Market Monitor: August Mid-Month Update

Headlines and Highlights

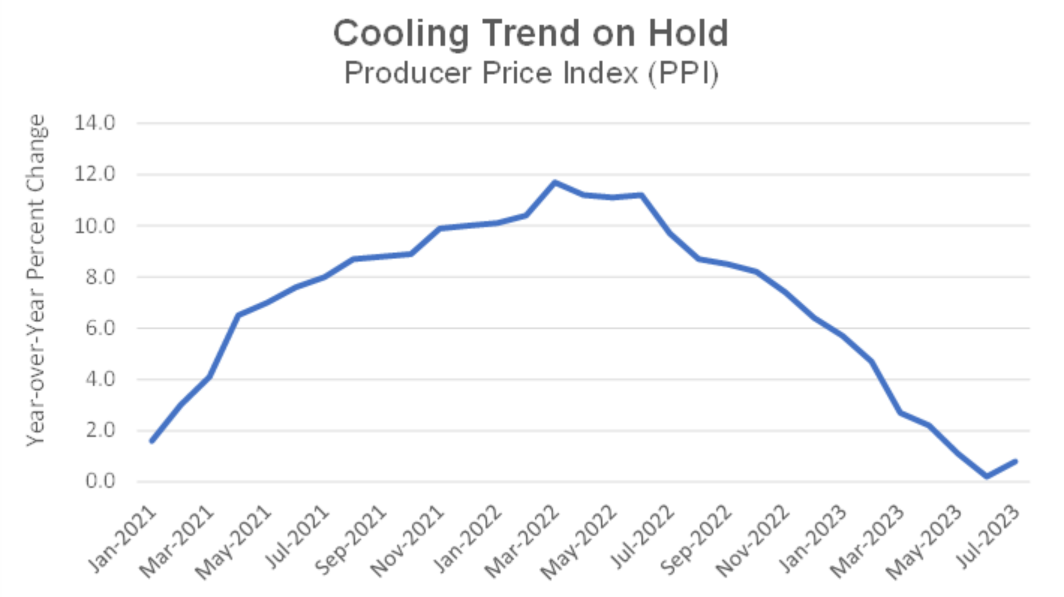

- Inflation’s swift deceleration pauses: Consumer and wholesale prices both picked up in July, underscoring that inflation’s descent to pre-pandemic levels may be bumpy. The latest monthly data do not appear to threaten the economy’s desired cooling trend, however. The consumer price index showed annual headline inflation increasing to 3.2% last month after rising 3.0% in June, though core prices climbed just 0.2% over the course of the month. Wholesale inflation as measured by the producer price index accelerated to an 0.8% annual rate due to higher service prices – the first pickup in 13 months – after slowing to 0.2% in June.

- Summer spending boosts economy: Stronger-than-expected spending by consumers and businesses has buttressed the U.S. economy in the face of higher interest rates. Retail sales increased in July by 0.7%, the most in six months, as Americans spent more on everything from sporting goods and hobbies to restaurants and bars, although spending on big-ticket items such as motor vehicles and furniture weakened. The Atlanta Federal Reserve, also noting more spending by private businesses than previously forecast, raised its estimate of third-quarter GDP growth to an annual pace of 5.8%, which would be the most of any quarter since 2021.

- Stocks’ rally stalls: Financial markets pulled back across the board this month, reflecting investor caution about the uncertainty of whether interest rates will move higher. Despite positive second-quarter earnings surprises from most large companies, the S&P 500 fell 3.2% through mid-August, trimming the index’s year-to-date gain to 16.7% and endangering its five-month winning streak. The benchmarks for small caps (-5.3%), international developed stocks (-4.6%), emerging-markets stocks (-6.9%) and U.S. REITs (-4.1%) all gave ground, as did those for taxable (-1.6%) and municipal (-0.5%) bonds.

Chart of Interest

Wholesale prices rise: The index, measuring inflation before it hits consumers, ticked up in July.

Sources: Bureau of Labor Statistics, Altair Advisers

Key Takeaways

- Corporate earnings for the second quarter comfortably exceeded expectations, a promising sign for the economic outlook. S&P 500 companies reported profits down 3.8% from a year earlier as earnings season neared completion – much better than the estimates of a 7% drop before it began – with more firms (79%) beating analyst estimates than in any quarter since 2021. The biggest detractors were energy companies, whose profits are anticipated to accelerate in the second half.

- China’s slowdown raises a new challenge for global growth. Beijing acknowledged a worsening economic slump, lowering a key interest rate unexpectedly amid weak data on consumer spending, industrial output, investment and unemployment. The International Monetary Fund had forecast in a recent report that China would supply 35% of global economic growth this year, an amount now in serious doubt.

- U.S. employers added fewer workers in July and more Americans applied for unemployment benefits as the labor market cooled, easing pressure on the Federal Reserve to raise interest rates at its meeting next month. Wage growth, which the Fed would like to see weaken, remained fairly strong at 4.4%, however.

- The market’s odds that the Fed is done raising rates this year have risen to nearly 70%, according to the CME FedWatch Tool. A majority of traders, though, also do not expect a rate cut from the current high level until next May.

- The 30-year mortgage rate rose to a two-decade high above 7% as the Fed’s aggressive interest-rate increases continue to put upward pressure on home loans as well as auto, business and credit-card borrowing. A gauge of homebuilder sentiment fell in August for the first time this year as expectations for sales and buyer traffic both fell because of higher rates.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice.