Market Monitor: December Update

Headlines and Highlights

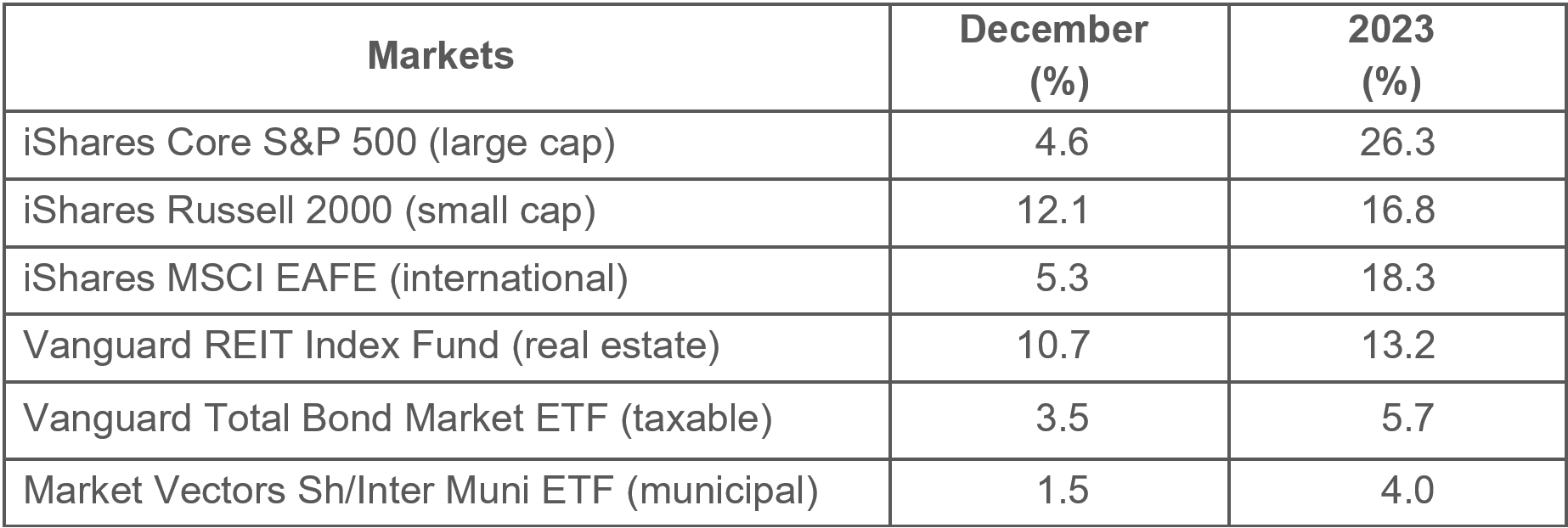

- Year-end rally elevates markets: A powerful rally to close out 2023 climaxed with U.S. stocks rising near record highs, REITs and foreign stocks also surging, and global bonds capping their best two-month run in years. The Federal Reserve added to markets’ upward momentum when it dropped its forecast of another interest-rate hike and predicted multiple cuts in 2024. Small-cap stocks led the U.S. charge with their best month (+12.1%) in more than three years as investors embraced risk in light of the Fed’s pivot, falling inflation and a strong economy. Bond yields sank in expectation of coming rate cuts, sending the prices of existing bonds up sharply.

- Inflation dips further under 3%: Annual inflation as measured by the personal consumption expenditures (PCE) price index sank to 2.6% in November from 2.9% the prior month in a sign of strong progress in the inflation fight. Overall prices fell 0.1% – the first monthly decline since April 2020 – due to a nearly 3% drop in energy. The data reinforced the Federal Reserve’s intention to lower interest rates this year with inflation approaching its objective after having raised them by more than 5 percentage points in 2022 and 2023. The Fed clarified recently that the 2% target is based on headline PCE rather than core, which excludes food and energy prices.

- Holiday spending bolsters economy: Consumers stepped up their spending during the holiday season, a key early indicator showed, in a welcome development for the economy and retailers who had feared a drop-off. Mastercard data measuring in-store and online retail sales from November through Christmas Eve reflected a 3.1% increase compared to the same period a year earlier. Restaurants (up 7.8%) saw one of the largest rises. Online shopping (up 6.3%) accounted for a big share of the increase.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The U.S. economy will probably grow more slowly in 2024 as the lagged impact of high interest rates is more fully felt. The Federal Reserve estimates real GDP growth at just 1.3% year-over-year, down from its most recent projection of 2.6% for 2023. The underlying growth outlook is healthy, however, thanks to solid household balance sheets and increased business investment.

- Inflation should reach the Fed’s 2% goal well before the central bank’s conservative timeframe estimate of 2026, based on the significant cooling of recent months. A sharp slowdown in rent prices nationwide that is not yet reflected in the government’s inflation data could help bring it back to the 2% target in the coming months.

- The Fed will loosen its monetary policy with multiple interest-rate reductions unless inflation fails to moderate further as expected. Rate cuts could begin as soon as its March meeting. However, we believe the central bank will cut rates more slowly than the current market consensus, which predicts the federal funds rate falling from the current 5.25% to 3.75% or lower by year-end.

- Bonds should benefit from more dovish global central banks, the Fed included. The U.S. 10-year Treasury yield may be pushed lower, although we expect it to be more rangebound in 2024 than the wide range in which it moved throughout 2023.

- Wars and geopolitical threats involving Ukraine, the Middle East and China heighten uncertainty for the market outlook in 2024. Bouts of increased volatility are likely as the U.S. presidential election approaches, although historical precedent suggests any downturn from these events will be short-lived.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.