Market Monitor: July Update

Headlines and Highlights

- Fed hikes interest rates to 22-year high: The Federal Reserve raised the benchmark interest rate for the 11th time in just over a year to a range of 5.25%-5.5%, a level last seen in 2001. Chair Jerome Powell left the door open to another increase at the Fed’s next meeting in September, reiterating the central bank’s commitment to getting inflation down to 2%. Inflation as measured by the Consumer Price Index has sunk to 3% from 9.1% a year ago. And the Fed’s preferred inflation measure, the core Personal Consumption Expenditures (PCE) price index, was 4.1% year-over-year in June after cooling to its slowest monthly pace, 0.2%, in nearly two years.

- Economy defies recession fears with accelerated growth: S. economic growth unexpectedly picked up pace in the second quarter, rising to an annualized rate of 2.4% from 2.0% in the prior three months. Consumer and business resilience in the face of high interest rates has lessened concerns that the Fed’s tightening could cause a contraction this year or next. An early projection of third-quarter growth by the Atlanta Federal Reserve pegs it at an even better rate of 3.5%.

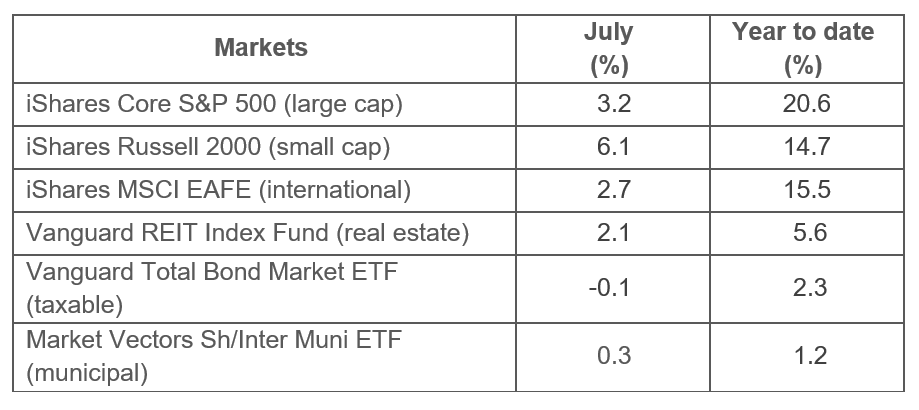

- Markets stay on the upswing: S. stocks logged a fifth consecutive monthly gain as the tech-led rally of 2023 broadened with gains from all 11 sectors in both June and July. Small caps, which tend to outperform when the economy strengthens, led the way for a second straight month. U.S. large caps continue to be the top-performing asset class this year with a 20.6% total return for the S&P 500. The benchmarks for small caps (14.7%), international developed stocks (15.5%) and emerging-markets stocks (11.5%), too, are up double digits through seven months. Bonds were little-changed in July and retain small year-to-date gains.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- A soft landing – reduced inflation without a recession – looks increasingly possible for the economy following the unexpectedly strong increase in GDP along with a continued cooling of price growth. We believe a recession will not happen this year and if one occurs next year it will be mild.

- The Fed is likely done raising the federal funds rate unless recent progress in reducing inflation slows. The PCE inflation report and leading indicators provide additional evidence of cooling beyond the June CPI report, as Chair Powell had said was needed. The combined data should help persuade the Fed leader and his colleagues to forgo another rate hike this fall.

- The earnings recession that has seen S&P 500 companies’ profits decline for the past three quarters looks poised to end in the second half – an encouraging sign for investors – based on better-than-expected second-quarter reports. Analysts surveyed by FactSet now estimate a slight earnings uptick in the third quarter followed by 7.5% growth in the fourth quarter.

- Global economic growth is likely to remain lower than the historical norm in the second half because of rising interest rates, China’s economic difficulties, the protracted war in Ukraine and tense relations between Washington and Beijing. However, encouraging recent inflation data abroad may soon allow central banks to stand down from further rate hikes, which would brighten the international outlook. We see minimal risk of a global recession.

- The U.S. dollar is likely to weaken further in the months ahead, aiding investors, after falling 4% against other major currencies from March through July. The end of the Fed’s hiking cycle as foreign central banks continue to raise rates should help resume its downward trend. A weaker dollar historically has been a tailwind for stocks, particularly international investments denominated in local currencies as well as U.S. large caps, which derive a significant share of their revenue from abroad.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice