Market Monitor: March Mid-Month Update

Headlines and Highlights

- Fed poised to hold firm as inflation tops forecasts: Inflation rose more than expected in February, reinforcing that the Federal Reserve is still likely months away from reducing interest rates. The Fed is all but certain to forgo a rate cut at its meeting on Wednesday after the consumer price index (both headline and core measures) climbed 0.4% last month. That left the CPI’s annual rate at 3.2% (3.8% for core), remaining stubbornly above the Fed’s 2% target.

- International, U.S. stocks move higher: Overseas benchmarks have narrowed the performance gap with their U.S. peers this month, with international developed markets adding 2.0% (now +4.5% for the year to date) compared to 0.5% for the Standard & Poor’s 500 (+7.6% YTD). The S&P has notched three more record closes to reach 17 all-time highs in the year’s first 50 trading days, the most since 1998. Energy stocks jumped 6% to become the market’s top-performing sector in 2024 amid a 14% rise in oil prices. Small caps continue to lag for the month (-0.7%) and year (+0.9%). Bond benchmarks are mixed this month and REITS continue to struggle.

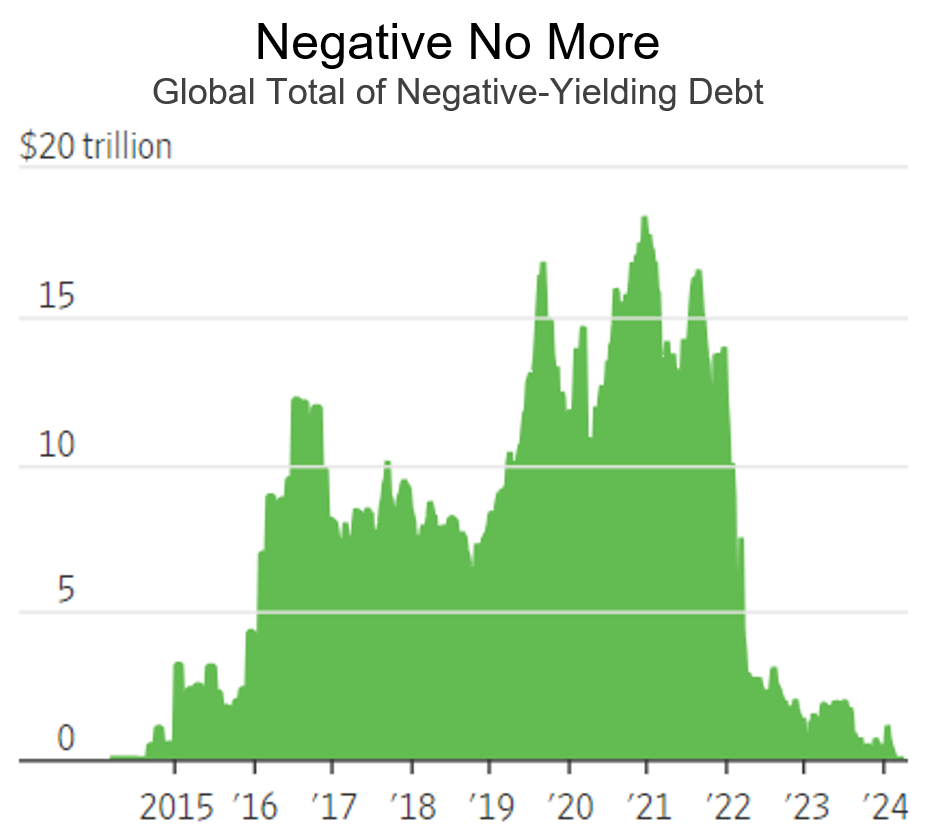

- The era of negative rates is over: Negative interest rates, the unconventional monetary policy tool deployed by numerous government banks worldwide to stimulate their economies in recent years, have ended. The Bank of Japan, the last central bank with negative rates, moved off them on Tuesday after eight years. Central banks in Sweden, Switzerland and the eurozone also had negative rates, but Europe’s decade-long experiment with negative rates ended in 2022.

Chart of Interest

End of an era: Central banks’ experiment with negative rates lasted for a decade.

Sources: The Wall Street Journal, FactSet

Key Takeaways

- Market expectations for Fed rate cuts continue to decline. The majority of traders in federal funds futures anticipate three cuts of a quarter-percentage-point by the end of 2024, according to the CME FedWatch Tool. That is down from four cuts a month ago and six as recently as mid-January.

- Unemployment rose to a two-year high of 3.9% last month but remained under 4% for a 25th consecutive month, the longest such stretch since the 1960s. Combined with 275,000 jobs added, the latest data pointed to a softening but still-healthy labor market. A moderating employment market should help keep the Fed on track to cut rates this year.

- U.S. consumer confidence declined last month but there has yet to be a meaningful slowdown in spending, which accounts for two-thirds of the economy. Americans stepped up their spending last month, nudging retail sales up 0.6% year-over-year following a 1.1% decrease in January that raised concerns about their staying power in the face of persistent inflation.

- A partial U.S. government shutdown may occur briefly this weekend as Congress continues to wrangle over spending priorities. The latest in a series of agreements on short-term funding was reached Monday night but may not be finalized before funds for a large swath of the federal government expire on Friday. Struggling to reach agreement on 2024 spending since the fiscal year began last October, congressional leaders have been relying on a series of stopgap bills to keep federal agencies funded.

- The national debt has grown at a faster pace in recent months, rising $1 trillion about every 100 days to exceed $34 trillion. Treasury Secretary Janet Yellen says the government’s growing debt burden remains under control and points to the government’s interest payments representing about 2% of GDP, in line with the historical average since 1960. The rising debt is a concern for the future economy but has little current impact on markets.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.