Market Monitor: December Mid-Month Update

Headlines and Highlights

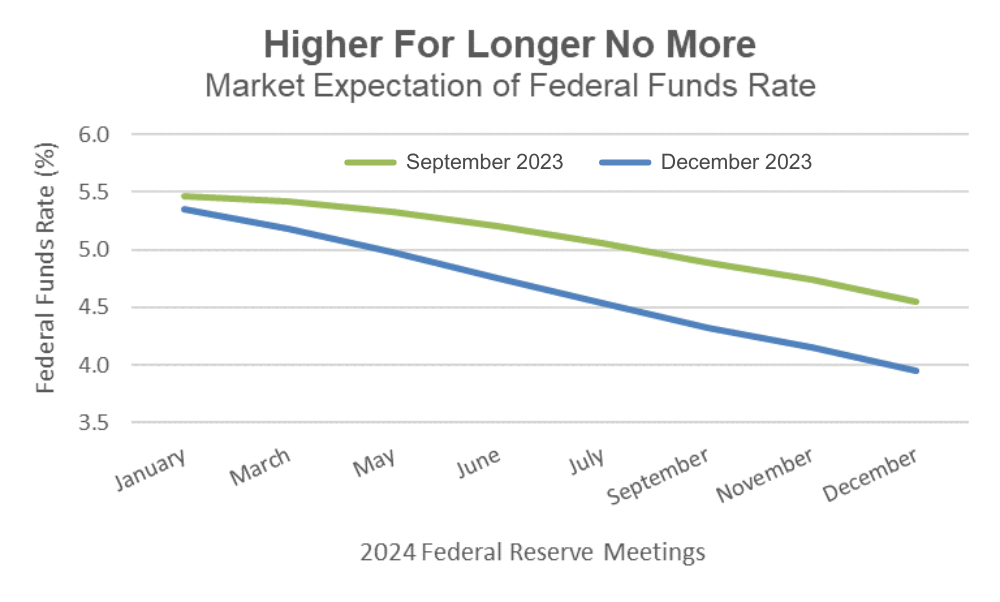

- Fed foresees multiple rate cuts in 2024: The Federal Reserve held interest rates at a 22-year high but made a notable shift in its monetary policy stance, dropping its prediction of one more rate hike and penciling in three or more rate cuts next year. Just six weeks after Chair Jerome Powell said the Fed was not even thinking about cuts, most of its policy-setting group forecast that it could drop the federal funds rate by about 0.75 percentage points in 2024. The dovish outlook came as the Fed lowered estimates for its preferred inflation gauge – the core personal consumption expenditures price index, currently 3.5% – to 3.2% in 2024 and 2.4% in 2025, finally reaching its 2% target in 2026.

- Job additions reaffirm U.S. economy’s strength: The economy produced robust job growth in November, reflecting a labor market that remains steady even as it slows gradually in the face of high interest rates. Employers added a more-than-expected 199,000 jobs last month, bolstered by 41,000 autoworkers and actors who returned to work after their strikes were settled. The unemployment rate fell unexpectedly to 3.7% – clear evidence that the economy remains far from falling into the recession that many expected in 2023.

- Investors cheer Fed news: The Fed’s new focus on coming rate cuts reinvigorated a market rally under way since the end of October. The Dow Jones Industrial Average reached an all-time high, the Standard & Poor’s 500 Index moved within 2% of its record, and the benchmarks for small-cap stocks (+9.8% in December) and other categories surged. The S&P 500 entered this week with a 24.8% total return for the year, a big rebound from last year’s 18.1% drop. Bond prices also rose sharply as yields fell amid growing prospects of rate cuts.

Chart of Interest

Solid progress: Rate cuts in sight: The Fed’s pivot has market traders anticipating cuts sooner and more often.

Sources: CME Group, Altair Advisers

Key Takeaways

- Smaller companies have joined the mega-cap technology stocks powering the market this year as the rally broadens. Through December 15th, the so-called Magnificent Seven (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta) were up 75% year-to-date, pulling the market up with them. But this month, small caps have roughly tripled the gain of large caps as investors take on more risk with lower interest rates approaching.

- Consumers have demonstrated their resilience this holiday shopping season, keeping the economy robust despite slowing growth. Retail sales rose unexpectedly in November by 0.3% over the prior month, reflecting an uptick in consumer confidence after three straight monthly declines.

- Inflation should soon see further declines in the largest measured component, rent, based on a wave of newly built apartments hitting the market. The median asking price for U.S. rent fell 2.1% last month compared with a year ago – the biggest drop since 2020, according to the real estate company Redfin.

- Europe has made substantial progress this fall in taming high inflation, with annual price growth falling to 2.4% last month. It continues to lag the U.S. economy overall with estimated GDP growth under 1% in both 2023 and 2024, based on December forecasts by the European Central Bank.

- The U.S. dollar is down more than 4% since the beginning of November, steepening its decline last week when the Fed signaled a coming pivot to rate cuts. The drop provided an additional boost for the stocks of U.S. multinational companies with substantial overseas revenue. It also has contributed to an 8% gain for international developed stocks this quarter, although they still trail their U.S. peers.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.