Market Monitor: January Mid-Month Update

Headlines and Highlights

- Markets off to strong start: Investors turned the page on an abysmal 2022 by pushing markets higher to start the new year. Hopes that the Federal Reserve will wind down its interest-rate hikes with inflation slowing helped lift the benchmarks for U.S. large caps by 4.2% and small caps by 7.2% through mid-January, with REITs (6.9%), international developed stocks (7.1%) and emerging-markets (8.3%) stocks also faring well. Bonds continued their recovery from last year’s record downturn; benchmarks for taxable and municipal bonds were up 2.8% and 0.9%, respectively.

- Inflation falls for sixth straight month: The increase in U.S. consumer prices eased again in December, the latest sign that price pressures appear to have peaked in response to the Fed’s campaign to cool down the economy. The Consumer Price Index fell to 6.5% year over year, down from 9.1% last June – still near a multi-decade high but the lowest since October 2021. Core CPI, which excludes food and energy, rose 0.3% last month but its annual rate of 5.7% was the lowest since December 2021.

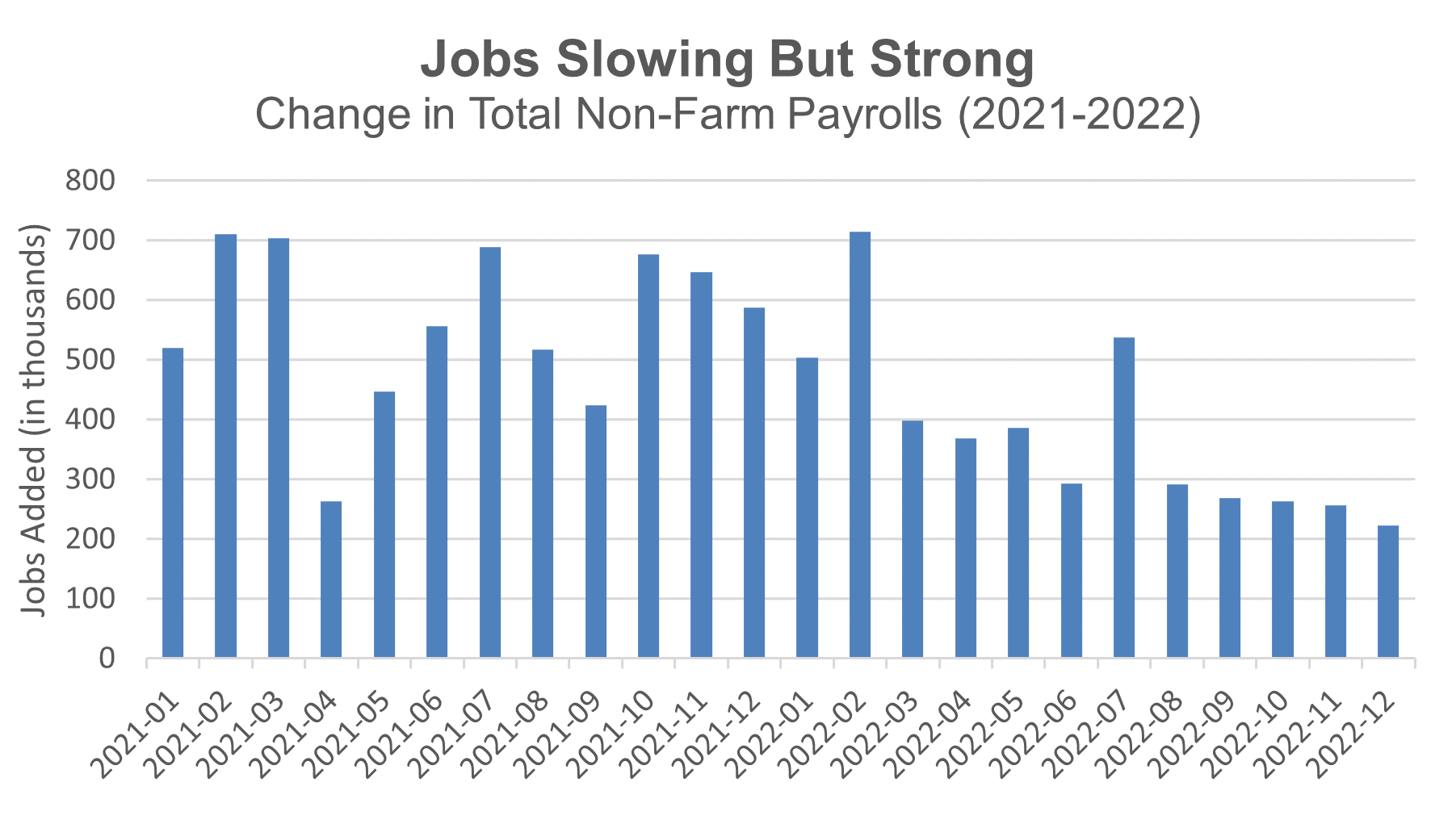

- Labor market stays resilient: U.S. employers added a better-than-expected 223,000 jobs in December and the unemployment rate fell to 3.5%, reinforcing that the economy remains in solid shape despite the impact of higher rates. The slight decline in monthly employment expansion, while still high by historical standards, shows cooling that the Fed wants to see more of before reducing rates. Average hourly wages also grew more slowly – another Fed prerequisite – but remained elevated at 4.6% above a year earlier.

Chart of Interest

Still booming: Monthly job gains continue to be impressive and above pre-pandemic norms.

Sources: Federal Reserve Bank of St. Louis, U.S. Bureau of Labor Statistics, Altair Advisers

Key Takeaways

- The Federal Reserve is now expected to approve a quarter-point rate increase on February 1st. Traders forecast at least one small additional rate hike after that, followed by rate cuts later this year – a pivot that Fed officials say they do not expect to happen in 2023.

- The World Bank significantly reduced its forecast for the global economy but stopped short of predicting a recession in pegging expected world growth at 1.7% this year, down from its 3% estimate last June, and 2.7% next year.

- Corporate earnings season, just under way, will be the key factor for U.S. markets to continue their fast start – or stall – as companies provide more guidance about rate cuts’ toll. Analysts surveyed by FactSet currently estimate fourth-quarter earnings to decline 3.9% year-over-year and forecast the lowest revenue growth (+3.9%) in two years.

- European stocks notched their biggest gains on record for the first two weeks of the year despite recession concerns for several countries, with the Stoxx Europe 600 Index rising 6.5%. European stocks have been outperforming the U.S. since the end of September, aided by the weakening dollar, China’s reopening and cheaper valuations.

- China’s reopening on January 8th after three years of Covid isolation poses both opportunities and risks for the global economy and investors. A resurgence in China’s pent-up consumer and investment activity could simultaneously boost global growth and reignite inflation, with the near-term risk that its wave of coronavirus cases spreads abroad.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice