE price index picked up to 2.3% in October and core PCE prices rose to 2.7%, extending a pause in two years’ steady progress toward the 2% target. Markets still expect the Fed to reduce rates by a quarter point to 4.25% at its December meeting but are less certain it will make the four additional cuts in 2025 that it projected earlier this fall.

- Economy stays durable as year-end approaches: Key indicators for growth, output and employment all displayed strength as the U.S. economy headed into the final month of 2024. Economic activity as gauged by the Atlanta Fed pointed to projected GDP growth of 3.2% in the fourth quarter despite a continuing, albeit slowing, manufacturing contraction. A survey of the services sector compiled by S&P Global rose to its highest level in 32 months, with orders increasing based on optimism about lower interest rates and the pro-business approach of the incoming administration. The number of Americans applying for unemployment benefits fell to a seven-month low, reflecting layoffs at historically low levels.

Selected Market Returns

Key Takeaways

- The holiday shopping season, an important barometer of U.S. consumer spending, got off to a strong start. Sales grew at a faster pace than last year on Black Friday as online transactions jumped 10% to $10.8 billion, according to Adobe Analytics, more than offsetting an 8% drop in in-store traffic.

- The market’s post-election reactions reflects speculation about the extent and impact of policies yet to be enacted by the incoming administration and may not reflect longer-term performance. This was the case after President Trump’s 2016 election victory, when some early trends ultimately reversed.

- President-elect Trump’s declared intention to impose broad new tariffs on Mexico, Canada, and China upon taking office January 20th is a source of uncertainty for U.S. and international markets. Companies have cautioned that tariffs will erode their profits and lead to higher prices for consumers. The extent and ramifications of any new tariffs remain unpredictable.

- The 10-year Treasury bond yield has risen significantly since polls began pointing in October to a Trump victory in the election, reflecting bond investors’ concern about the impact of tariffs. Bond investors worry that stiff tariffs would push prices of imported goods and other products higher, causing the Federal Reserve to stop reducing interest rates and possibly raise them instead to curb a new bout of inflation.

- The new economic policy team is taking shape, comprised of officials with existing ties or a record of support for the president-elect. Named to key positions are hedge-fund manager Scott Bessent as Treasury secretary, economist Kevin Hassett as National Economic Council director, Cantor Fitzgerald CEO Howard Lutnick as Commerce secretary, international trade attorney Jamieson Greer as U.S. trade representative, and former Trump budget director Russell Vought as director of the Office of Management and Budget. All but Hassett need to be confirmed by the Senate.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.