Market Monitor: July Mid-Month Update

Headlines and Highlights

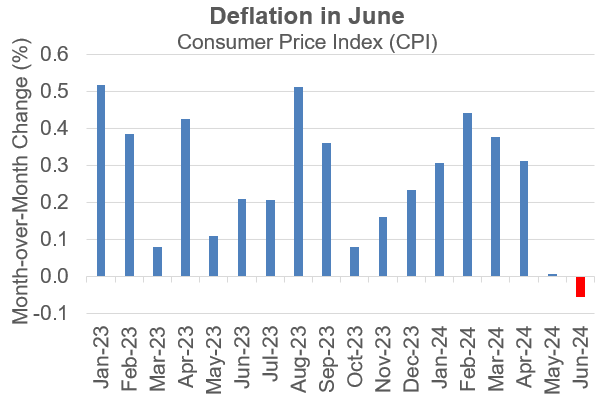

- Inflation slows notably: The Consumer Price Index declined in June from the previous month for the first time since the early days of the pandemic, lowering the annual inflation rate to 3.0%. Further underscoring progress in the inflation fight, core inflation – stripping out volatile food and energy prices – saw its smallest advance (0.1%) in three years. The data increased expectations that the Federal Reserve will start cutting interest rates soon. The inflation barometer the Fed relies on to set interest rates – the personal consumption expenditures (PCE) price index – also is expected to show inflation is easing when the data is released next week.

- Trump survives assassination attempt: Former President Donald Trump was shot in the ear in an assassination attempt at a campaign rally on Saturday in Pennsylvania. President Joe Biden and leaders from across the political spectrum condemned the shooting, emphasizing the need for peace and unity in the country. The political developments have had little impact on markets, although there has been speculative positioning in some areas based on increased expectations of a Trump victory in the November election.

- Markets remain buoyant: Financial markets have logged strong gains in July, accelerating through turbulent developments in the U.S. presidential race. The S&P 500 added 3.2% through mid-month for a year-to-date return of 18.9%, then rose further after the assassination attempt. International developed stocks gained 3.5% for a 2024 return of 9.0%. Previous laggards also thrived: As measured by their benchmarks, small caps were up 6.8% (8.6% year to date), U.S. REITs +5.0% (1.8%), taxable bonds +1.3% (0.7%), municipal bonds +0.7% (0.4%).

Chart of Interest

Flattened: The CPI fell 0.06% in June, the first negative reading since May 2020.

Sources: Bureau of Labor Statistics, Altair Advisers

Key Takeaways

- Former President Trump’s surge in the polls of key battleground states to become the overwhelming favorite in the November election has coincided with a rise in most markets, in part due to the temporary lessening of uncertainty. Trump’s rise raises the odds for increased deregulation, accelerated deglobalization, more tariffs, and a possible Republican sweep of Congress. We believe drawing conclusions about the outcome now would be unwise given how early it still is in the election cycle.

- The Fed is now forecast to lower rates three times by year-end, making quarter-percentage-point cuts at consecutive meetings in September, November and December, according to CME FedWatch. We think three 2024 cuts are unlikely but believe the Fed will initiate cuts in September and possibly add another by the end of the year.

- Inflation excluding housing indicators has been below 2% for 10 of the past 13 months. Housing prices are gradually returning toward pre-pandemic levels, but at a slow pace. We expect overall inflation to moderate further even though we may have the occasional higher-than-expected monthly reading.

- High prices are still a big worry for consumers and businesses despite the progress on inflation. July consumer sentiment as measured by the University of Michigan was the weakest since November in falling for a fourth straight month. Small businesses identified inflation as their top problem in June and sentiment remained below pre-pandemic level, according to a survey by the National Federation of Independent Business.

- Markets in France and the United Kingdom remained stable and mostly positive through election turmoil and changes in the makeup of their governments. Stocks in both countries are up modestly over the past month, contributing to strong performance by international developed markets

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.