Market Monitor: March Update

Headlines and Highlights

- Banking crisis abates: Turmoil in the banking system that erupted with three U.S. bank failures and the collapse of Credit Suisse in the first half of March subsided following the quick protective steps taken by federal agencies and other banks. Concerns of a potential wave of failures that prompted a surge of withdrawals ebbed by month’s end. Small and regional banks are expected to face further pressure, however, from new rules imposed by the Federal Reserve and bank regulators as well as the shift of customer deposits to the biggest banks.

- Fed may be weighing pause: The bank turbulence coupled with fresh data of cooling inflation appear to have cleared a path for the Federal Reserve to stop raising interest rates earlier than previously thought. Less than a month after Chair Jerome Powell suggested the Fed might raise rates higher than expected, the CME FedWatch Tool now estimates a close to 50% chance the Fed makes no further increases. Core inflation as measured by the Personal Consumption Expenditures index ticked down to 4.6% in February as consumers spent less on discretionary goods, resuming a downward trend following the prior month’s acceleration.

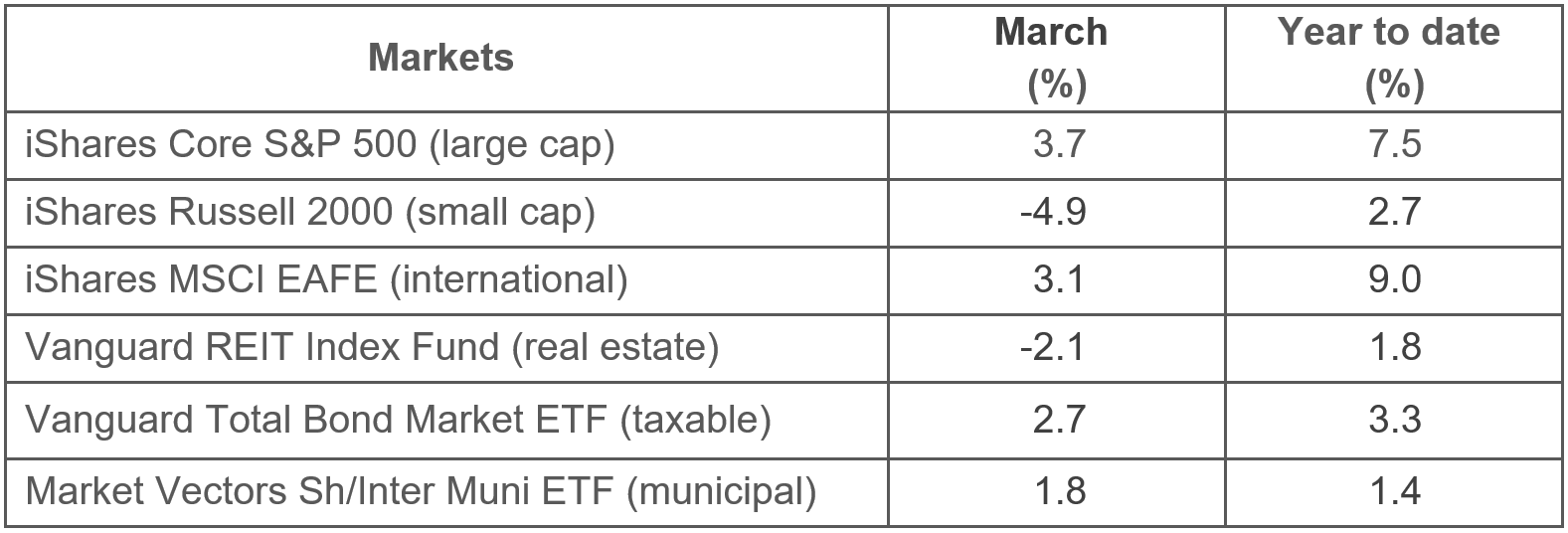

- Stocks bounce back from bank scare: S. and international stocks recovered from a banking-related sell-off to finish the month with strong momentum and solid year-to-date gains, aided by expectations of a less aggressive Fed. The S&P 500, which briefly dipped negative for the year in mid-March, rallied back to post a 7.5% total return for the first quarter. International developed stocks (+9.0%) performed even better than their large-cap U.S. counterparts, while U.S. small caps lost ground even after rebounding from a steep loss earlier in the month. Bonds retained solid gains for March as the 10-year Treasury yield fell to 3.5% from 4%.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The banking system appears to have emerged from last month’s tumult in stable condition as the government’s actions clearly indicate a willingness to do what is necessary to prevent a widespread banking crisis. We believe contagion risk is low, even though volatility and consolidation are likely to continue among regional banks as a wave of deposits flows to the larger national banks.

- Inflation is on an uneven but gradual path downward, as evidenced by core PCE rising a less-than-expected 0.3% last month while still remaining stubbornly high at 4.6% year over year. A slowdown in consumer spending, the impact of higher rates and tighter lending standards as a result of the bank scare should ensure further deceleration in the months ahead.

- The Federal Reserve is likely to pause its year-long interest-rate cycle after one more quarter-point increase, but could stand pat if economic conditions between now and its May meeting warrant further caution or show inflationary conditions cooling meaningfully. The Fed must carefully weigh the impact of the banking scare as well as the lagged effect of its rate hikes on the economy. We do not anticipate rate cuts this year, though, contrary to bond market expectations.

- Economic growth is projected to have continued at a modest 1.7% annual pace in the first quarter, according to the Federal Reserve Bank of Atlanta, despite the challenge posed by higher interest rates. However, the economy is likely to decelerate further as a result of the shakeup in banks and resulting curtailment of lending. A recession is increasingly probable but, most importantly, we do not believe a deep or lasting economic slowdown is likely.

- We anticipate bumpy, back-and-forth markets for the next several months until investors get more clarity on the full impact of rate increases and prospects for a recession. March saw the S&P 500 move 1% or more on nearly half the month’s 23 trading days (six up and five down). More of this up-and-down volatility likely lies ahead.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice