Market Monitor: January Update

Headlines and Highlights

- Fed slows to quarter-point rate hike, eyes more: The Federal Reserve raised its benchmark interest rate for an eighth straight meeting but reduced the size of the increase to 0.25 percentage point, nudging the target range up to 4.5%-4.75%. Chair Jerome Powell said the Fed is discussing “a couple more” rate hikes but does not want to overtighten, which suggests the central bank could stop by May. He reaffirmed his commitment to keeping rates elevated until inflation is further tamed. The core PCE price index, watched closely by the Fed, cooled to 4.4% in December – its smallest increase in 14 months – but remains well above the 2% inflation goal.

- Economy softening but stable: The U.S. economy decelerated in January after a better-than-expected 2.9% annualized increase in real GDP in the fourth quarter. Manufacturing saw negative growth and fell to its lowest level since May 2020 as gauged by the Institute for Supply Management index, and first-quarter GDP growth is forecast at just 0.9% by the Atlanta Fed. Yet the labor market showed ongoing resilience by adding 517,000 jobs to reduce unemployment to 3.4%, consumer spending remained brisk even after consecutive monthly declines, and more companies than expected have raised earnings guidance during this quarterly reporting season.

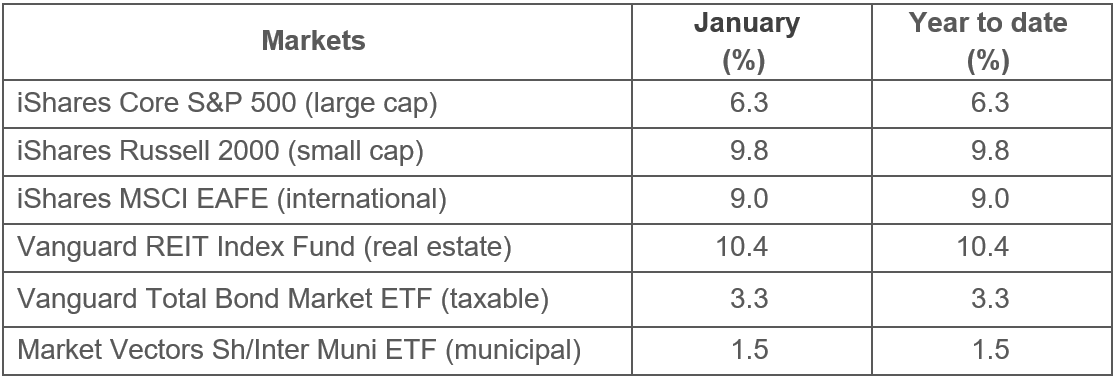

- Strong month for stocks, bonds, REITs: Investors’ optimism that inflation and interest-rate increases are on the wane made for a stellar start to 2023 for markets. The S&P 500, which had cooled in December along with other markets amid uneasiness about the economy, had its best January since 2019 with a 6.3% gain. International developed (9.0%) and emerging-markets (9.1%) stocks outperformed the U.S. benchmark again as the dollar weakened further, while real-estate investment trusts notched a double-digit return after last year’s 26% drop. The bond market also rallied sharply on the belief that declining inflation and a cooling economy will prompt the Fed to curb its monetary tightening.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- Contrary to market expectations, we expect no loosening of monetary policy or rate cuts by the Federal Reserve before 2024. We view the two potential catalysts for rate reductions this year – inflation nearing 2% or a deep economic slump – as unlikely. Chair Powell repeated again this week that there will be no rate cuts in 2023 if the current conditions of slower growth, modest gains in unemployment and a slow decline in inflation continue.

- A buoyant job market and still-strong consumer demand should enable the U.S. economy to ride out the current slowdown. While the odds of a mild recession in the next 12 to 18 months remain uncomfortably high, the economy’s ability to keep growing after months of rate increases reinforces our belief that no deep recession is likely.

- The world economic outlook for 2023 is shadowed by high inflation and further interest-rate hikes by global central banks, but a global recession is unlikely. Europe’s economy has shown more resilience than expected this winter thanks in part to warmer weather that has lessened the impact of an energy crunch caused by the Ukraine war. The dollar’s weakening also has aided non-U.S. economies and markets.

- Stocks will be tested in the first half of 2023 as the economy slows and the Fed decides how restrictive its policy should be. However, we believe the stock market is well-positioned for a better year assuming the Fed stops its increases before risking more than a mild recession. Better earnings guidance from S&P 500 companies than analysts expected in the past two weeks bodes well for the market’s continued stability.

- Bonds have stabilized after their worst year ever, as January’s significant gains in both taxable and municipal bonds reinforced. Taxable bonds are off to their best start ever, with the category benchmark Bloomberg US Aggregate Bond Index up nearly 3% in January, and our municipal bond index gained 1.5%. Last year’s bond-market debacle has allowed for a reset with higher, more attractive yields across all maturities.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice