Market Monitor: July Mid-Month Update

Headlines and Highlights

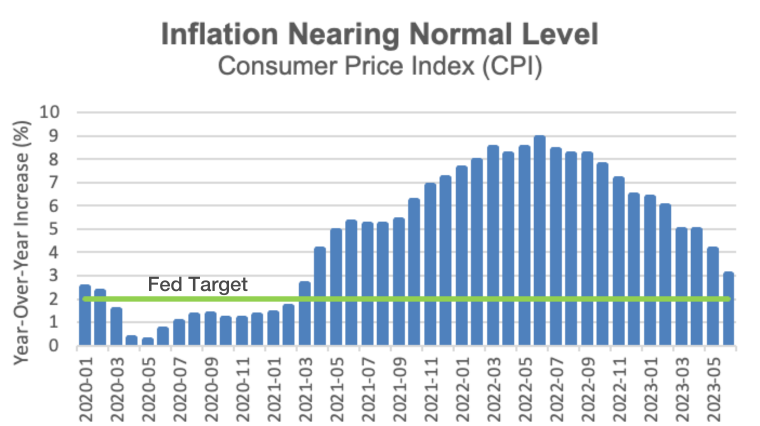

- Inflation’s year-long decline sees steepest drop yet: Headline consumer prices rose just 0.2% in June and at an annual pace of 3.0%, down from the four-decade high of 9.1% a year earlier. Stripping out food and energy, the Consumer Price Index’s core measure slowed more than expected to 4.8% as goods prices fell while service prices continued to grow faster than desirable. Adding to the encouraging trend, U.S. wholesale prices slowed to a crawl. The Federal Reserve meets July 25-26 and is expected to announce another 0.25% interest-rate increase after skipping one in June for the first time in 15 months.

- Labor market moderates but still thriving: The June jobs report showed a healthy slowing in a solid but no longer red-hot employment market, with 209,000 jobs added and the jobless rate falling to 3.6%. Labor market participation among people in the so-called prime working-age category (25 to 54) rose to the highest rate since 2001, 80.9%. Wage growth was stronger than expected, rising 4.4% from a year earlier, which may keep the Fed on track for a hike next week.

- Markets add to 2023 gains: Financial markets kicked off the second half with gains in all major asset classes to extend first-half momentum. While technology-related stocks continued their advance, the biggest July gainers through mid-month were three categories that lagged in the first half: U.S. REITs, international real estate and emerging-markets stocks, all up close to 4% as gauged by benchmarks. The S&P 500 rose another 1.3% for a year-to-date gain of 18.4%, small caps increased 2.3% for a 2023 return of 10.5%, and international developed stocks added 2.0% to push their yearly return to 14.3%. Taxable and municipal bonds had incremental gains.

Chart of Interest

Big cooldown: Headline inflation is at a more than a 2-year low, though still above the 2% target.

Sources: U.S. Bureau of Labor Statistics, Altair Advisers

Key Takeaways

- U.S. inflation is now comfortably below the 5% federal funds rate, a significant milestone in the inflation crackdown that should help persuade the Federal Reserve to end its tightening soon. The central bank appears on the verge of stopping after likely making an additional quarter-percentage-point hike at its meeting next week.

- The Fed’s makeup should become slightly less hawkish with the departure of James Bullard, who has consistently pushed for aggressive rate increases to combat high inflation. Bullard, the Fed’s longest-serving current policymaker as president of the St. Louis Federal Reserve since 2008, resigned to become the dean of Purdue’s business school. A nonvoting member of the Federal Open Market Committee this year, he has remained influential and continued to argue for more rate hikes.

- U.S. consumers have been buoyed by the fall in inflation as well as the labor market’s strength. Consumer sentiment as measured by the University of Michigan soared in July to a nearly two-year high. Retail spending increased in June, up a modest 0.2% from the previous month.

- The U.S. dollar has weakened to its lowest level in more than a year as expectations for an end to Fed rate hikes fuel a rally in foreign currencies. The dollar has fallen 3% against a basket of other major currencies this month, a decline which should boost S&P 500 companies’ third-quarter revenue and earnings. A softening dollar historically is a tailwind for both overseas stocks and those of U.S. multinationals with significant international sales.

- Positive earnings surprises by big banks got the second-quarter earnings season off to a strong start in mid-July. The quarter is still forecast to be the third in a row with lower profits than a year earlier: an estimated decline of 7.1%, according to FactSet, before an expected return to higher profits in the second half.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice