Market Monitor: April Mid-Month Update

Headlines and Highlights

- Stalled progress on inflation clouds rate outlook: A third straight month of hotter-than-expected inflation nudged the consumer price index up to 3.5% year-over-year (3.8% excluding food and energy), likely pushing back the Federal Reserve’s planned interest-rate cuts. Higher housing costs were the biggest contributor to the CPI’s rise. The market consensus is now for just two cuts by year-end, down from six at the start of 2024. The CME FedWatch Tool estimates that the first reduction will come in September.

- Markets hit by rates pessimism, geopolitical scare: Most financial markets have slumped this month as the result of dimmed rate-cut hopes and the exchange of hostilities between Israel and Iran. The S&P 500 fell 3.6% through mid-month after ending March at an all-time high and its peers in international developed markets retreated 3.4%. U.S. small caps, which tend to be more sensitive to interest rates, tumbled 7.0%. The worsened outlook for rates also hurt REITs (-7.1%) and taxable (-2.3%) and municipal bonds (-0.5%), deepening their early 2024 losses.

- Consumers keep spending vigorously: Retail sales exceeded forecasts in March, underscoring resilient consumer demand that is fueling the economy’s momentum. The Commerce Department said the value of retail purchases, unadjusted for inflation, rose 0.7% from the prior month after February sales also were revised higher. Sales at internet sales retailers such as Amazon climbed 2.7%, driving much of the increase. Consumer spending accounts for two-thirds of U.S. GDP, which the Atlanta Fed estimates rose 2.8% in the first quarter.

Chart of Interest

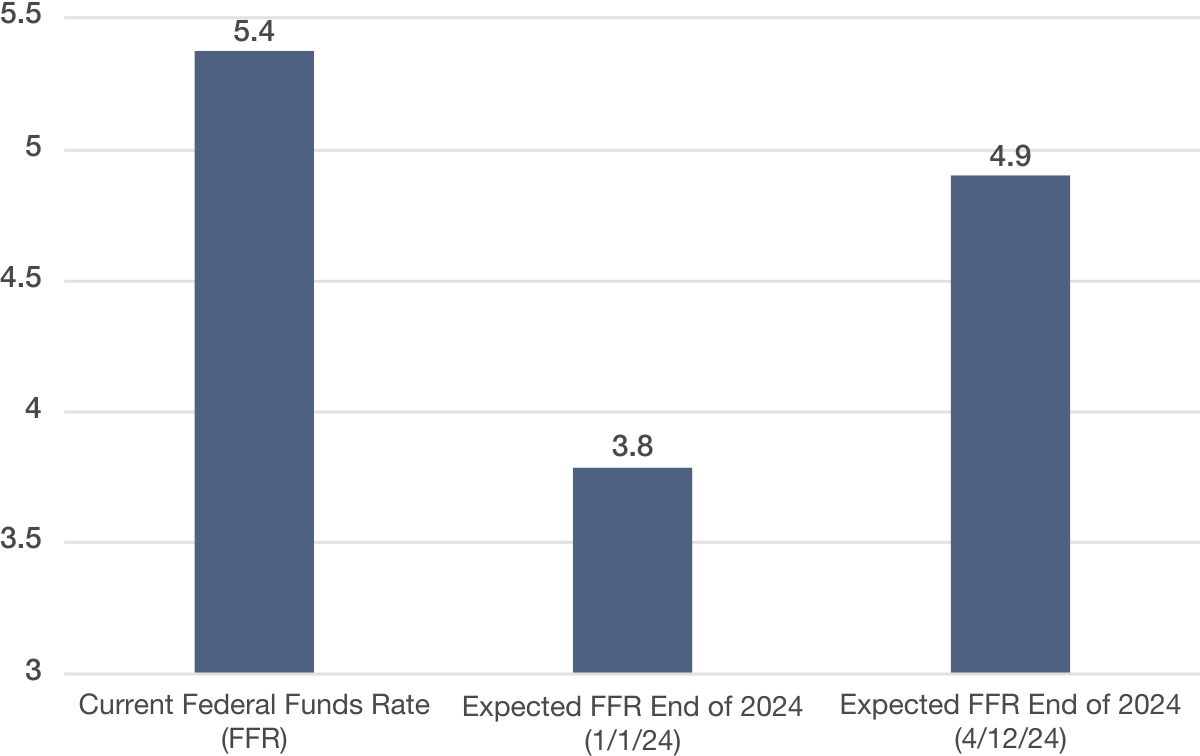

Slower To Go Lower

Federal Funds Rate – Market Expectations

Reduced relief: Investors now see rates near 5% at year-end compared to under 4% at the start of 2024.

Sources: CME Group, Altair Advisers

Key Takeaways

- The world economy is growing slightly faster than expected in 2024 thanks to robust activity in the United States and many emerging-market economies. The International Monetary Fund upgraded its estimate for global growth to 3.2% from 3.1% at the beginning of the year, characterizing the economy as “surprisingly resilient” despite significant rate hikes by central banks. The IMF bumped up its estimate for U.S. economic growth in 2024 to 2.5% from 2.1%.

- The escalation in international tensions has sent global energy prices up sharply this year, including a 16% jump in Brent crude oil. Expansion of the wars in Ukraine and the Middle East would pose a challenge for oil supplies at a time when global inventories are at their lowest level in years. Oil prices still are well off the 2022 peak and below where they were a decade ago.

- Longer-term bond yields have risen this month as a result of stickier-than-expected inflation and a strong economy signaling fewer rate cuts ahead. The 10-year U.S. Treasury yield reached a 2024 high of 4.7% this week, yet still below its 2023 peak of 5.0%. Bond prices fall when yields rise.

- The dollar, too, has climbed sharply because of declining prospects that the Fed will soon lower rates. The greenback is up 5% this year against a basket of other leading currencies and near a 52-week high, reversing last year’s decline. A rising dollar is a headwind for international stock investments denominated in U.S. currency. The dollar is likely to resume softening once rate cuts draw nearer.

- S&P 500 companies have entered corporate earnings season with analysts forecasting a third straight quarter of higher profits. Earnings growth is estimated by FactSet at 3.4% for the first quarter and in the low double digits for the full year.

The material shown is for informational purposes only. Past performance is not indicative of future performance, and all investments are subject to the risk of loss. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities. Information herein incorporates Altair Advisers’ opinions as of the date of this publication, is subject to change without notice, and should not be considered as a solicitation to buy or sell any security. While efforts are made to ensure information contained herein is accurate, Altair Advisers cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice. See Altair Advisers’ Form ADV Part 2A and Form CRS at https://altairadvisers.com/disclosures/ for additional information about Altair Advisers’ business practices and conflicts identified. All registered investment advisers are subject to the same fiduciary duty as Altair Advisers.