Market Monitor | December Mid-Month Update

Headlines and Highlights

- Inflation accelerates ahead of Fed decision: The consumer price index ticked up to 2.7% in November as a result of goods inflation rising at the fastest monthly rate in 1½ years. Core consumer prices – excluding food and energy – also rose at a firm pace in holding at 3.3%. The increase in goods inflation was expected and due partly to a jump in vehicle prices as drivers bought replacements for cars and trucks damaged in hurricanes. While inflation remains sticky, markets expect the Federal Reserve to proceed with another interest-rate cut this Wednesday.

- Global economy seen picking up pace: The world economy remains resilient and on course for slightly faster growth over the next two years unless a resurgence of protectionist policies drags down global trade, according to a Paris-based international think tank. The Organization for Economic Cooperation and Development forecast 3.3% global expansion in 2025 and 2026, up from an estimated 3.2% this year, boosted by “very robust” U.S. growth. The OECD said lower inflation, job growth and rate cuts should help offset fiscal tightening in some countries.

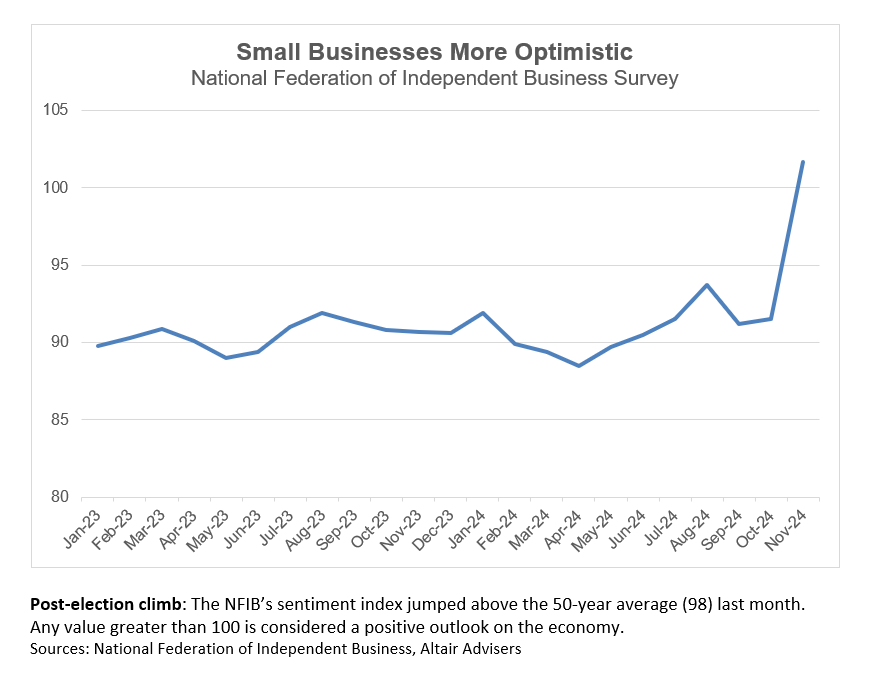

- Small business sentiment surges: Optimism is on the rise among small-business owners and operators since the November presidential election. The latest survey by the National Federation of Independent Business lifted its optimism index to the highest level since June 2021 amid hopes of more tax-friendly, pro-growth policies under the Trump administration. Smaller-company stocks, too, jumped 8% after the election before easing back. The small-cap Russell 2000 index was down 3.6% in the first half of December but still up 17.1% for the year.

Chart of Interest

Our Views

- Inflation’s stalled cooling is unlikely to dissuade the Federal Reserve from reducing the benchmark interest rate by another quarter-point on Wednesday, dropping it to 4.25%. However, we expect the Fed to be more hesitant on additional rate cuts in 2025 until it sees a further drop in inflation toward the 2% target.

- The job market is slowing but still saw a monthly pickup in hiring in November, the latest evidence that it remains on firm footing. The labor market continues to be the linchpin for growth of the U.S. economy. Its gradual softening bolsters the case for the Fed to lower rates this week at its final 2024 meeting.

- The incoming administration’s outspoken intentions to move aggressively on deregulation and tax cuts have increased confidence among corporations and small businesses and should provide a tailwind for U.S. stocks in 2025. The biggest threat to markets is the extent and response to significant tariffs that President-elect Trump vows to impose as soon as he takes office, especially in the context of continued stubborn inflation.

- Geopolitical volatility also remains a risk for markets, particularly with new political and other turmoil emerging this month in Syria, South Korea and France. Markets have remained resilient amid wars in the Middle East and Ukraine thanks largely to the strength of the global economy. Given the positive economic outlook as 2025 nears, we are cautiously optimistic that this stability will continue.

- Bonds have delivered relatively muted returns of between 2% and 3% this year amid the bond market’s wariness of a new bout of higher inflation, which could cause the Fed to shelve planned interest-rate cuts. We still believe in bonds’ role as an important portfolio diversifier and record of outperformance during periods of stock market volatility.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.