Market Monitor: January Mid-Month Update

Headlines and Highlights

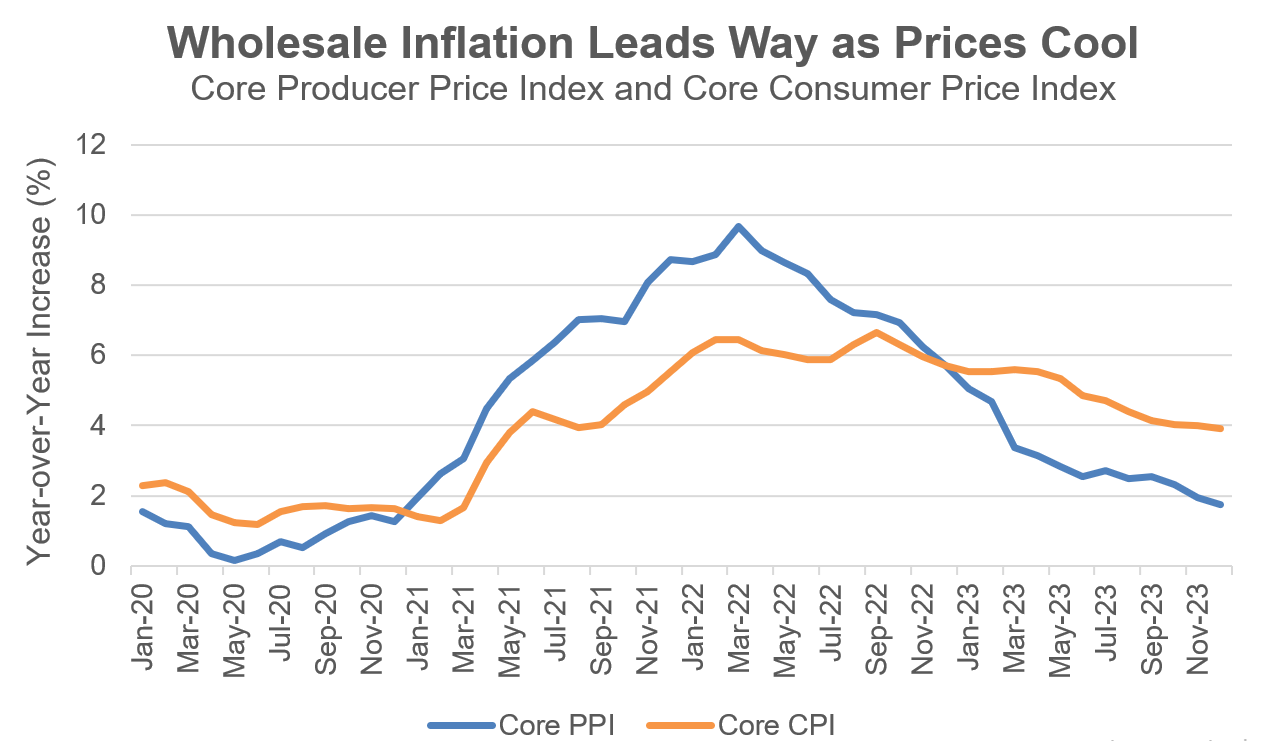

- Inflation trending favorably for rate cuts: The annual inflation rate for both wholesale and consumer inflation edged lower in December, the latest confirmation of cooling price growth. The core producer price index, which gauges inflation before it reaches consumers, slowed for a third straight month to 1.8%. The core consumer price index, which has slowed its decline recently, ticked down to 3.9% year-over-year. The Federal Reserve has signaled it will lower interest rates this year as overall inflation continues to drop toward its 2% target.

- Mixed start to year for markets: Financial markets were muted to begin 2024 after a sizzling year-end rally ended. The S&P 500 rose 0.3% to remain within striking distance of its all-time high, but most other indexes declined slightly. Small caps as benchmarked by the Russell 2000, which led the market’s surge in November and December, retrenched by 3.7% in their worst start to a year since 2016. Taxable and municipal bonds were fractionally lower.

- Government shutdown deadline nears: Congress scrambled to avert yet another partial government shutdown by a Friday midnight deadline. Leaders of both houses are attempting to pass a bipartisan stopgap deal to keep the government funded into March but face resistance from hardline conservatives in the House who advocated further cutbacks. The budget agreement proposes just under $1.66 trillion in discretionary spending for fiscal 2024, adhering to levels negotiated by President Biden and former House Speaker Kevin McCarthy.

Chart of Interest

Decelerating: Wholesale prices are rising more slowly than consumer costs, a sign that inflation is likely to continue to cool.

Sources: St. Louis Federal Reserve, Altair Advisers

Key Takeaways

- Global inflation is at risk of rising again as a result of the attacks by Houthi rebels in Yemen on Red Sea shipping, forcing cargo carriers to divert from the Suez Canal route to a much longer course around the Cape of Good Hope. The longer journeys cost more by adding 10 days or more to shipping times and disrupting supply chains.

- Market participants predict several more interest-rate cuts this year than the Fed itself does. A majority (60%) of traders in federal funds futures forecast the Fed will reduce the rate from its current 5.25% to 3.75% (implying six cuts) or lower by year-end, according to the CME Group’s FedWatch Tool. The Fed’s “dot plot” of individual FOMC members’ expectations last month indicated that three cuts are likely in 2024.

- The labor market remains steady but is cooling. Employers added a more-than-expected 216,000 jobs in December but the totals for prior months were revised lower. The unemployment rate held at 3.7%. The healthy labor market has been a big reason behind consumers’ robust spending in the face of high inflation.

- Corporate profits for S&P 500 companies were estimated to have increased by above 4% year-over-year as fourth-quarter reporting season began in earnest this week, according to FactSet. Analysts are projecting earnings growth of 11.8% for the full year in 2024.

- Small business owners cited inflation as still their biggest concern last month despite its having eased considerably over the past year. Labor quality was the No. 2 worry, with 40% having job openings they could not fill, according to the survey by the National Federation of Independent Businesses.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.