Market Monitor: October Update

Headlines and Highlights

- Fed holds rates at 22-year high: The Federal Reserve kept interest rates unchanged for a second straight meeting and gave no indication another increase is imminent or likely, furthering market assumptions that its historic cycle of rate hikes is finished. Chair Jerome Powell said tighter financial and credit conditions from the Fed’s aggressive ramp-up are likely to weigh on economic activity, which could help cool inflation without additional monetary restrictions. The current federal funds rate, a range of 5.25%-5.5%, is the highest since 2001. Even if the Fed opts for no further rate increases, Powell made clear that cuts will not happen any time soon.

- Economy grew at fastest pace in two years; now slowing: Consumers’ heavy spending helped power the U.S. economy to an annual growth rate of 4.9% in the third quarter, the most since the final three months of 2021. The economy is now transitioning to a slower pace amid the lagged consequences of sharply higher interest rates and consumers’ challenges including the depletion of pandemic-era savings and the resumption of mandatory federal student loan repayments. The Atlanta Fed estimates growth in the fourth quarter at an annual rate of just 1.2% so far.

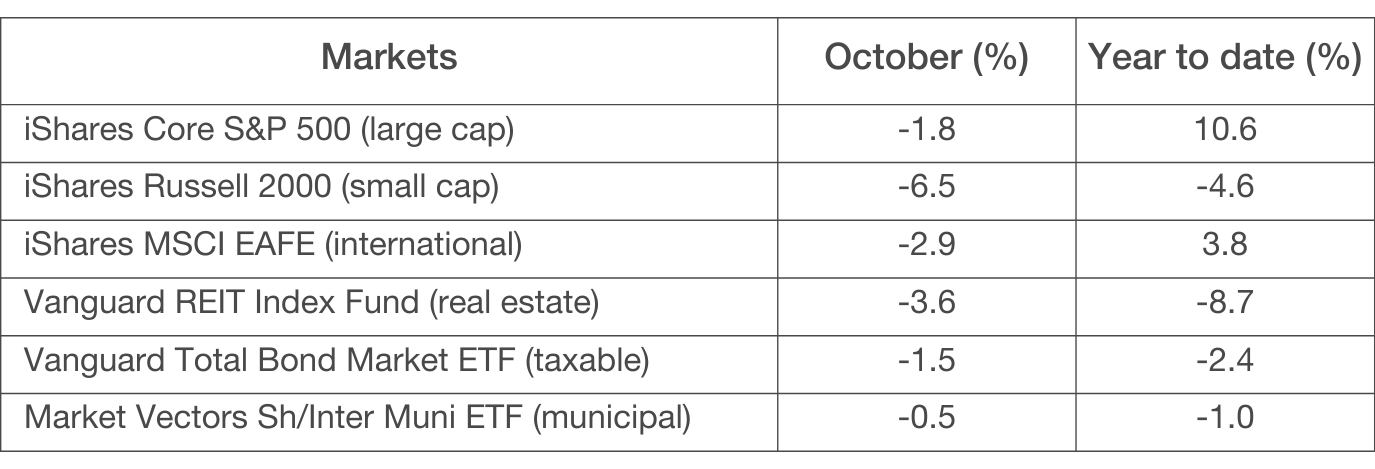

- S&P 500 falls into correction amid market-wide slump: The Standard & Poor’s 500 ended October with its first three-month losing streak since 2020 and most other asset classes also were down in a month dominated by higher interest rates and other market headwinds. The S&P 500 dipped briefly into correction territory – a drop of 10% since late July – while retaining a 10.6% gain for 2023. The small caps benchmark sank more than 6% for a second straight month, reflecting the greater vulnerability of smaller businesses to higher interest rates. Bonds fell as the yield on the 10-year U.S. Treasury touched 5% for the first time since 2007.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The Federal Reserve’s extended rate pause and Jerome Powell’s noncommittal comments after Wednesday’s meeting have reaffirmed our view that unless inflation unexpectedly heats up again the Fed is done with the rate-hike campaign it put on hold in July. Barring a recession, however, we do not expect a rate cut in the next six months as the Fed looks to ensure that the still above-average inflation is brought back down to its 2% target.

- The U.S. economy is growing more slowly again after outperforming expectations in 2023, including the exceptional 4.9% GDP expansion in the third quarter, though showing little sign that a material pullback is imminent. The longer that rates and inflation remain elevated, however, the heavier the burden on the economy and the greater the risk of an economic slowdown.

- Inflation appears to remain on a sustainable path back to historic norms despite the pickup in consumer spending in September and an acceleration in the Fed’s preferred gauge. While the core personal consumption expenditures (PCE) price index rose 0.3% from the previous month, its year-over-year increase of 3.7% was in keeping with the overall trend of declining inflation since last year’s peak.

- A major expansion of the war between Israel and Hamas would risk causing a global energy shock as well as posing a threat to geopolitical stability. Oil prices so far have remained mostly stable despite periodic volatility and remain close to where they were at the time of Hamas’ October 7th

- Bond investments may be headed toward an unprecedented third straight year of negative returns in 2023. The rise of longer-dated U.S. Treasury yields to multi-year highs has hurt prices, which move inversely from their yields. But we believe a turnaround is coming, with yields appearing to be at or near their upper bounds.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.