Market Monitor: June Update

Headlines and Highlights

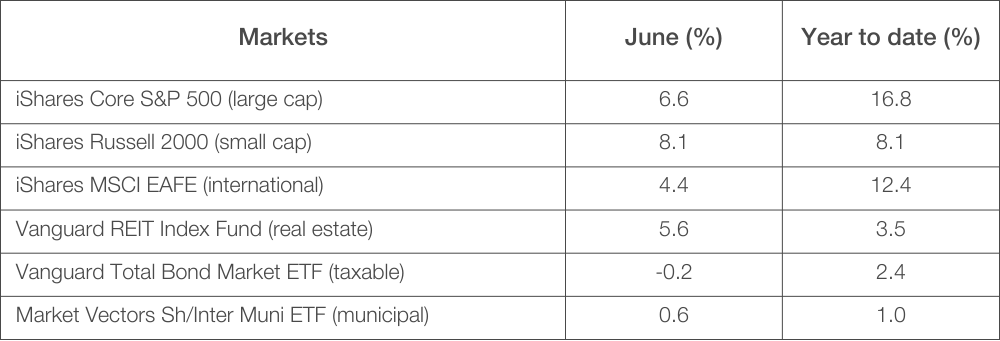

- Stocks cap strong half with big month: Investor optimism fueled by a long-awaited pause in interest-rate hikes and a drop in inflation produced the best month for the U.S. stock market since October, with international stocks close behind. The benchmark S&P 500 rose 6.5% in June and 16.8% in the first half, reaching its highest level since April 2022. Technology stocks were the difference-maker in the opening six months; the tech-heavy Nasdaq Composite had its best first half (+31.7%) in 40 years. Bonds remained pressured by rates as the benchmark 10-year U.S. Treasury rose to 3.8%, but prices reached the midway point of 2023 with small gains.

- Inflation cools, economy steady: Inflation as measured by the Federal Reserve’s preferred gauge cooled off in May with consumers continuing to ease up on spending. The Personal Consumption Expenditures price index fell by half a percentage point to its lowest annual level (3.8%) in two years after personal spending for the month ticked up just 0.1%. Core PCE, which excludes the more volatile food and energy categories, also declined but remained well above the Fed’s 2% target level at 4.6%. The economy remains on course for modest growth despite some mixed signals: The leading economic index fell for a 14th straight month, but housing starts surged, the job market stayed strong and consumer sentiment improved.

- China’s recovery stalls: The surge in activity that briefly buoyed China’s economy after its reopening from COVID-19 lockdowns has stagnated, reflected in weakening data and a worsening jobs shortage. The world’s second-largest economy grew faster than expected in the first quarter. Since then, consumer spending has turned sluggish, manufacturing has contracted for three straight months, the property market is in crisis, and exports and new orders are declining, reflecting less overseas demand. China’s central bank recently cut a key policy rate, an acknowledgment by the government that the economy is struggling.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- U.S. inflation is trending lower at an encouraging pace and we see it dropping to around 3% in the months ahead, based on real-time data not yet reflected in either the Consumer Price Index or the PCE price index. While it is unlikely to reach 2% this year, its decline lessens the risk of the Federal Reserve overtightening its monetary policy and causing the economy to contract.

- The Fed has projected another two interest-rate increases by year-end, but barring an unexpected reversal of inflation’s decline we are skeptical it will follow through on both. Cooling economic and inflation data are working in the central bank’s favor, and they are well aware of the increased risks to the economy if they push rates much above the current 5% level. We continue to believe there will be no rate cuts before 2024, however, which recently also became the market’s consensus view.

- Consumers have kept the U.S. economy healthy during a period of steeply higher rates and inflation and we do not view the recent slackening in their spending as a red flag. Consumer confidence as measured by the Conference Board’s survey rose to a 17-month high in June, reflecting positive views following the resolution of the debt ceiling and softening inflation.

- Corporate earnings estimates for the second quarter have fallen by more than two percentage points in the past three months, according to FactSet, with profits now pegged to have declined 6.8% from a year ago in a second straight quarter of contraction. They will face a further test as companies feel the full impact of more than a year of rate increases. However, companies have acted quickly to cut costs and that should be reflected in a return to overall earnings growth in the third quarter.

- The stock market is bound to face more headwinds in the second half than it did in an unusually calm first half as companies absorb the lagging impact of more than a year of rate increases. However, we are encouraged by the fact that the market has seen broadened participation over the last few weeks instead of being driven higher solely by technology-related stocks. A well-balanced market is less prone to a big pullback.

- China’s slowdown adds pressure on the global economy but we believe it can be offset by several positive factors in the outlook for non-U.S. stocks. Valuations are attractive, other emerging-markets such as Mexico and Brazil have accelerated, Japan’s market has rebounded and Europe is positioning itself well for a strengthened recovery. Rising headwinds for the dollar should help, too, given that other central banks are raising rates while the U.S. is closer to the end of its hiking cycle.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice