Market Monitor: February Update

Headlines and Highlights

- Inflation’s path choppy but trending lower: Conflicting data from the Fed’s preferred inflation gauge showed prices rising at a faster pace in January while still cooling to a modest 2.4% over the prior 12 months. The monthly reading from the Personal Consumption Expenditures price index marked further progress toward the Federal Reserve’s 2% target while illustrating that the inflation threat has not yet been fully extinguished. The 0.3% price growth in January was up from just 0.1% the prior month. The Fed is expected to leave interest rates unchanged at its March 19-20 meeting while waiting for further evidence that inflation will stabilize around 2%.

- Japan stocks finally overtake 1989 high: Japan’s benchmark Nikkei 225 eclipsed its elusive all-time high thanks to a powerful rally that has made it the world’s best-performing major index this year. The Nikkei was up 17% in 2024 through the end of February, fueled by surges in chip-related stocks and a pivot by some investors away from the slumping Chinese market. Japan endured a long period of economic stagnation after its market – greatly inflated by a bubble in the second half of the 1980s – peaked on the last day of trading in 1989. European stocks, too, hit a record high in late February, joining their Japanese and Wall Street peers.

- S&P 500 has best February in nearly a decade: The Standard & Poor’s 500 had its biggest February rise since 2015, topping 5% as impressive company earnings reports and solid economic data buoyed investor optimism. Technology stocks continued to help drive the market rally for a fourth straight month, led by Nvidia. The leading chipmaker for artificial intelligence was up 58.6% year-to-date and has contributed 26% of the S&P 500’s gains. Taxable bond prices fell as yields rose on expectations the first rate cut will come later than previously thought. The 10-year U.S. Treasury yield had its biggest monthly jump since October – from 3.9% to 4.25%.

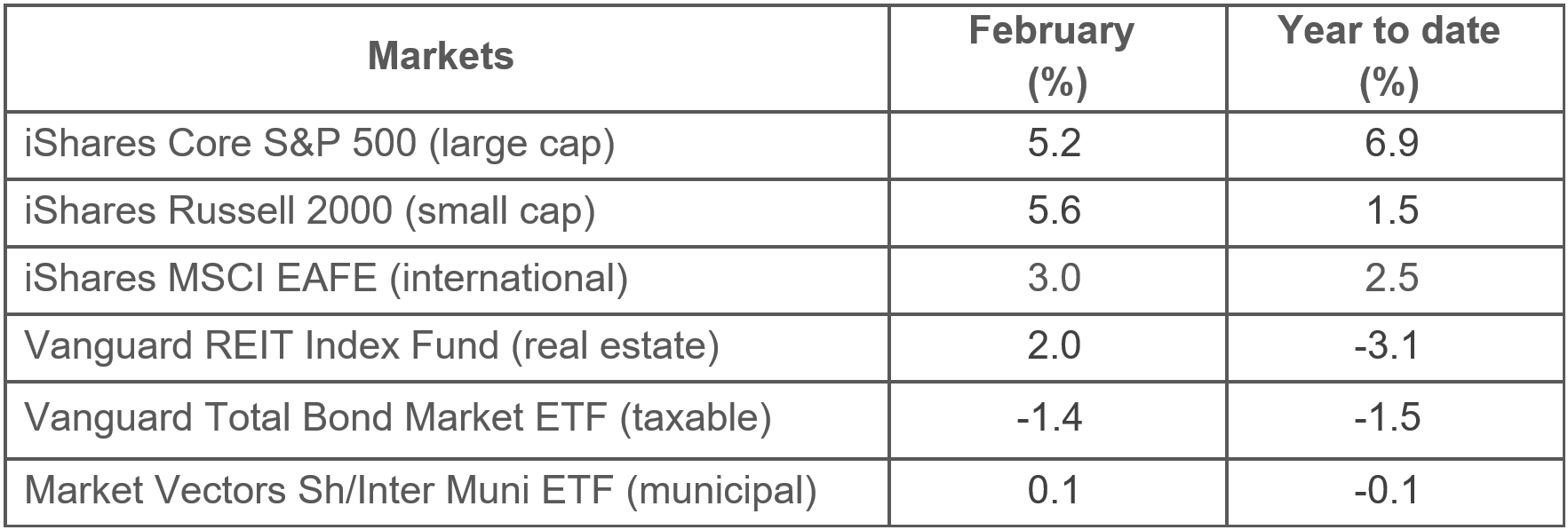

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The Federal Reserve is unlikely to reduce interest rates before this summer, based on officials’ recent comments coupled with the robust state of the U.S. economy. We anticipate no more than three rate cuts by year-end – fewer than the four or more expected by the futures market – if the economy stays healthy and the Fed maintains its wariness about the potential reemergence of higher inflation this summer.

- An economic downturn this year, once widely expected, looks unlikely. The lagging impact of rate hikes remains a threat, but it has already been 7½ months since the last rate increase in July 2023 and the economy shows little sign of weakening meaningfully. First-quarter real GDP growth is estimated by the Atlanta Fed at 2.1% – down from the second half of last year but still healthy.

- Strong fourth-quarter earnings reports have affirmed investors’ positive view of the markets, especially for stocks tied to the artificial intelligence boom. S&P 500 companies reported a second straight quarter of higher profits (+4.0%) following their lengthy slump, led by particularly upbeat reports from Nvidia and other technology firms. We believe companies’ strong fundamentals will continue to support the market.

- International stocks in developed markets have delivered strong returns since October following a long period of underperformance, and their outlook has improved. While continuing to underperform their U.S. peers, they should benefit this year from interest-rate cuts by global central banks, improving economies, and attractive valuations.

- Taxable and municipal bonds are off to slow starts this year because of the market scaling back rate-cut expectations. We expect bond prices to rise again as inflation continues to moderate and the Fed begins reducing rates.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.