Market Monitor: March Update

Headlines and Highlights

- Fed keeps rates on hold: The Federal Reserve kept interest rates unchanged at a range of 5.25% to 5.50% as expected, citing the bumpy path toward lower inflation but leaving open the likelihood of a rate cut within months. Since its March 20th decision, Federal Reserve Governor Christopher Waller pointed to a robust economy and strong hiring as additional reasons to wait until inflation is closer to the 2% target. Market traders expect three rate cuts by the end of this year, now in line with what the Fed was foreshadowing a few months ago, lowering the federal funds rate to at least 4.50%.

- Government funding approval ends shutdown threat: Congress finally agreed on spending levels for federal agencies for the fiscal year that began last October with a $1.2 trillion package covering the next six months. The spending bill, signed into law by President Biden, narrowly averted the latest in a series of shutdown deadlines caused by partisan policy disagreements that limited funding to a series of stopgap measures. The package lacked the White House’s requested assistance for Ukraine, Israel and Indo-Pacific allies.

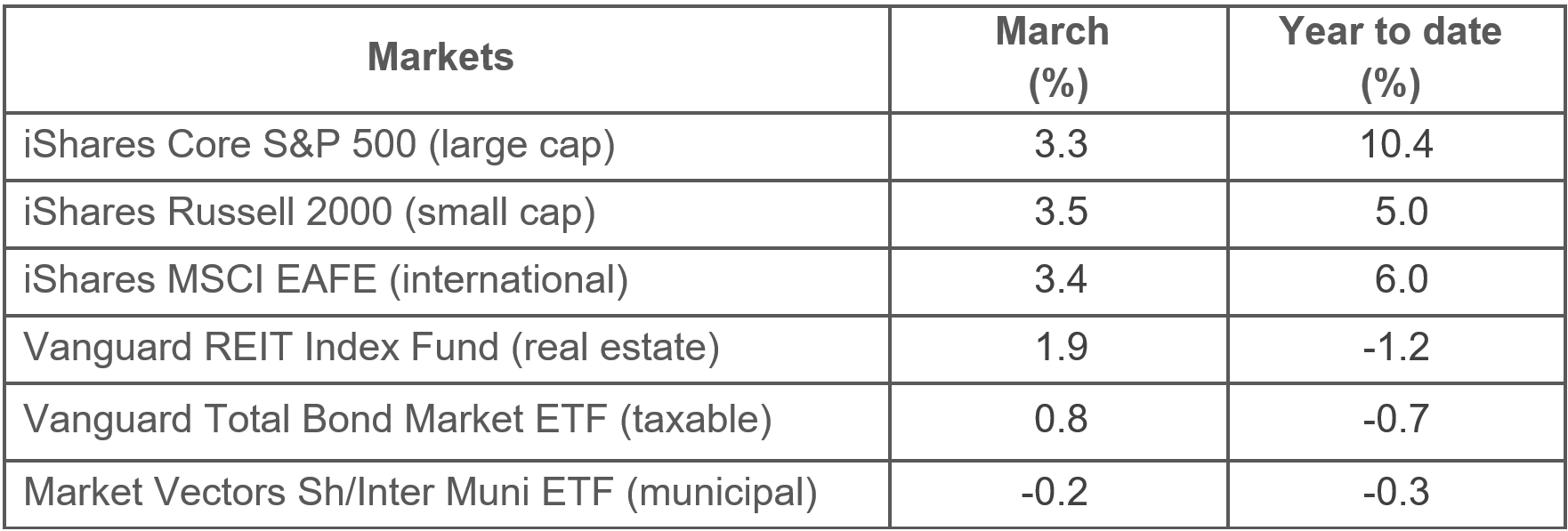

- Stocks off to best start since 2019: Global stock markets finished the first quarter with their best performance in five years thanks to U.S.-led economic strength and investors’ continuing optimism for artificial intelligence. The MSCI All Country World Index, a broad measure of global stock performance, gained 8.2% as an extended runup in the U.S. market (S&P 500 +10.4%) was joined by rallies in Europe and Japan. Small caps (+5.0%) and international developed stocks (+0%) started the quarter slowly but outperformed large caps in March as momentum broadened out. Bond benchmarks had a mixed showing last month, the result of longer rates drifting slightly higher, and finished the quarter in the red.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The U.S. economy remains robust despite some mixed data in January and February and concerns about a potential slump caused by high interest rates have diminished. Consumer confidence held steady in March, the labor market is cooling at the desired gradual pace and corporate earnings have not wavered, making for a solid outlook for the months ahead.

- The Federal Reserve is taking longer than the market originally expected to start lowering interest rates but still appears likely to begin cuts around midyear. Its policymakers have made clear they are wary about the economic risk of maintaining high rates for too long, so this pause should not last many months longer.

- Supply chains that already are stressed because of global trade disruptions in the Red Sea face an additional challenge as a result of the Baltimore bridge collapse, although we do not anticipate a material impact on prices. While the temporary shipping delays may increase prices for some goods, the main remaining obstacles to lower inflation remain higher rent costs and service prices.

- A more balanced market bodes well for the sustainability of U.S. stocks’ strength. The Magnificent Seven and other technology stocks no longer account for the majority of gains as every sector except for real estate is positive in 2024, with energy, communications services, financials and industrials leading the way. International stocks also are demonstrating resilience in a strong 2024 performance.

- Bond investments should get a boost over the course of the year as interest-rate cuts become reality. First-quarter performance of both taxable and municipal bonds was disappointing as yields reversed course from last year, rising incrementally as hopes for imminent cuts dimmed. When rates and yields go up, prices of existing bonds fall.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.