Market Monitor: November Mid-Month Update

Headlines and Highlights

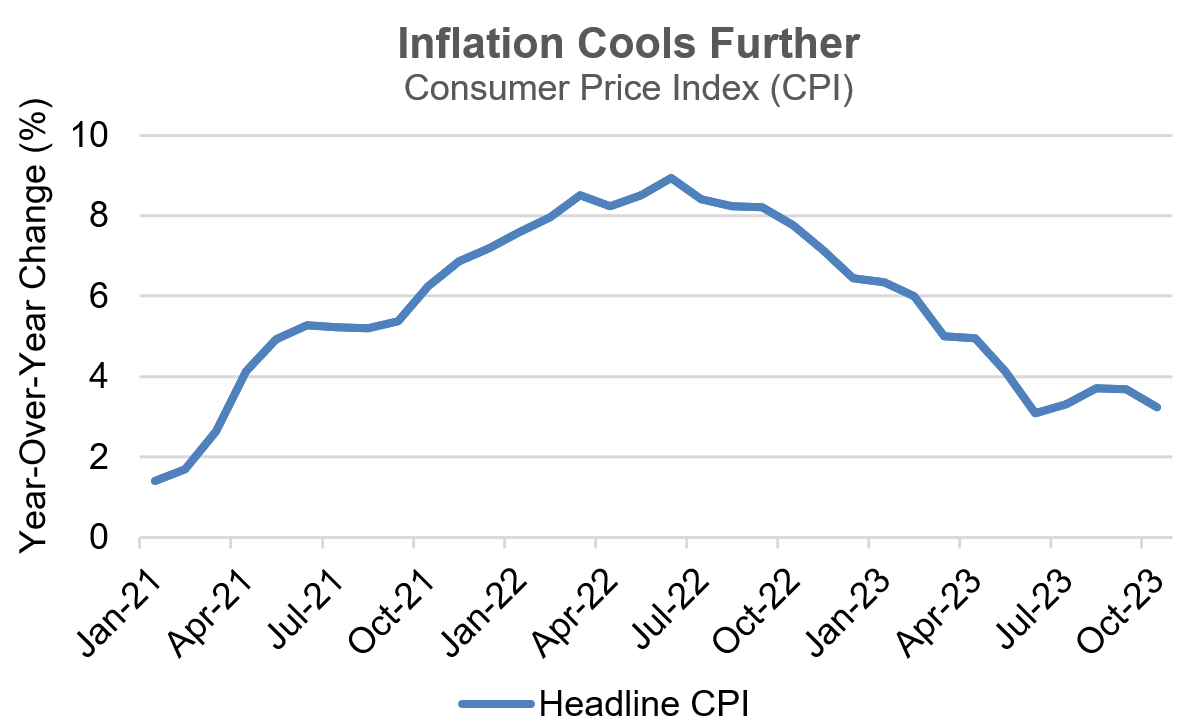

- Inflation retreats further; Fed’s goals in sight: October data delivered a double dose of positive inflation news as the Consumer Price Index decelerated to close to its lowest annual rate (3.2%) in 2½ years and wholesale prices fell to a pace of just 1.3%. Annual core inflation was somewhat higher than those headline numbers: 4.0% for the CPI and 2.4% for the Producer Price Index. The lower-than-expected readings, however, fueled assumptions that the Federal Reserve needs no further interest-rate increases to drive inflation down to its 2% target rate.

- Consumer spending slows with holiday season approaching: U.S. retail sales fell slightly last month for the first time since March, although not yet reflecting a meaningful pullback in consumer spending in the face of economic challenges. Falling prices for both gasoline and cars were a factor in the 1% lower sales total, as was a fifth straight monthly decline in core goods prices. Excluding autos and gasoline, sales were up 1% from September, suggesting that consumers remain resilient going into the holidays.

- Markets see powerful rebound: Investors’ optimism about the downward trend in inflation and the likelihood the Fed is done with rate hikes sparked a market-wide rally following three consecutive down months. After falling into correction territory in late October, the S&P 500 jumped 7.5% in the first half of November to push its year-to-date rise to 18.9%, with technology stocks again leading the way. The benchmark for small-cap stocks surged back into plus territory for the year with an 8.5% rise. Benchmarks for international stocks and U.S. and global REITs all added between 6% and 9% and bond prices rallied strongly as yields fell.

Chart of Interest

Solid progress: Inflation approached its slowest annual growth rate since March 2021 last month.

Sources: Federal Reserve Bank of St. Louis, Altair Advisers

Key Takeaways

- The Federal Reserve is unlikely to raise interest rates again but will hold off for months on any rate cut, based on Fed officials’ repeated comments. Market expectations as gauged by the CME FedWatch Tool indicate no likely rate cut before next May at the earliest.

- Inflation for services remains stubbornly elevated even as goods prices have decreased, but significant cooling appears likely in the months ahead. Shelter costs that account for a large amount of it are driven mostly by rent prices, which are coming down quickly based on Zillow data not yet reflected in the government’s monthly inflation reports.

- The Israel-Hamas conflict remains largely confined to Gaza nearly six weeks after Hamas’ attack on Israeli territory, easing concerns about the possibility of a broader Middle East war. Oil prices that initially surged after the October 7th attack have fallen to four-month lows as supply worries fade. West Texas Intermediate (WTI) crude has stabilized at around $76 a barrel, down from last month’s peak of $90.

- Third-quarter earnings for S&P 500 companies were significantly better than expected, with estimated year-over-year growth of 4.1% that has steadily risen since earnings reporting season began last month. FactSet now estimates improving earnings growth of 3.2%, 6.7% and 10.5% for each of the next three quarters – a positive sign for investors that the earnings recession that lasted from the last three months of 2022 through the midpoint of 2023 is over.

- Bond yields have come down sharply this month in a reflection of market optimism about inflation. The yield on the 10-year Treasury note fell as low as 4.4% this week, less than a month after reaching 5% for the first time since 2007. The descent of yields, which move opposite to prices, has turned the benchmarks for both taxable and municipal bonds positive for 2023. Despite the recent declines since mid-October, yields still remain high compared to their range over the past 15 years.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.