Market Monitor: February Update

Headlines and Highlights

- More rate hikes expected as inflation stays elevated: Hotter inflation than anticipated so far in 2023 has dampened earlier expectations that a halt to the Federal Reserve’s interest-rate increases could be imminent. The Fed’s preferred inflation gauge, the Personal Consumption Expenditure (PCE) price index, showed core prices unexpectedly accelerating by 0.6% in January after having declined steadily in the second half of 2022, with annual core inflation climbing to 4.7% from 4.4%. Market estimates as measured by the CME FedWatch Tool are now for the Fed to raise the federal funds rate by an additional quarter-point at its meetings in March, May and June.

- Chinese economy rebounding rapidly from lockdowns: China’s factory activity is recovering faster than expected following the end of pandemic-related constraints and a nationwide Covid outbreak, a positive sign for the world’s second-largest economy. Government data showed that the country’s manufacturing sector, while not back to pre-pandemic levels, grew at its fastest pace since 2012 last month. China is still dealing with a depressed real estate market and declining demand abroad for its exports.

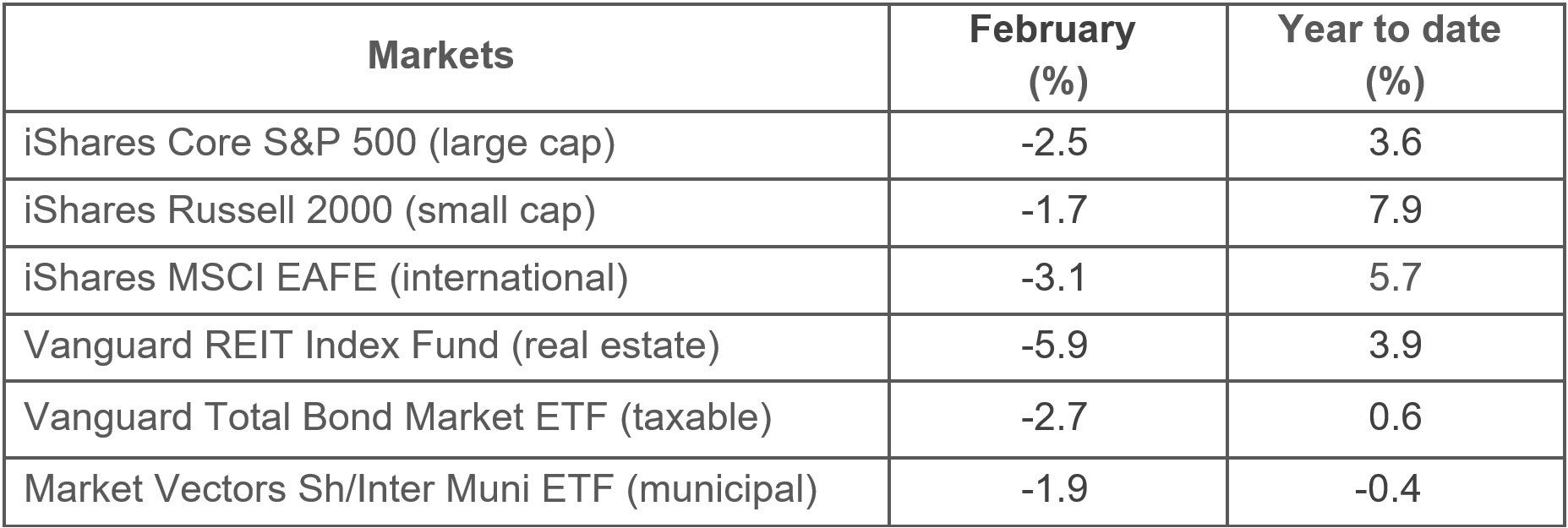

- Markets retrench after strong start to year: Most asset classes gave ground in February, declining as rate expectations and yields rose but retaining year-to-date gains. The U.S. stock market’s main large-cap benchmark finished the month 11% above its October low but still 17% below its all-time high of January 2022 after a 2.5% decline. International developed stocks continued to outperform their U.S. peers for 2023. Bonds reversed direction with losses as concerns about a prolonged period of higher interest rates drove yields higher.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- Stubbornly high inflation in the United States and Europe to start the year has likely extended the rate-hike cycle of global central banks. While the Federal Reserve remains near the end of its cycle, tough talk by Fed officials about inflation reinforces our belief that they will not pause or reach the end of their rate hikes before summer.

- China’s initial recovery from its zero-Covid clampdown brightens the outlook for the global economy. A vigorous reopening period has boosted the chances of the world economy achieving modest growth this year. However, China’s rebound does pose an additional risk for global inflation.

- The U.S. economy continues to deliver a mix of signals both positive (3.4% unemployment, strong hiring, robust service sector, inflation well off the peak) and negative (declining corporate earnings, contracting manufacturing sector, leading economic index down 10 straight months, cooling housing market). While a continued slowdown or mild recession in the next 18 months is likely, the economy’s continued growth bolsters our belief there will not be a deep recession.

- Markets’ recovery pace in coming months will be shaped by the Fed and companies’ ability to absorb higher costs and the lagging impact of higher rates. Corporate earnings have declined only modestly so far but will be highly economy-dependent moving forward. We expect periodic volatility in the months ahead as markets gain more clarity on the extent of the slowdown.

- Bonds had a rough February following their best-ever start to a year, with higher inflation readings driving the 10-year Treasury back to 4% for the first time in four months. However, we believe they have the potential for solid gains in 2023 as the Fed ultimately stops hiking rates and the rise in yields slows. Last year’s worst-ever year in the bond market has allowed for a reset with higher, more attractive yields across all maturities.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice