Market Monitor: November Update

Headlines and Highlights

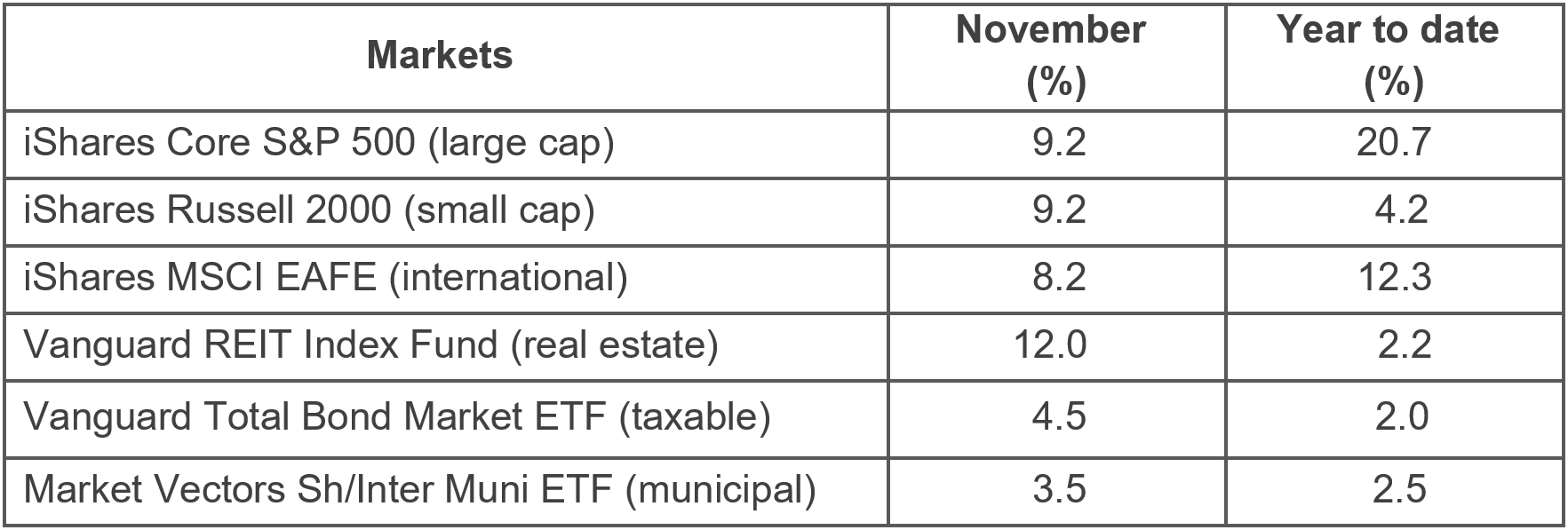

- Stocks stage powerful rally: Global stocks had their best month of the year thanks to progress on inflation and brightening prospects for interest-rate cuts in 2024. The S&P 500 snapped a three-month losing streak with a 9.2% rise, its biggest monthly increase since July 2022. Big tech stocks once again led the way. International developed stocks (8.2%) were close behind their U.S. peers with their best month since November 2022. Outsize gains for the benchmarks of U.S. REITs (12.0%) and small caps (9.2%) lifted those benchmarks back into positive territory for the year.

- Consumer spending and inflation slow: The Federal Reserve’s preferred inflation metric cooled in recent weeks as consumers spent a bit less vigorously. The core personal-consumption-expenditures price index edged down to an annual rate of 3.5% in October, keeping inflation on a trajectory toward the Fed’s 2% goal. Inflation-adjusted personal spending advanced just 0.2%, confirming that the economy is reverting to a normal pace after the unexpected growth surge in the July-through-September quarter. That trend is likely to help reassure the Fed that no further interest-rate hikes are needed.

- Historic month for bonds as yields fall: Bonds had their best month since the 1980s by some measures as yields tumbled. Investors’ expectations that the Fed will pivot to a less restrictive monetary policy amid slowing in the economy and inflation pushed the benchmark 10-year U.S. Treasury yield down by more than half a percentage point in November to 4.3%. That drop prompted a jump in the benchmarks for both taxable (4.5%) and municipal (3.5%) bonds, finally sending them out of negative territory for the year.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The Federal Reserve is likely to hold interest rates at their current high level until next spring at the earliest unless an unexpected shift in economic conditions occurs. Fed officials continue to hold out the possibility of further rate hikes if needed, but their next move will almost certainly be a rate cut in 2024.

- The economy is finishing out the year with scant sign of the recession that many, if not most, Wall Street pundits expected when 2023 began. A soft landing (no recession whatsoever and inflation returning to Fed target) is a strong possibility but not assured. Growth is slowing; the Atlanta Fed estimates GDP to expand at only 1.2% annual rate in the fourth quarter. But the economy is still healthy.

- Consumers are likely to cut back from their spending sprees of summer and early fall in the face of high interest rates, but we see no signs of a concerning drop-off in spending that would worsen the outlook for 2024. Despite some concerning data, the consumer has allowed the economy to remain strong.

- Stocks have carried impressive momentum into December, historically a strong month for the U.S. market, following the seventh-best month in the last 30 years. We see several signs suggesting continued, if smaller, gains: The rally has broadened from the tech-only run of earlier 2023; the job market and corporate earnings remain robust, and inflation is falling.

- Government bond yields have continued to drop, confirming our view earlier this fall that the 10-year Treasury’s rise had peaked at 5%. We believe there is still room for the 10-year note to decline beyond its current 4.2% with inflation coming down and the Fed not yet embarked on rate cuts.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.