Market Monitor: August Update

Headlines and Highlights

- Job market cools: Fresh government data showed slowdowns in the numbers of job openings and jobs added, reflecting a labor market returning to normal after overheating during the pandemic and contributing to the surge in inflation. Job openings have declined by 2.5 million in the past three months, the largest such decline on record. The reports also showed decelerating wage growth and a rise in unemployment to 3.8%. The job market’s cooling strengthens the case for the Federal Reserve to stop raising interest rates.

- Inflation slightly ticks back up. Core inflation as measured by the Federal Reserve’s preferred gauge, the Personal Consumption Expenditures Index, as expected edged up to 4.2% in July – the latest evidence that the path back to a normal level of price growth will be bumpy. Services inflation excluding housing, a metric the Fed is particularly focused on driving lower, accelerated sharply for a second consecutive month. But core goods prices fell and housing price rises slowed significantly, signs of overall progress in the effort to chip away at inflation.

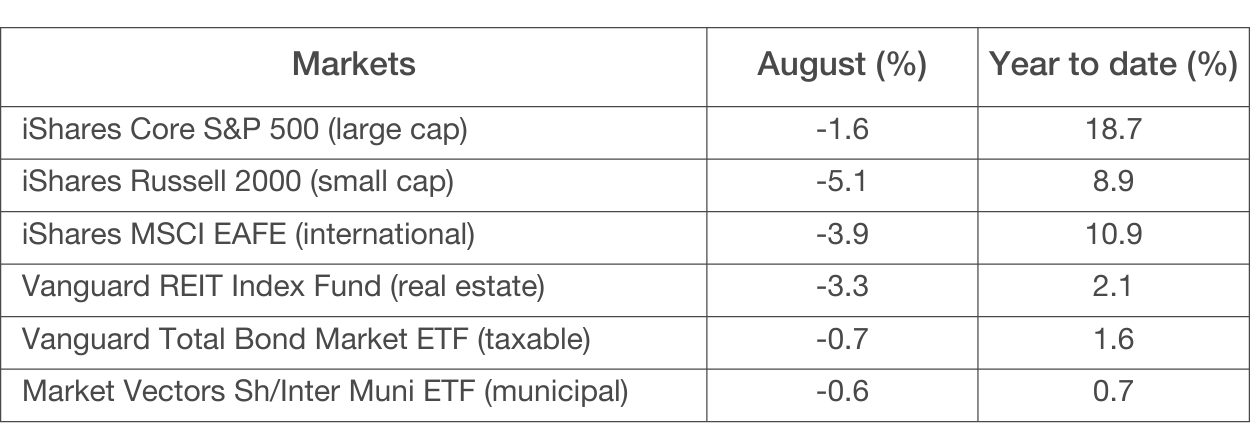

- Markets retreat in August: U.S. large-cap stocks suffered their first monthly setback since February and other financial markets also gave ground despite a final-week rally. A slight uptick in a key U.S. inflation measure, China’s economic slump and some tough talk from Fed officials dampened investors’ enthusiasm in what remains an above-average year for the stock market. Bonds fell as the benchmark 10-year Treasury yield rose to a 16-year high of 4.3% before edging back.

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The Federal Reserve will likely keep interest rates elevated for a lengthy period because even though inflation is slowing there are components that remain stubbornly high. We do not anticipate another rate hike this year but a rate cut appears distant.

- The U.S. economy’s resilience in the face of higher rates and inflation means the recession that was widely forecast at the beginning of 2023 almost certainly will not happen this year. Whether a recession occurs in 2024 hinges on the severity of lagged consequences from higher rates, the health of the jobs market and consumers’ continued ability to spend vigorously.

- Inflation should continue its decline through the rest of this year despite the slight increase in July. Rental prices that are not yet reflected in the government’s inflation statistics have continued to moderate and the surge in summer spending, especially in the service sector, is likely to taper off.

- A government shutdown starting October 1st is increasingly probable with Congress deadlocked over legislation needed to fund government operations in the new fiscal year. We expect temporary volatility in financial markets if this occurs but no lasting damage to either stocks or the economy. In four shutdowns since the 1990s, including one in 2018-19 that lasted 35 days, disruptions and delays were widespread but the economic impact was negligible and the stock market was either flat or rose slightly.

- The commercial real estate market likely faces more volatility ahead but there are promising areas beyond the much-publicized woes of the office sector, which accounts for only a small percentage of the industry. REITs have managed to stay flat despite this year’s turmoil and should be positioned to begin a recovery now that interest rates are at or near their peak.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice