Market Monitor: February Mid-Month Update

Headlines and Highlights

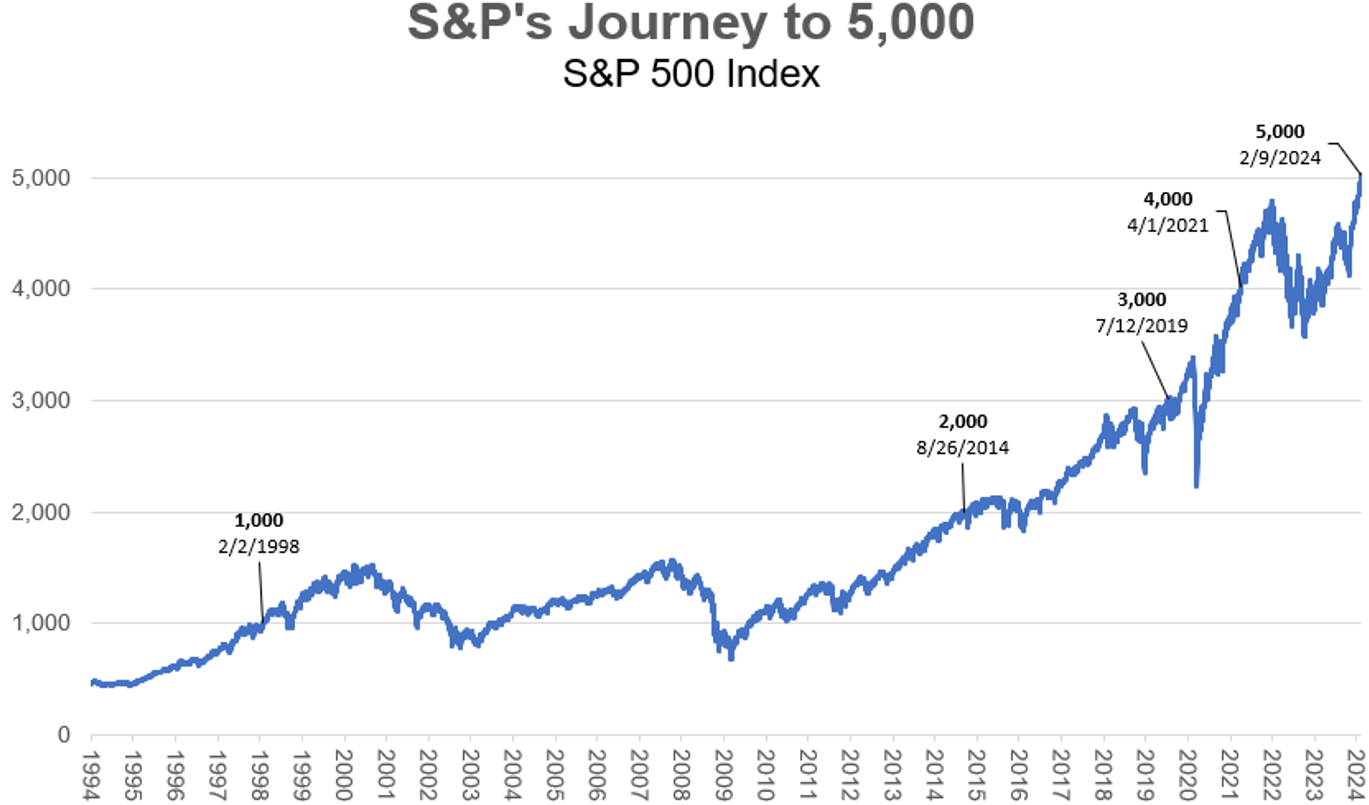

- S&P 500 hits milestone: The Standard & Poor’s 500 index topped the 5,000 level for the first time, propelled by the strong U.S. economy and investors’ optimism about prospects for interest-rate cuts. The stock market benchmark is up 5% for 2024 at mid-month. Tech stocks and others tied to optimism about the future of artificial intelligence continued to play a disproportionate role in the market rally. International stocks have narrowed their year-to-date decline in February. Bond prices fell, reflecting the rise in rates.

- Inflation progress slowed in January: Consumer price inflation was higher than expected last month, falling to an annual rate of 3.1% from 3.4% in December but staying stubbornly elevated in core prices outside the volatile food and energy categories. The Consumer Price Index is now down to a third of its 9.1% peak in the summer of 2022 but moving more slowly toward the Federal Reserve’s 2% target. Prices were up 0.4% from the prior month. The latest data likely delayed any Fed rate cuts and caused markets to fall sharply in response before recovering.

- Profits on the rise: Corporate profits have surprised to the upside in the first two-thirds of fourth-quarter earnings reporting season, a positive sign for the economy and markets. S&P 500 companies were on track to report 2.9% higher earnings than in the same quarter a year earlier, according to FactSet, despite challenges from higher interest rates. That would mark a second consecutive quarter of earnings growth and the strongest quarter since 2022.

Chart of Interest

Quick pace: The S&P rose from 4,000 to 5,000 in under three years despite a big drop in 2022.

Sources: Morningstar, Altair Advisers

Key Takeaways

- The Fed appears even more unlikely than before to lower interest rates before its May 1st meeting, based on comments by Chair Jerome Powell downplaying the chances of a March cut as well as on hotter-than-expected January inflation data. Market traders trimmed their expectations for 2024 rate reductions but a majority still expect four or more quarter-percentage-point cuts by year-end, according to the CME FedWatch Tool.

- A soft landing for the U.S. economy is now widely expected thanks to cooling inflation and the economy’s resilience. Just a quarter of business analysts and economists surveyed by the National Association of Business Economists (NABE) expect the U.S. to fall into recession this year, compared to a year ago when a majority forecast one for 2023.

- A concerning earnings report by New York Community Bank has highlighted the continued pressures on regional banks that started with the Silicon Valley Bank failure last spring. Shares of Hicksville, N.Y.-based NYCB, which has about $100 billion in assets, have lost about 60% of their value since it reported unexpected losses on real estate loans. There is little immediate sign, however, of an acute regional bank crisis like the one that erupted last March.

- War in the Middle East has had only a modest impact on financial markets so far this year. Oil prices have risen about 7% in 2024 but remain below where they were on October 7th, the day of the Hamas attack on Israel. Prices have been held down by concerns that continued high interest rates will contain energy demand.

- China’s economy, the world’s second-largest, is being weighed down by persistently low consumer spending as income growth slows and high jobless rates push down wages for some workers. The economy sank further into deflation in January when the consumer price index fell 0.8% compared with a year earlier, according to official data – the fastest pace of decline in 15 years. China’s government has enacted a number of policies this year to support its struggling stock market but has yet to step in with a huge stimulus package, as it has in prior downturns.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.