Market Monitor: June Mid-Month Update

Headlines and Highlights

- Fed pauses, signals more tightening likely: The Federal Reserve kept interest rates unchanged for the first time in 15 months but projected two more future increases following a pause to further assess the economic impact of its steep hikes. The decision came a day after the Consumer Price Index report showed headline inflation fell in May for the 11th straight month to a two-year low of 4.0%. Core CPI (excluding food and energy) remained higher at 5.3%; both rates are well above the Fed’s target. “The process of getting inflation back down to 2% has a long way to go,” Fed Chair Jerome Powell said, citing core inflation in particular.

- U.S. consumers, China reopening boost global economy: The world economy is growing at a faster pace than anticipated in 2023, according to forecasts by two global organizations. Resilient U.S. consumer spending, China’s sooner-than-expected reopening, falling energy prices and a reduction in supply-chain bottlenecks are credited with boosting the world economy above expectations. The first half is expected to be stronger than the second half. The World Bank and the Organization for Economic Cooperation and Development (OECD) now see global GDP in 2023 at 2.1% and 2.7%, respectively, up from their previous estimates of 1.7% and 2.6%.

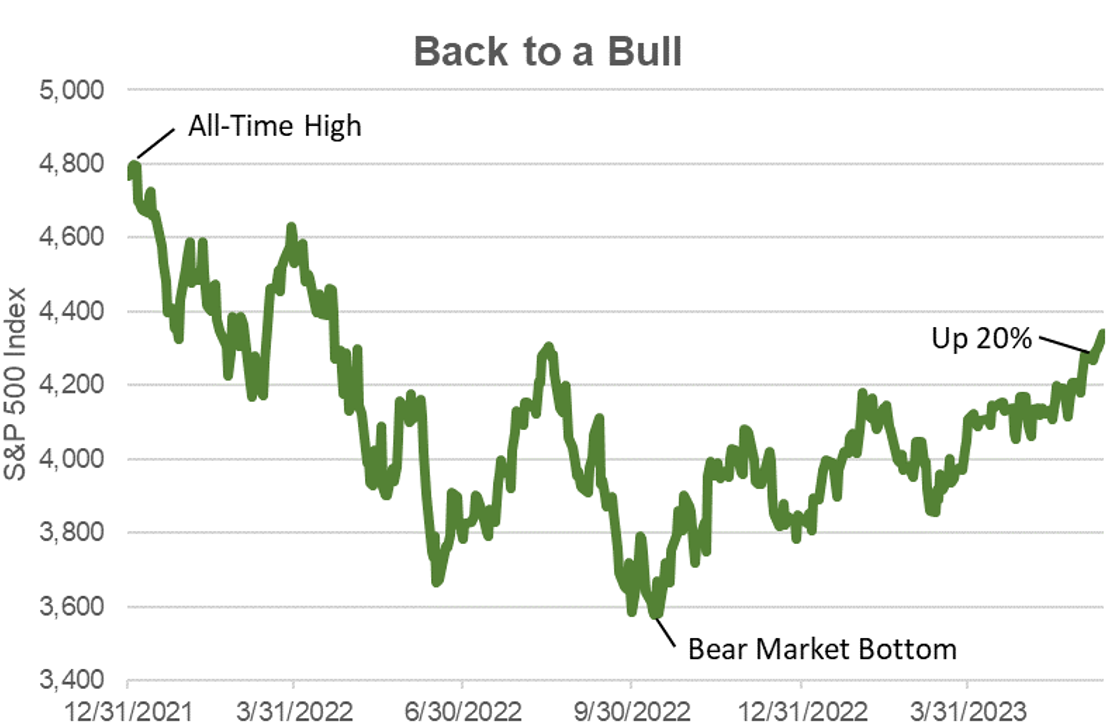

- S&P 500 enters bull market: The resurgent S&P 500 index crossed into what is widely defined as a bull market on June 8th after rising more than 20% from its October 12th The bear market, lasting 248 trading days, was the longest since 1948. Virtually all the gains have come from an artificial intelligence-spurred surge in technology companies, particularly by mega-cap stocks Apple, Microsoft, Nvidia, Amazon, Meta, Alphabet and Tesla. The S&P is up 5% in June and 15% in 2023 but remains 9% off its all-time high. The tech-dominated Nasdaq is up 31% this year.

Chart of Interest

New Bull Replaces Bear: The U.S. bear market lasted nine months and lost 25.4%.

Sources: Morningstar, Altair Advisers

Key Takeaways

- The Federal Reserve remains aggressive in its monetary policy stance even while forgoing another rate hike, signaling at its June meeting that this could be a very short pause. Fed officials now project a peak federal funds rate of 5.6%, up from the current 5%-5.25% range, with not a single one of its 18 surveyed officials forecasting rate cuts before 2024.

- Inflation softened at a quickening pace in May, with the Consumer Price Index tumbling nearly a full percentage point from 4.9% year-over-year in April, and housing trends suggest a material decline to well under 4% in the second half. Rent and other housing costs have slowed meaningfully but have not yet filtered into the CPI’s shelter category, the inflation gauge’s largest component.

- U.S. employment remains surprisingly resilient after more than a year of interest-rate hikes. Initial jobless claims – applications to begin unemployment benefits – increased sharply to their highest level since October 2021 and the jobless rate climbed to 3.7% from 3.4%, signs the labor market may be softening. But the blockbuster job gains reported for April (339,000 nonfarm positions added) along with increases in job openings and declining layoffs show a sturdy labor market.

- The eurozone fell into a technical recession with a second straight quarter of economic contraction in the January-to-March quarter, according to the 20-nation bloc’s latest estimate of GDP (-0.1%). The bumpy economy has not prevented stock markets in Germany, France, Italy and Spain from rising double digits this year as investments benefit from a pullback in energy prices, the dollar’s decline and the reopening of China’s economy, since many European businesses are major exporters.

- Prices of U.S. taxable and municipal bonds retain slight gains for this year despite edging lower in the second quarter as the Fed’s rate-hike campaign pushes yields higher. Bonds have stabilized following their biggest annual losses on record in 2022.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice