Market Monitor: April Update

Headlines and Highlights

- U.S. economy advances amid challenges: The economy continues to expand at a slowing pace, delivering inflation-adjusted GDP growth in the first quarter of 1.1% annualized in a third straight quarter of growth since output fell in the first half of 2022. The cooling was also reflected in the latest inflation reading showing the personal consumption expenditures price index, the Federal Reserve’s preferred inflation gauge, falling to 4.2% in March from 5.1% a month earlier. Wage growth ticked higher to start the year, however, rising 1.2% in the first quarter over the prior quarter. Coupled with inflation remaining well above the historical norm, that may push the Fed to raise interest rates again at its meeting this week.

- Fallout from bank turmoil sinks First Republic: Federal regulators seized First Republic Bank and sold most of its assets to JPMorgan Chase at auction to head off further weakness in the U.S. banking industry. The collapse of San Francisco-based First Republic, the 14th-largest U.S. bank with $229 billion in assets, marked the second-biggest bank failure in U.S. history and third in two months. It had struggled since losing $100 billion in deposits in a March bank run by panicked customers after Silicon Valley Bank’s collapse. JPMorgan CEO Jamie Dimon said the banking system is “extraordinarily sound” and this deal should help ensure continued stability.

- Europe dodges a recession: The 20-nation eurozone returned to narrow (0.3%) growth in the first quarter, underscoring its surprising resilience in the face of Russia’s war on Ukraine, signs of banking strain and sizable interest-rate hikes to combat inflation. Europe’s inflation remains high at an estimated 6.8% but has fallen sharply from its peak of 10.6% six months ago. Its stable economy has buoyed investors’ confidence, helping international developed stocks to outperform their U.S. peers so far in 2023.

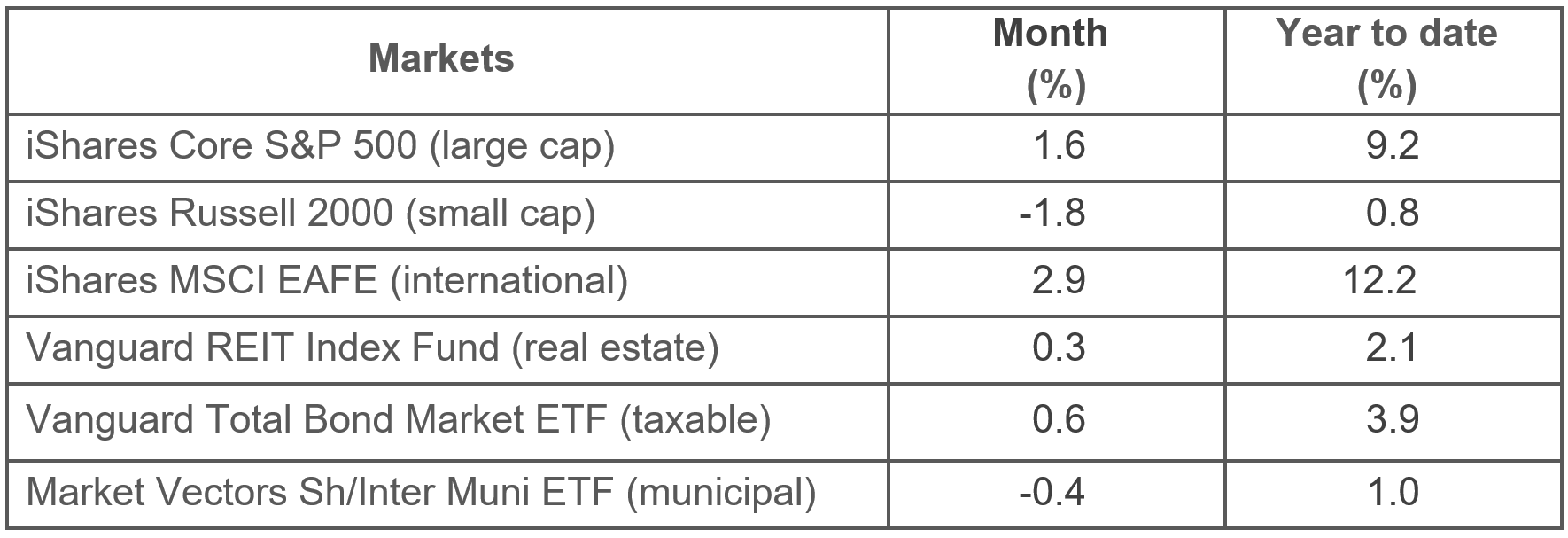

Selected Market Returns

Sources: Morningstar, Altair Advisers

Our Views

- The Federal Reserve will probably pause its rate-hike cycle after announcing a final quarter-percentage-point increase on Wednesday. A cut in rates is unlikely this year barring a serious decline in either the economy or inflation, which we believe are both unlikely.

- Federal regulators’ shutdown and auction of ailing First Republic Bank should help further restore confidence in the U.S. banking system. More consequences are likely from the March banking tumult, which has resulted in tighter lending conditions. But the contagion from the initial crisis appears to have ended and the potential for collapses has been reduced.

- The health of corporate earnings, estimated to have declined for a second straight quarter, will determine whether the U.S. economy maintains its resilience. We believe this earnings slump will be short-lived as long as costs normalize. S&P 500 firms have reported better-than-expected profits over the past two weeks, reducing FactSet’s estimate of the expected first-quarter decline by half to -3.4%, and analysts are forecasting positive results in the second half.

- Inflation is making slow but steady progress in the right direction, nudged lower by 13 months of Fed rate hikes, and we expect the trend to continue. Leading indicators not yet reflected in the government’s official inflation statistics point to the potential for a meaningful decline by year-end.

- The debt ceiling showdown is intensifying and will hang over markets until it is resolved. But recent political developments in Washington give us more confidence that a solution to the impasse will be found without resulting in a first-ever U.S. default.

The material shown is for informational purposes only. Forward-looking statements are subject to numerous assumptions, risks, and uncertainties, and actual results may differ materially from those anticipated in forward-looking statements. As a practical matter, no entity is able to accurately and consistently predict future market activities, and all investments are subject to the risk of loss. While efforts are made to ensure information contained herein is accurate, Altair Advisers LLC cannot guarantee the accuracy of all such information presented. Material contained in this publication should not be construed as accounting, legal, or tax advice